The XRP price experienced a 5% decline over the past 24 hours, settling at $2.41 as of 3:44 a.m. EST, despite a significant 80% surge in trading volume to $3.1 billion.

This downturn followed pointed criticism from Vibhu Norby, an executive at the Solana Foundation, who characterized XRP as a "mediocre token" that has been surpassed by Solana (SOL) in terms of speed, scalability, and developer engagement.

I want Ripple and XRP to succeed at an insane degree such that the entire industry moves forward.

But the fact is that the community does not argue with facts, even though the data is readily available. And as a longtime engineer and truth seeker, that bothers me.

It is totally… pic.twitter.com/2U6tOmG8sI

— vibhu (@vibhu) November 1, 2025

The remarks have intensified the ongoing rivalry between the two blockchain communities. XRP proponents have countered by highlighting Ripple's expanding role in cross-border payments and its growing portfolio of institutional partnerships.

Analysts suggest that the criticism may have contributed to short-term selling pressure. However, long-term sentiment remains divided as both networks compete for prominence in real-world financial applications.

Concurrently, Nate Geraci, president of The ETF Store, has expressed his expectation for the launch of the first spot XRP exchange-traded fund (ETF) within the next two weeks.

Sometime in next two weeks, I expect launch of first spot xrp ETFs…

SEC had open litigation against Ripple for past five years, up until three months ago.

IMO, launch of spot xrp ETFs represents final nail in coffin of previous anti-crypto regulators.

Have come a *LONG* way.

— Nate Geraci (@NateGeraci) November 3, 2025

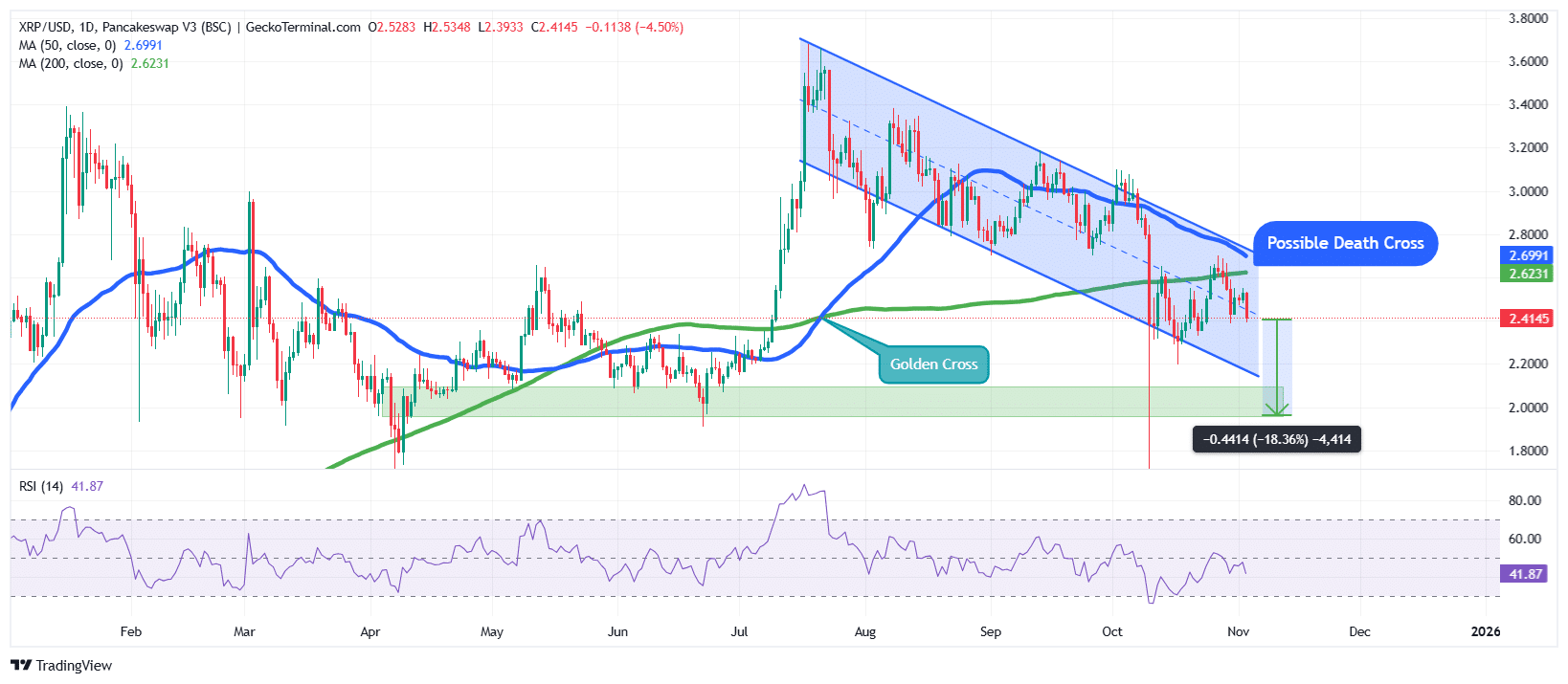

XRP Price On A Sustained Bearish Trend

Following a period of trading within the $2 range from April to July, the XRP price experienced a parabolic rally, reaching a new all-time high (ATH) of approximately $3.65.

This surge was further validated by the formation of a golden cross, where the 50-day Simple Moving Average (SMA) crossed above the 200-day SMA.

However, XRP bulls subsequently lost control of the price, driving it into a clearly defined falling channel.

As a consequence of this recent decline, the price of XRP has now fallen below both the 50-day and 200-day SMAs, confirming a shift towards a bearish trend.

Meanwhile, the Relative Strength Index (RSI) is indicating a selloff, having dropped below the 50-midline and currently sitting at 41. Should the RSI maintain this downward trajectory, bears could regain dominance over the price, potentially pushing it into oversold territory around the 30 level.

Furthermore, the 50-day SMA is converging with the 200-day SMA. A potential cross between these two moving averages could form a death cross, which historically signals further price depreciation.

Ripple Token Price Set Up For An 18% Drop

Based on the current XRP/USD chart analysis, the short-term outlook for the Ripple token price leans bearish. The potential formation of a death cross typically suggests continued downward price momentum.

The price of the Ripple token remains contained within a falling channel pattern, which indicates persistent selling pressure in the market.

If the bearish momentum persists, XRP could retest the support zone located around $1.95. This level would represent an approximate 18% decline from its current trading price.

According to crypto analyst Ali Martinez, the XRP price may be on a trajectory to reach $2.25.

$XRP showing signs of weakness. A retest of $2.25 might be next! pic.twitter.com/RMYX15hbRt

— Ali (@ali_charts) November 2, 2025

A sustained closing price below $2.20 could confirm further downside potential. Conversely, a breakout above the upper boundary of the channel, which is currently near $2.70, could invalidate the bearish outlook and signal a potential recovery towards the $3.00 mark.