The United States Manufacturing PMI soared to 53.3 in August, marking a 39-month peak, according to S&P Global's preliminary report released on August 21, 2025.

This data suggests strengthened U.S. economic activity, influencing macroeconomic perspectives and potentially affecting the cryptocurrency market indirectly through shifting investor sentiment.

Preliminary data from S&P Global unveiled a surge in the U.S. Manufacturing PMI to 53.3 for August. This reading signals a 39-month high, reflecting strong performance within the manufacturing sector. Additionally, the Services PMI recorded a two-month low at 55.4, while the Composite PMI reached an eight-month high of 55.4.

The strong PMI readings have significant implications for economic strategies and potential adjustments in monetary policies. A robust manufacturing sector might prompt reevaluation of interest rate trajectories by the Federal Reserve, impacting credit markets. Meanwhile, despite improvements in manufacturing, the services sector noted a slight dip, reflecting mixed economic signals.

"A strong flash PMI reading for August adds to signs that US businesses have enjoyed a strong third quarter so far. The data are consistent with the economy expanding at a 2.5% annualized rate, up from the average 1.3% expansion seen over the first two quarters of the year." — Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Did you know? A similar spike in PMI during July 2021 reached an all-time high of 63.4. This historical context shows how PMI trends can influence broader market behaviors, including risk assets and currencies, reflecting investor confidence and macroeconomic stability.

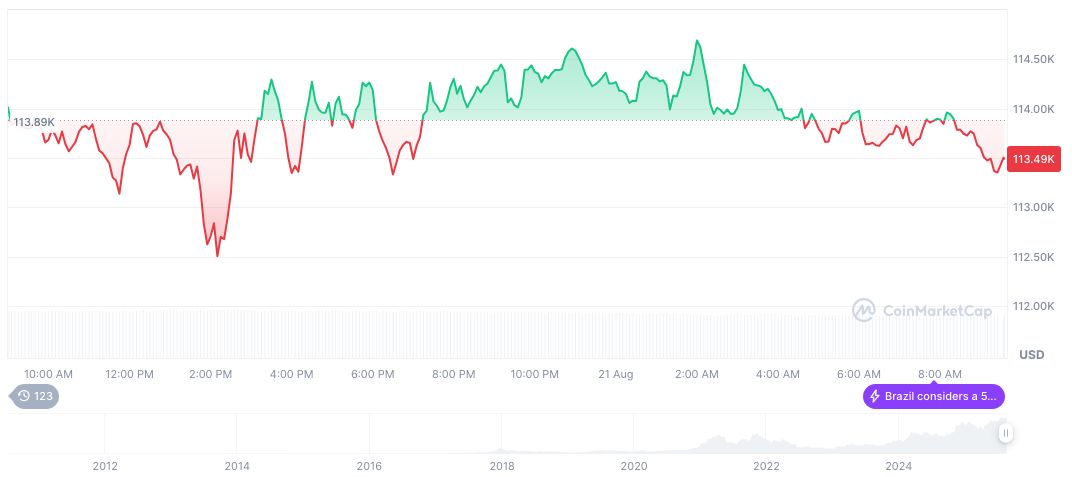

Bitcoin recorded a price of $113,477.85, and a market cap of $2.26 trillion, holding a 58.49% market dominance as of August 21, 2025. CoinMarketCap data indicates Bitcoin experienced a decrease of 0.18% over the past day, with a 4.67% decline in the last week.

Bitcoin(BTC), daily chart, screenshot on CoinMarketCap at 14:35 UTC on August 21, 2025. Source: CoinMarketCap

Bitcoin(BTC), daily chart, screenshot on CoinMarketCap at 14:35 UTC on August 21, 2025. Source: CoinMarketCap

The overview from Coincu research suggests the strong PMI results could prompt short- to medium-term fluctuations in risk assets. Potential adjustments in Federal Reserve strategies might influence trading volumes and volatility. Historically, a robust PMI aligns with optimistic economic forecasts, presenting strategic insight for financial investors.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

By Coincu

about 4 hours ago