Key Market Indicators

- •XRP mirrors a past multi-cycle pattern that supported large trend continuation phases.

- •Derivatives activity expands while traders keep positions measured on major exchanges.

- •Price stays stable within a narrow range as liquidity supports short-term balance.

XRP price shows stable trading conditions as multi-cycle structural patterns align with rising derivatives activity and controlled intraday movement.

Multi-Cycle Structure Suggests Ongoing Trend Continuity

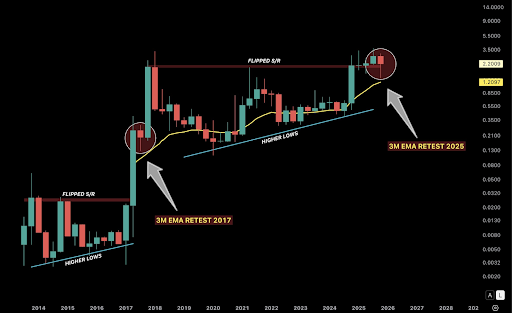

The broader XRP structure reflects a long-cycle pattern that matches the behavior seen during the 2017 expansion. ChartNerdTA notes that XRP once retraced toward the three-month 20-EMA after a strong breakout before advancing sharply. The current three-month pullback toward the same moving average shares the same visual setup.

The chart also shows rising higher lows that stretch across nearly a decade. This rise held during the 2021 rejection, which met the same resistance area observed in 2017. That region acted as a seven-year ceiling that XRP moved above during last year’s breakout, forming the base for the present cycle.

The three-month 20-EMA now sits near $1.20. ChartNerdTA marks this level as the point where the structural trend would break if price closes below it. XRP maintains structure as long as the pair remains above that threshold, giving the market a defined macro range.

Intraday Trading Shows Steady Behavior After Early Volatility

XRP as of writing, trades at $2.18 after a 1.4% decline over the past 24 hours. The price fluctuated between $2.17 and $2.26 through the session. A sharp push toward the upper end of the range earlier in the window created a fast swing before reversing into a calmer drift lower.

The movement formed a brief V-shape that transitioned into a controlled pullback. Selling pressure during the decline remained measured, allowing XRP to settle near the mid-range zone. The price held around $2.18 into the early morning hours, with traders waiting for new direction.

Liquidity remains firm with a $131.55B market cap and $3.79B in 24-hour volume. The intraday chart shows steady turnover without aggressive spikes. Buyers have continued to support XRP near $2.18, while short-term supply capped advances near $2.22 to $2.26.

Derivatives Reaction Shows Increased Activity With Cautious Positioning

XRP derivatives data shows stronger activity across futures markets. Total derivatives volume rose 56.19% to $6.57B. Open Interest increased 0.48%, showing higher participation without expanding net positioning. Options activity declined, with volume down 74.70% and OI down 78.80%, signaling reduced volatility trades.

The 24-hour long-short ratio is at 0.97. Exchange-specific readings indicate a clearer upward lean, with Binance at 2.74 and OKX at 1.49. These readings show measured long positioning even as traders avoid aggressive leverage.

Liquidation data reflects the day’s volatility. One-hour readings show short liquidations dominating, while the 12-hour window recorded more long liquidations. Over 24 hours, total liquidations reached $7.36M, mostly from long positions. XRP remains active within derivatives markets while traders keep positions controlled.