According to a report shared by CryptoQuant, recent on-chain data from the XRP Ledger points to a clear shift in market structure, driven primarily by large participants rather than retail flows. The analysis is based only on spot market metrics visible in the uploaded charts, with no external assumptions.

Whale Orders Are Growing as Price Compresses

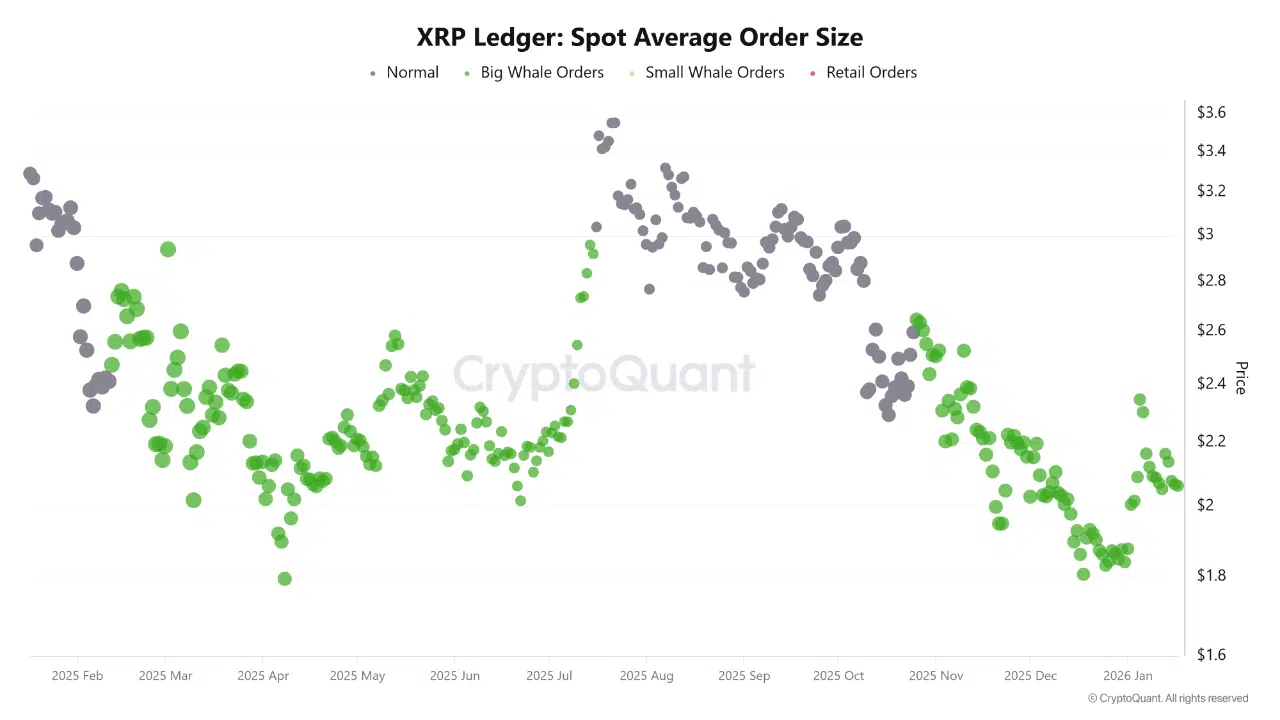

The Spot Average Order Size chart shows a sustained increase in green dots, which represent big whale orders. These large orders become more frequent during periods when XRP’s price trades between roughly $1.80 and $2.20, indicating that higher-value participants are actively transacting while price remains range-bound.

Smaller retail-sized orders appear less dominant during this phase, suggesting that accumulation or distribution decisions are increasingly controlled by larger players. Historically, this type of structure reflects strategic positioning rather than emotional, short-term trading.

