The XRP price has experienced a notable decline, slumping 9% over the past week and 0.6% in the last 24 hours, trading at $2.27 as of 3:50 a.m. EST. This price action occurs alongside a significant 51% surge in trading volume, reaching $4.41 billion.

This downturn comes despite the impending launch of two major XRP Exchange Traded Funds (ETFs) this week. Franklin Templeton is scheduled to debut its XRP ETF tomorrow, followed by Bitwise's launch on November 20. The anticipation is that new institutional inflows into these funds could provide a much-needed boost to the cryptocurrency.

In a separate development, Canary Capital's XRP ETF (XRPC), which commenced trading on Thursday, marked the largest ETF launch of the year, recording $58 million in first-day trading volume.

XRP Price: On-Chain Activity Surges

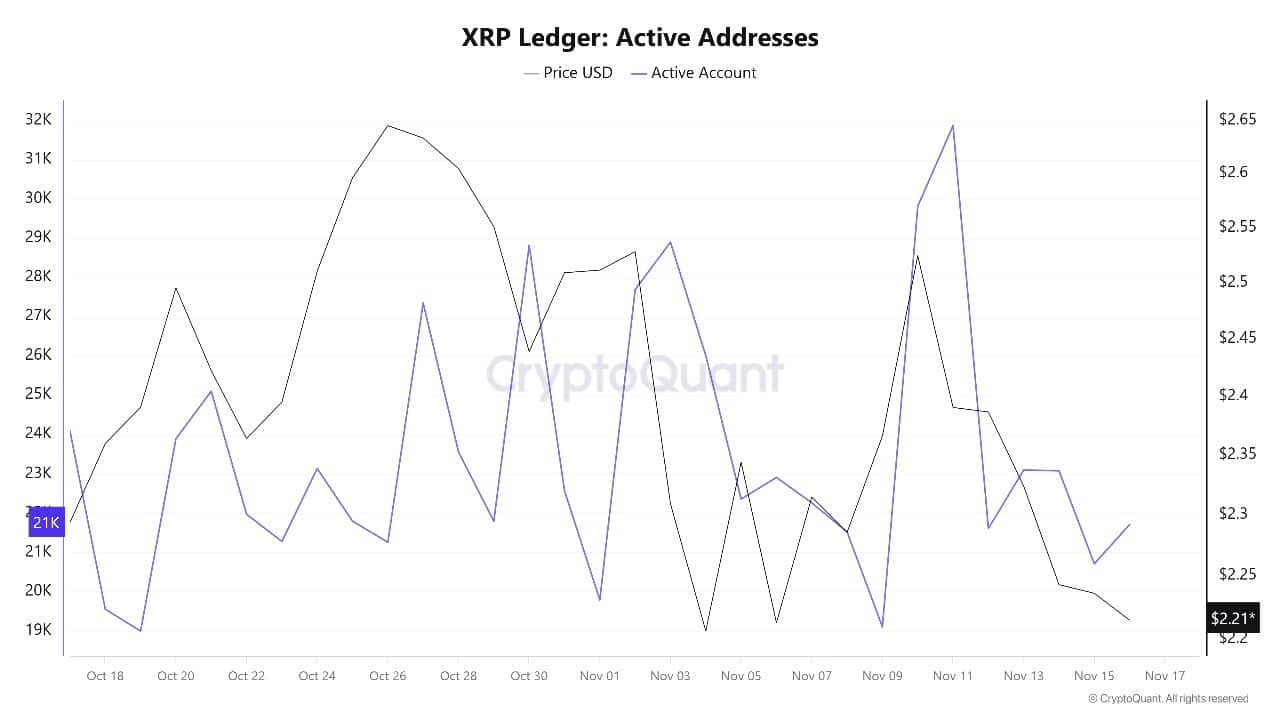

While XRP's price performance has been a disappointment for traders in the past week, on-chain signals indicate a rise in network activity. The number of active addresses on the XRP Ledger has surged by 40% this week, reaching approximately 32,000. This represents a strong indicator of growing interest, even as the price experiences a decline.

Furthermore, there was a 200% spike in network volumes, with nearly 2.56 billion XRP transactions recorded across wallets and exchanges in a single 24-hour period.

Large investors have demonstrated significant activity, executing 716 substantial transfers and moving approximately 200 million XRP over two days. This level of activity is often a precursor to a sharp price movement, though the direction remains uncertain.

Traders are closely monitoring the support zone between $2.20 and $2.00, as well as the resistance area between $2.35 and $2.60. These price levels align with key moving averages and previous swing highs.

