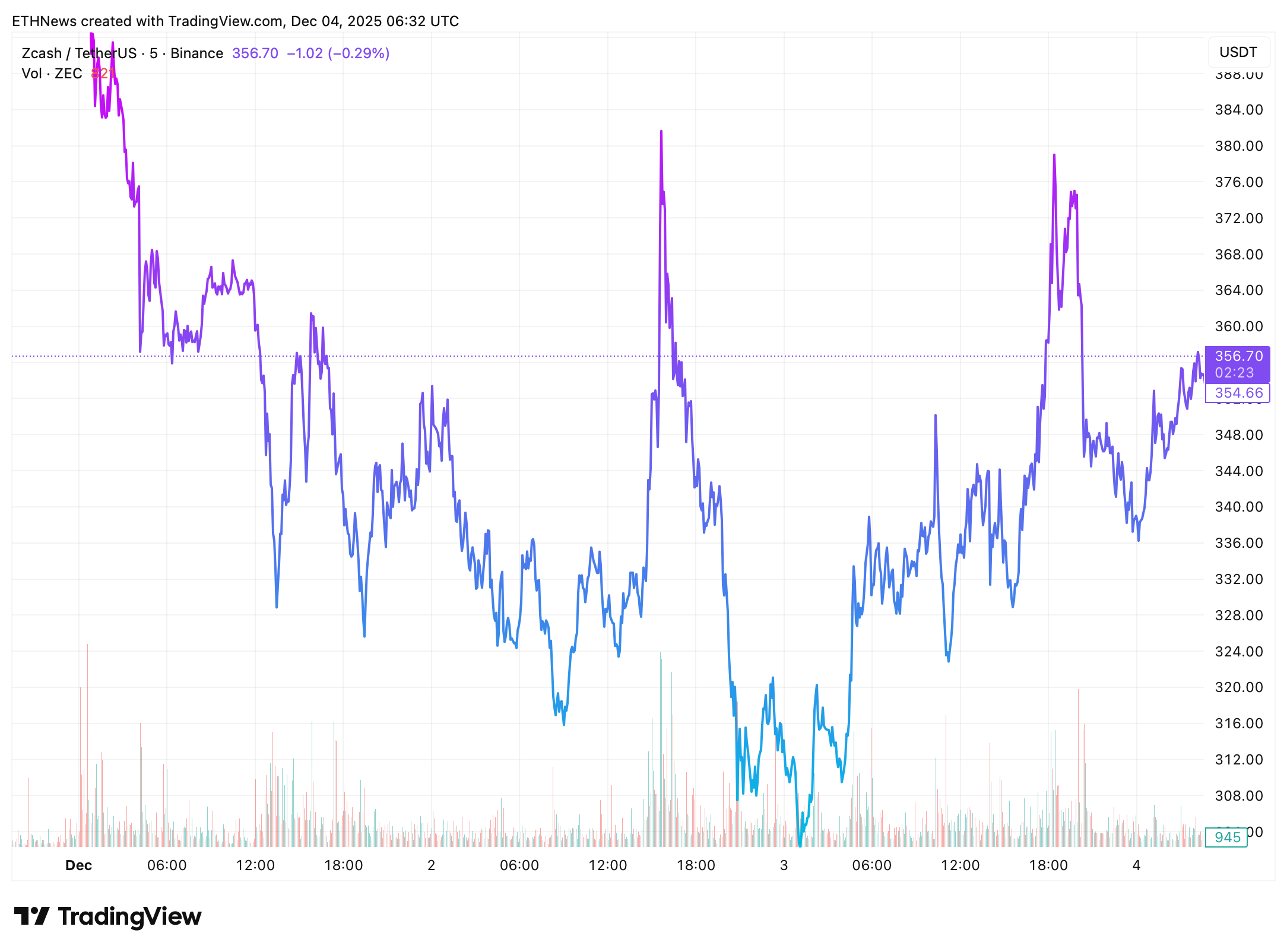

Zcash (ZEC) is attempting to stabilize after a sharp early-December drop, with price action now grinding around the key $350–$360 region. The chart shows a deep retracement from the November highs, forming a rounded bottom structure after a sequence of lower lows. Volume has begun to tick up during intraday recoveries, suggesting early attempts at demand returning.

The chart shows ZEC’s December decline extending into the $315–$320 area before buyers stepped in aggressively, creating a V-shape rebound toward the $350s. This reaction zone closely aligns with the 0.618 Fibonacci retracement level, historically one of the strongest bounce regions in swing-trading setups.

Analyst View: Altcoin Sherpa Flags a Potential Swing Long

Altcoin Sherpa notes that ZEC’s current structure offers a clean setup for swing traders looking for a mid-term bounce. He highlights the confluence between the recent retracement and the 0.618 Fib level, arguing that this zone often attracts technical traders seeking oversold reversals.

Sherpa does not expect ZEC to revisit its all-time highs but believes the current pullback may fuel a healthy relief rally. Based on past volatility and the depth of the correction, he estimates that a rebound of 20–40% is a realistic expectation if the market holds above the 0.618 region.

He also mentions that invalidation should sit just below this Fib level, as losing it could open the door to another leg down.

Technical Picture: A Bounce Setup With Defined Risk

ZEC’s recent price action resembles several classic swing-low structures:

- •A steep drop into a major Fibonacci level

- •A sharp intraday reversal with strengthening volume

- •A shift from aggressive selling to gradual re-accumulation

- •Higher lows forming on lower timeframes

The chart shows momentum flipping once the price reclaimed $330, followed by a steady advance toward $350–$360. This recovery suggests sellers may be losing control, at least temporarily, giving the market space for a technical bounce.

The primary resistance zones ahead sit around $380 and then $410, which align with previous breakdown points.

Outlook

Zcash is currently positioned in one of the most attractive technical regions for bounce traders. With a clean invalidation point and an established Fibonacci confluence, the market structure supports the idea of a relief rally, especially if broader altcoin sentiment continues improving alongside Bitcoin’s recent recovery.

Sherpa’s thesis focuses on a disciplined swing approach rather than long-term bullishness. If ZEC maintains strength above the 0.618 Fib region, the odds of a move toward the mid-$400s increase meaningfully.