Zcash (ZEC) has recently experienced significant volatility, retracing from its recent peaks while still maintaining gains from its recent lows. Despite these fluctuations, the cryptocurrency is showing signs of resilience and renewed interest from traders. The critical question for investors and market observers is whether ZEC can translate this current rebound into a sustained upward trend.

ZEC Key Statistics

- •Current Price: $349

- •Market Cap: $5.8 billion

- •Trading Volume (24h): $1.17 billion

- •Circulating Supply: 16 million ZEC

- •Total Supply: 16 million ZEC

- •CoinMarketCap Ranking: #22

In the past 30 and 7 days, Zcash has seen a decline of 51.90% and 35.22% respectively from its recent highs, indicating a notable pullback in price. However, the cryptocurrency has also risen 15.05% from its lowest price during these same periods, demonstrating signs of resilience and potential for recovery.

ZEC/USD Market Analysis

Key Levels

- •Resistance: $400, $470, $550

- •Support: $320, $280, $240

The ZEC/USD pair is currently trading near $349.15, having retraced significantly from its peak of $744. The price action is consistently moving beneath the Parabolic SAR markers, which continue to signal a bearish tone. The overall price trend remains downward, characterized by a pattern of consistent lower highs and lower lows, which shapes market sentiment. For any shift towards an upward trend to materialize, ZEC must first challenge and surpass key resistance levels at $400, $470, and $550. These are zones where previous rallies encountered selling pressure and momentum faltered.

The Relative Strength Index (RSI) reading of 38.63 suggests growing exhaustion in the current downtrend. This condition creates the possibility, though not a certainty, of a short-term corrective bounce if buyer interest begins to emerge. If selling pressure persists without significant intervention from buyers, the market could gravitate towards support levels near $320, $280, and $240. These levels are associated with previous periods of price consolidation. The behavior of ZEC around these support areas will be crucial in determining whether the market finds a temporary floor or experiences a deeper retracement, making upcoming price reactions particularly important to monitor.

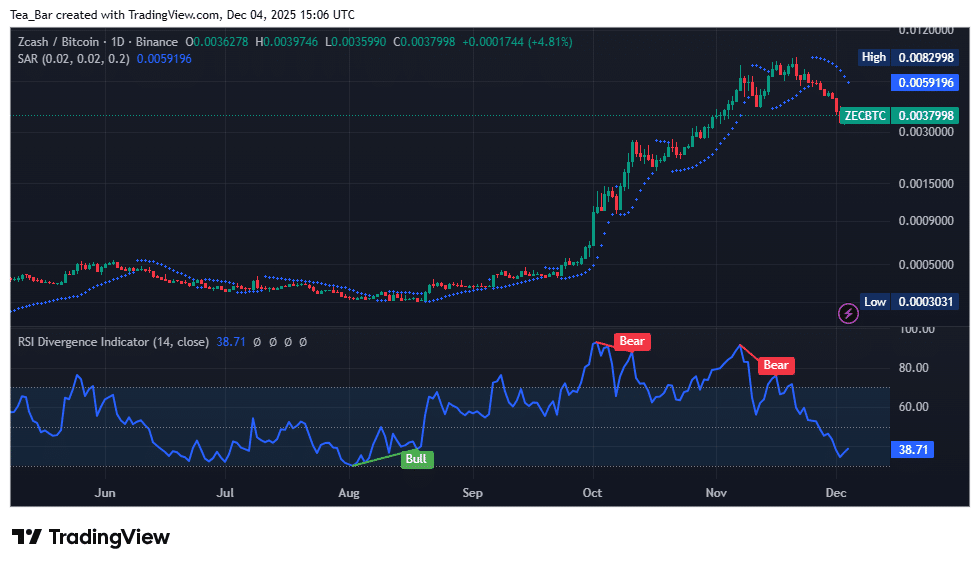

ZEC/BTC Performance Insights

The ZEC/BTC pair is presently trading around 0.0037998, reflecting a continued pullback from its peak of 0.0082998. The Parabolic SAR dots remain above the candles, reinforcing the indication of ongoing bearish momentum. This decline is further corroborated by a weakening RSI, currently at 38.71, which signifies sustained downside pressure following consecutive bearish divergences observed in October and November. Unless the ZEC/BTC pair can reclaim levels around 0.0042000 or higher to alter market sentiment, it remains vulnerable to further pullbacks toward the next demand zones. Consequently, the forthcoming price action will be critical in assessing the readiness of buyers to defend the current trading range.

Recent activity observed on social media platforms suggests that ZEC has been experiencing a rebound over the past few days, outperforming many other altcoins. Analysts interpret this movement as a potential indicator of a rounded bottom formation, which could signify the commencement of an emerging upward trend. This perspective suggests the possibility of short-term momentum gains, potentially attracting renewed interest from traders looking for promising opportunities within the altcoin market.

Zcash Fundamentals: Privacy, Adoption, and Market Potential

The fundamental outlook for Zcash is increasingly influenced by its technological advancements and its potential for broader adoption. The Sapling network upgrade, implemented in October 2025, significantly reduced the costs associated with shielded transactions, thereby enhancing the practicality of private payments. Furthermore, Ztarknet, a Layer 2 scaling solution inspired by Starknet, is designed to process transactions at speeds exceeding 1,000 transactions per second without compromising privacy. These developments are expected to stimulate growth in the shielded pool, which currently accounts for 29% of the total ZEC supply. Historically, major protocol upgrades, such as Halo 2 in 2024, have coincided with substantial price rallies. Additionally, listings on prominent exchanges like Coinbase and Gemini contribute to enhanced liquidity, although they may also introduce short-term price volatility.

Regulatory landscapes and institutional involvement add further complexity to Zcash's future prospects. While the SEC's recent rejection of leveraged crypto ETFs indicates a cautious approach from regulators, institutional adoption continues to grow, evidenced by Grayscale's ZEC Trust and the significant holdings of Cypherpunk Technologies. Zcash's opt-in transparency model may appeal to institutions prioritizing regulatory compliance, offering a balance against concerns regarding privacy coin regulations in various jurisdictions, including the European Union. Broader market dynamics, including high volatility and the influence of whale activity, also play a role in shaping price action. Considering these evolving factors, a key question remains: will Zcash's shielded transactions reach 50% of its total supply by 2026, thereby solidifying its position as a leading "privacy-first" cryptocurrency?