When buyer activity intensifies without an immediate price increase, it often signals preparation for a more significant shift. The observed increase in active addresses, rising volume, and whale movements suggest that market sentiment may not be as negative as the current price drop might imply.

XRP Price Technical Analysis: Rangebound, But Support Is Critical

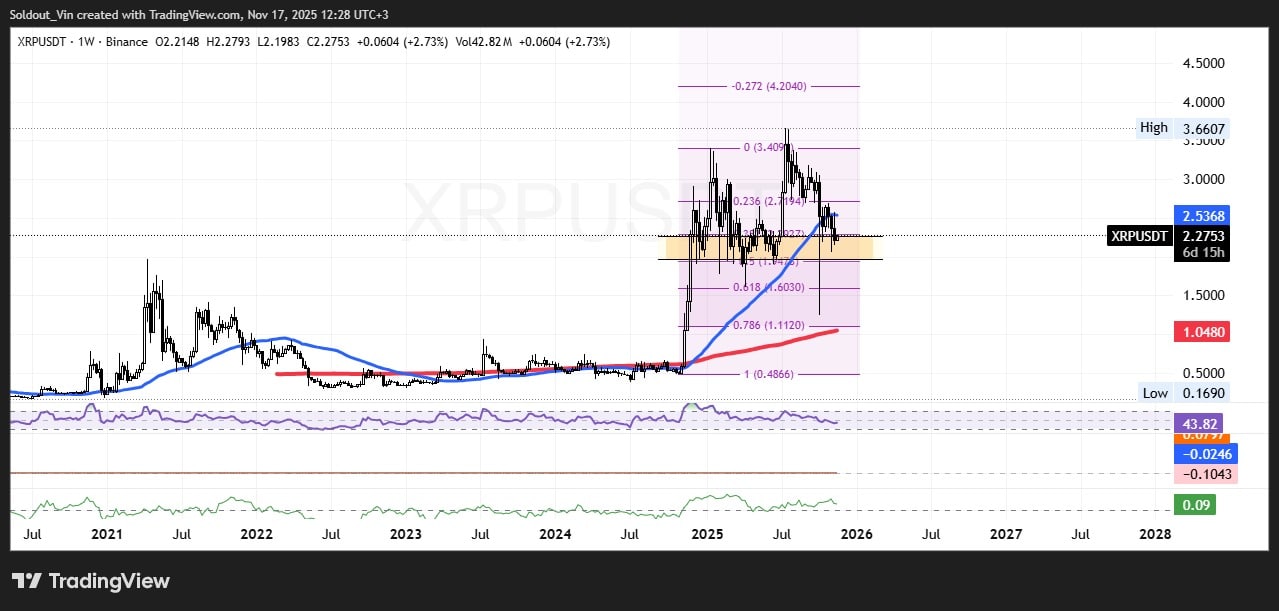

The weekly XRPUSDT chart illustrates continued volatility, alongside distinct price zones where support is likely to be found. Currently, XRP is trading near $2.28, having recovered from a brief dip to around $2.07 earlier in the week. Strong buying pressure quickly reversed this decline, indicating that buyers are actively defending key support levels.

Several critical technical levels are currently in play. Immediate support is identified between $2.20 and $2.00. In recent trading sessions, XRP has experienced price bounces each time it approached the $2.07 level, indicating renewed buyer interest.

Key resistance is situated within the $2.35–$2.60 band. A sustained rise above $2.58 could potentially lead to a move towards $2.76, and subsequently, to $2.89 or even higher.

The Relative Strength Index (RSI) is exhibiting rapid fluctuations. Recently, the RSI dropped to as low as 31.76, a level often associated with oversold conditions, suggesting that any further price dips could be met with upward reversals as traders capitalize on these conditions.

The MACD indicator points towards consolidation. With the blue MACD line closely tracking the red signal line, this could indicate a period of sideways movement or a mild rebound preceding a more significant breakout.

On the long-term chart, XRP remains positioned above most major moving averages. Historical data from previous ETF launches for other cryptocurrencies, such as Bitcoin, has shown that initial price dips were often followed by rallies. This trend supports expert predictions that recent ETF launches, even if initially met with selling pressure, could ultimately contribute to a market turnaround as new investors enter.

Should volatility persist and XRP break below the $2.00 level, downside risk could emerge. However, as long as the price holds above the established support zone, XRP has the potential to recover and retest the $2.58–$2.76 resistance area.