Claims that the New York State Court of Appeals dismissed a $464 million fine against Donald Trump for civil fraud, reported on August 21, 2025, remain unverified.

With Trump still appealing, no official documents or statements confirm dismissal, impacting neither financial nor crypto markets.

The case, overseen by Judge Arthur Engoron with Letitia James as AG, revolves around Trump's real estate dealings. Official documents affirm no fine dismissal, with Trump's appeal still processing. The claim suggests a swift resolution but lacks substantive backing from court announcements.

Market analysts note no direct cryptocurrency impact, given the case's focus on traditional assets. Discussion among regulatory bodies and key crypto figures shows no response indicating crypto repercussions.

Additionally, Trump's crypto policy raises concerns among EU regulators, highlighting a potential international debate on crypto regulations.

Did you know? The precedent for such a fine dismissal in New York is rare, reflecting a broader trend of stringent legal outcomes in financial fraud cases.

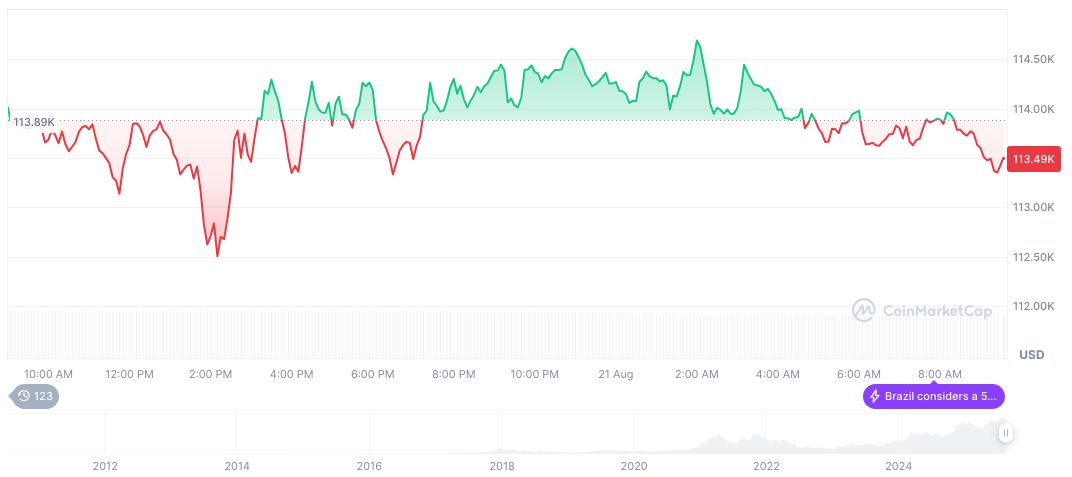

Bitcoin (BTC) stands at $113,234.99, with a $2.25 trillion market cap. BTC's dominance holds at 58.67%. The 24-hour trading volume decreased by 15.29% to $60.80 billion. Over 90 days, BTC increased by 3.47%, per CoinMarketCap.

Bitcoin(BTC), daily chart, screenshot on CoinMarketCap at 15:05 UTC on August 21, 2025. Source: CoinMarketCap

Bitcoin(BTC), daily chart, screenshot on CoinMarketCap at 15:05 UTC on August 21, 2025. Source: CoinMarketCap

Based on Coincu's research, legal complexities might slow regulatory advancements, influencing financial institutions' trust. Historical case adherence signals stringent legal consequences within the U.S. financial system, as shown in past civil fraud cases. Potential shifts in handling real estate asset documentation may arise from ongoing evaluations.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

By Coincu

about 3 hours ago