Key Insights

- •XRP price has dropped 6.7% to $2.04 despite Ripple securing an expanded Singapore license.

- •The Monetary Authority of Singapore has approved broader payment activities for Ripple Markets APAC.

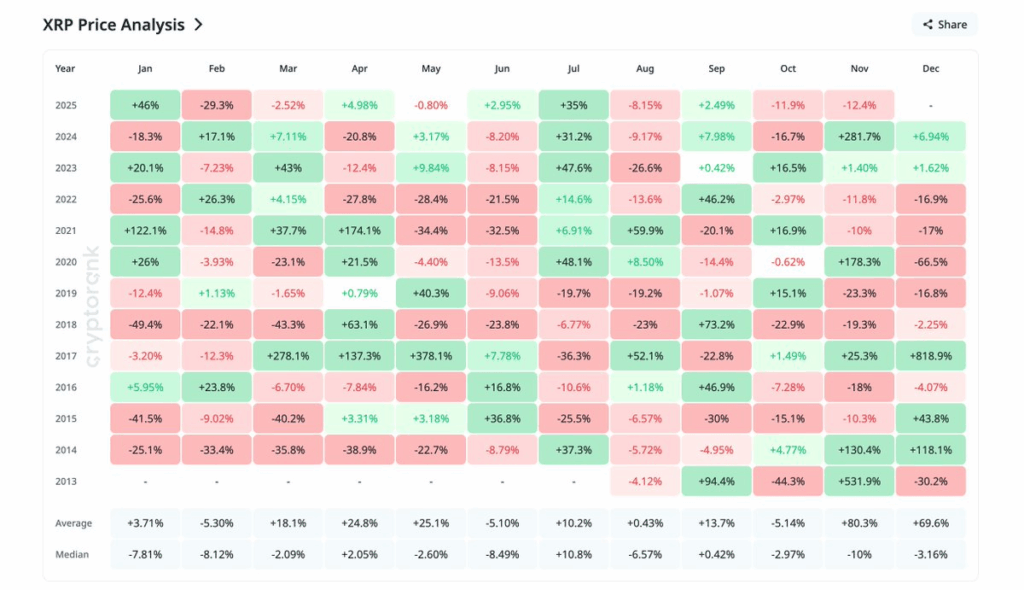

- •Historical data indicates that December has historically seen average XRP returns of 69.6% across multiple years.

XRP Price Faces Short-Term Pressure

The price of XRP experienced a 6.7% decline in the past 24 hours, trading at $2.04 according to current market data. This price movement occurred despite Ripple's recent announcement regarding the Monetary Authority of Singapore's approval for an expanded scope of its Major Payment Institution license.

Ripple's Singapore subsidiary, Ripple Markets APAC Pte. Ltd., has received approval for a wider range of regulated payment offerings. This development positions the financial technology company among a select group of blockchain-enabled institutions globally that hold a Major Payment Institution license from the Monetary Authority of Singapore.

The monthly performance of XRP price is currently showing a negative 18.4%. Historical monthly data reveals that December typically delivers the strongest performance for XRP.

The average December return across the years from 2013 through 2024 reaches 69.6%, according to compiled statistics.

However, the median December performance shows a negative 3.16%, indicating a high variance in outcomes. December 2024 saw a gain of 6.94%, while 2023 posted a 1.62% increase.

Notable December rallies include an 818.9% surge in 2017 and a 66.5% decline in 2020. December 2021 showed a 17% loss, while 2013 recorded a 30.2% drop.

Individual year performance varies significantly, ranging from triple-digit gains to double-digit losses. The current December 2025 shows a negative 12.4% through the end of November, indicating a weak start to a historically strong month.

The year-to-date performance for XRP price in 2025 includes a 46% gain in January, followed by a 29.3% decline in February.

March posted a 2.52% loss, while April saw a gain of 4.98%. May experienced a drop of 0.80%, followed by a rally of 2.95% in June. July added 35% before August declined by 8.15%. September gained 2.49% while October fell 11.9%.

XRP Price in Focus as Ripple Expands Singapore Operations

Ripple announced that the Monetary Authority of Singapore has approved an expanded scope for payment activities for its subsidiary, Ripple Markets APAC.

This enhancement to the Major Payment Institution license permits Ripple to offer a broader range of regulated payment services to customers in Singapore. This development has also boosted hopes regarding its potential impact on XRP price in the future.

Ripple President Monica Long stated that the Monetary Authority of Singapore has set a leading standard for regulatory clarity in the digital assets space. According to Long, Singapore demonstrates that innovation can thrive under clear regulatory rules.

The company maintains a regulation-first approach in its operations in Singapore. Ripple established its Asia Pacific headquarters in Singapore in 2017.

The Monetary Authority of Singapore has gained recognition for its leadership in establishing clear regulatory frameworks for digital assets.

Ripple Payments integrates digital payment tokens with a global payout network, facilitating fast cross-border payments. This end-to-end solution is designed to serve banks, crypto companies, and fintech firms worldwide.

Key benefits include Digital Payment Token settlement using RLUSD and XRP, with payments completed within minutes.

The platform supports the entire payment flow, encompassing collection, holding, swapping, and payout processes.

Asia Pacific Growth Drives Ripple's Strategic Focus

Fiona Murray, Ripple's Vice President for Asia Pacific, stated that the region is leading the world in the practical usage of digital assets.

On-chain activity has increased by approximately 70% year-over-year, with Singapore being a central point of this growth. This development may also contribute to increasing the appeal of XRP price among global traders.

Singapore has played a pivotal role in Ripple's global business since the establishment of its headquarters in 2017. The city-state has fostered an environment conducive to financial institutions through its clear regulatory frameworks.

The Monetary Authority of Singapore is internationally recognized for setting standards in digital asset regulation. This jurisdiction attracts blockchain companies seeking regulatory certainty for their operations.

Ripple emphasizes a strong commitment to regulatory partnership and transparency in its Singapore operations. The expanded license reinforces the company's continued investment in market infrastructure.

Analysts Predict XRP Price Recovery Scenarios

Analyst STEPH IS CRYPTO has drawn a comparison between the current XRP price chart pattern and that of Ethereum prior to its significant rally. This observation suggests the possibility of similar technical formations and indicates potential for major upside movement.

The historical average December return of 69.6% supports a bullish seasonal outlook. Past performance indicates that December has historically delivered outsized gains in certain years.

Analyst JAVON MARKS has identified a hidden bull divergence formation in the XRP price action. This pattern suggests a potential recovery of 55%, with the price potentially reaching above the $3.48 level.

A recovery to $3.48 from the current $2.04 represents a 70% gain from present levels. The news regarding Ripple's expanded Singapore license serves as a positive catalyst, despite the near-term weakness in XRP price.

The discrepancy between positive developments from Ripple and the declining XRP price reflects broader market conditions. Cryptocurrency markets are currently navigating macro uncertainties that are affecting investor sentiment towards risk assets.