90-Day CVD Confirms Taker Buy Dominance

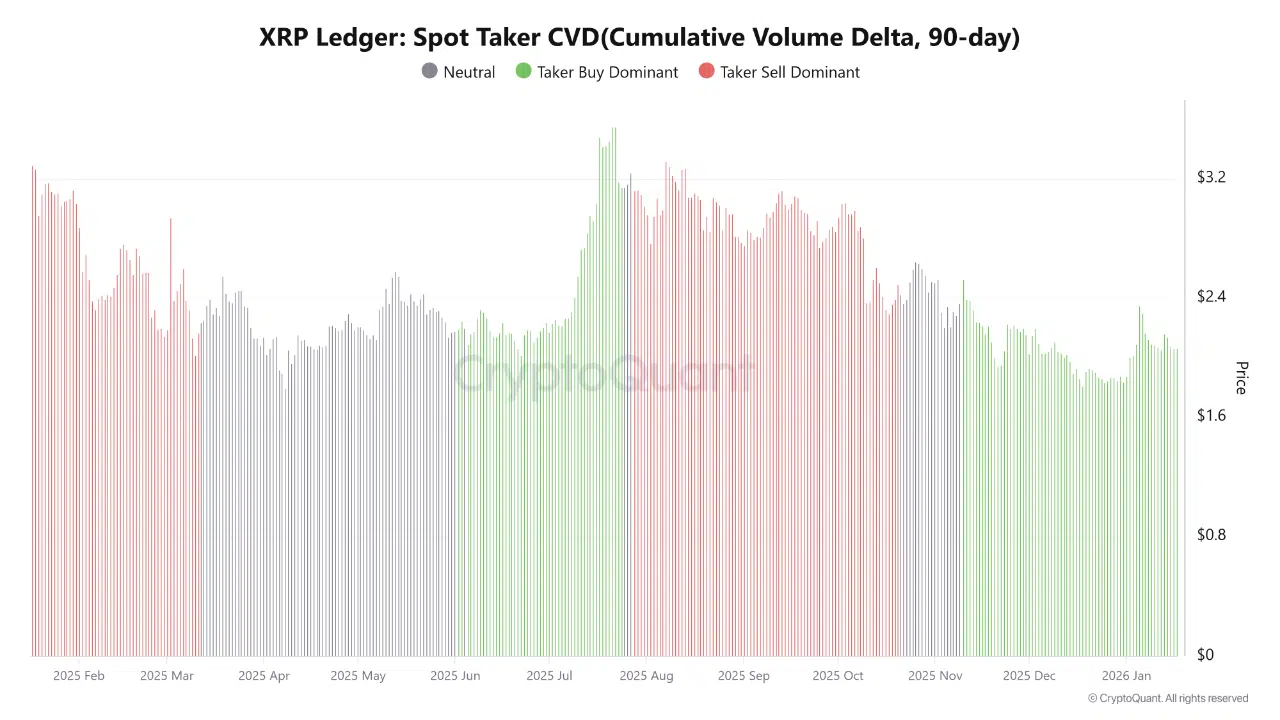

The 90-day Spot Taker CVD (Cumulative Volume Delta) chart adds further confirmation.

Over the most recent period, the bars are predominantly green, signaling taker buy dominance. This means market buys have outweighed market sells over an extended window, reflecting sustained demand executed aggressively at market prices. Notably, this buy-dominant behavior persists even as price volatility cools, which often points to absorption of available supply rather than speculative chasing.

What the Data Suggests

When large average order sizes align with positive long-term CVD, it typically indicates:

- •Supply is being absorbed by larger entities

- •Selling pressure is being met with strong market buying

- •Price compression is occurring under the surface of accumulation

While this data does not guarantee an immediate breakout, it does show that XRP is currently trading in a structurally constructive environment where buyers remain in control of spot market flow.

Bottom Line

Based solely on CryptoQuant’s on-chain data:

- •Whale-sized spot orders are increasing

- •90-day taker flow remains buy dominant

- •Market structure favors accumulation over distribution

If this behavior continues, price movement is more likely to resolve with strength rather than breakdown, as long as buy-side dominance remains intact.