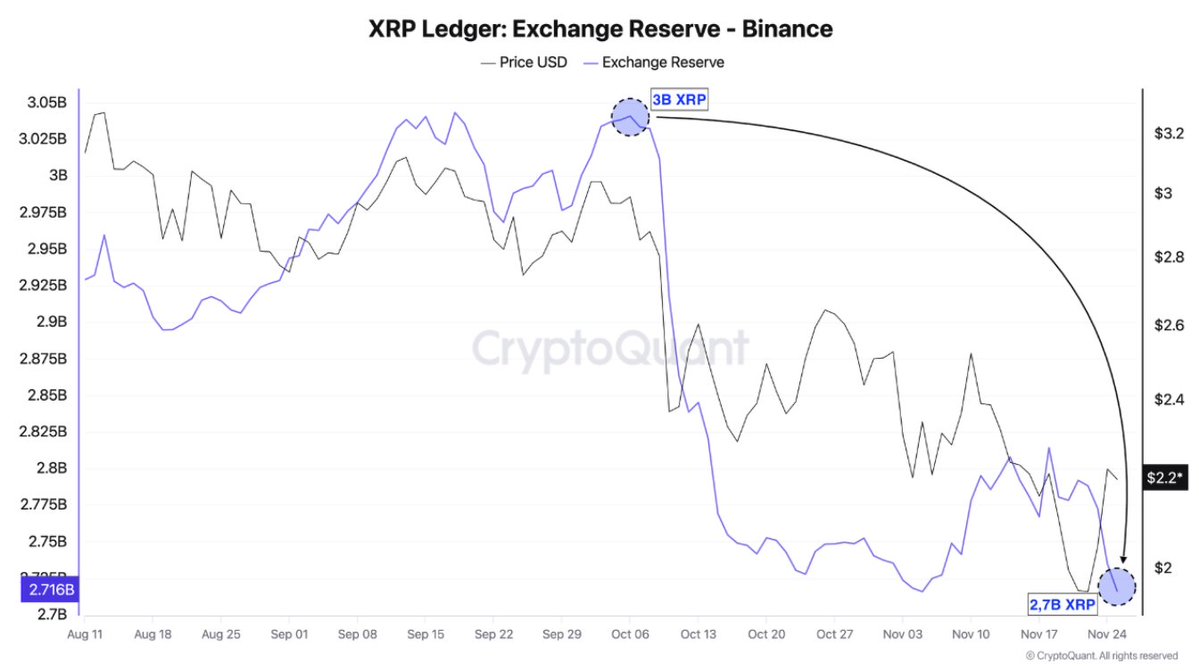

XRP is entering a decisive phase on Binance as exchange-held reserves fall sharply, marking one of the steepest supply drops of the year. Fresh CryptoQuant data shows that Binance’s XRP reserves have declined from roughly 3 billion tokens in early October to around 2.7 billion by late November. The reduction is notable not only for its size but also for the speed at which the reserves have thinned out, suggesting meaningful shifts in trader and institutional behavior.

Analyst Darkfost emphasized that the current pace of withdrawals could push XRP into a more structured market environment, especially if institutions continue absorbing supply while exchange balances shrink. With XRP trading near $2.20, the market is now watching whether this reserve trend becomes a leading indicator of a larger rotation in investor positioning.

Data Shows a Clear and Persistent Outflow Trend

The chart reveals a smooth, continuous downward arc in Binance’s XRP reserves over the past six weeks. After topping out at the 3B XRP mark in early October, the reserves have steadily tracked lower toward the 2.7B zone. What stands out is that this drawdown has occurred regardless of intraday volatility in XRP’s price.

Price action has fluctuated sharply, from peaks above $3.00 earlier in the month to the current $2.20 area, yet the reserve line continues its downward slope, highlighting consistent net outflows rather than exchange-driven accumulation.

The decline aligns with a period where XRP traders appear to be shifting toward off-exchange storage or positioning through institutional channels. The slope of the reserve trend suggests no counterpressure from deposit spikes, reinforcing the view that supply on exchanges is becoming more constrained.

XRP Price Lags Behind the Reserve Trend – For Now

Interestingly, the price has not mirrored the drop in exchange reserves. The chart shows XRP rising into early October as reserves peaked, then sliding lower as the reserves declined. That divergence, higher supply leaving exchanges while price consolidates, often reflects transitional phases where participants accumulate quietly rather than aggressively bidding on open markets.

Such patterns historically serve as early signals of tightening float, especially when reserves approach multi-month lows. Traders typically monitor these structures to gauge whether supply exhaustion might support a stronger price reaction once broader market conditions stabilize.

What the Shrinking Reserves Could Mean Going Forward

If the decline continues below the 2.7B level, Binance’s XRP reserves may fall to lows not seen since summer. Analysts often interpret persistent outflows as a sign that long-term holders and institutional allocators are absorbing supply and reducing short-term sell pressure.

Darkfost notes that the ongoing drawdown could push XRP into a more organized trend structure, with “expanding institutional interest” acting as a potential catalyst. For now, the key question becomes whether price eventually responds to the contraction in available exchange liquidity or continues lagging behind reserve trends until macro conditions shift.

In a market dominated by volatility and fast rotation, XRP’s sharply declining exchange reserves stand out as one of the clearest structural signals on Binance heading into December.