XRP is currently trading around $2.41. Following a significant 35% decrease on October 10, the token has been consolidating within the $2.10 to $2.60 price range.

An analyst from the Working Money YouTube channel has made a bold prediction, suggesting that XRP's price could potentially climb to as high as $6 within the next five weeks. This analysis is based on several key indicators and market dynamics.

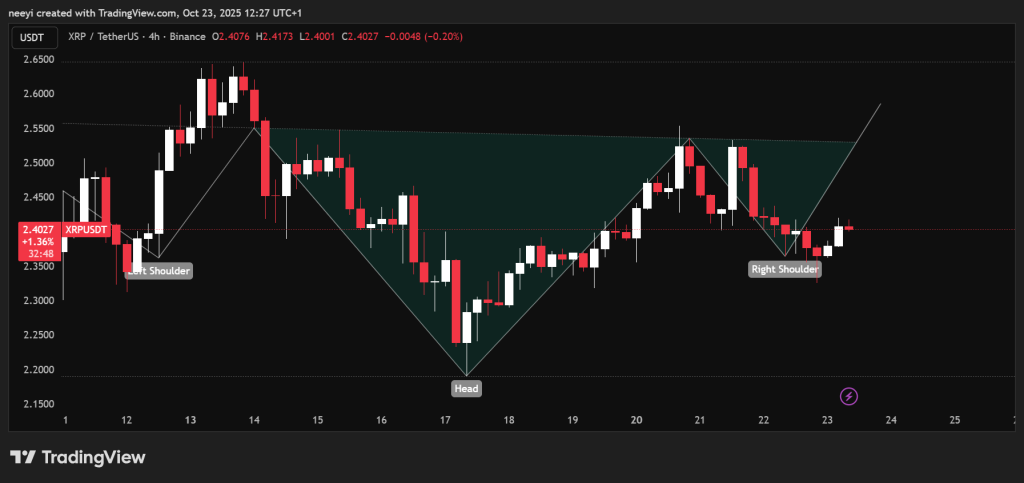

The analyst highlighted that the current XRP chart exhibits an inverted head and shoulders pattern. This specific chart formation is widely recognized as a bullish setup, often indicating a potential trend reversal.

On the 4-hour chart, XRP has repeatedly tested the $2.52 resistance level. Each instance of rejection suggests that buyers are accumulating strength and preparing for a decisive breakout.

XRP's price movements continue to correlate with Bitcoin, which is a common observation in the cryptocurrency market. The analyst noted that Bitcoin recently experienced some volatility around the $107,000 mark but has largely remained below its opening price. A potential rise in Bitcoin's price could consequently drive XRP upward, potentially pushing it past its current resistance levels.

Why the Broader Market Environment Matters

The commentator also pointed to market sentiment, as measured by the Fear and Greed Index, which currently stands around 29. This reading signifies extreme caution within the market. Historically, such low sentiment readings have often preceded significant market rallies.

Periods of widespread fear can present opportunities for long-term investors. The global cryptocurrency market capitalization is approximately $3.64 trillion, which is close to its previous peak of $4 trillion.

While prices have seen a cooling-off period, overall volatility remains relatively low. This could indicate that the market is in a phase of regrouping rather than experiencing a downturn. The analyst believes this is a consolidation phase rather than a full-blown bear market, setting the stage for a potential upward movement.

Institutional Interest Could Reshape the XRP Token Market

Beyond technical analysis, fundamental developments surrounding XRP are also shifting. Ripple and several associated entities, including Evernorth and SBI Holdings, have been actively pursuing strategic initiatives to enhance XRP's role as a reserve and liquidity asset. The analyst emphasized that these partnerships are designed to broaden XRP's application in institutional lending, liquidity provision, and decentralized finance (DeFi) integration.

The involvement of prominent figures such as Ripple co-founder Chris Larsen, along with executives like Ashish Birla and David Schwartz, lends significant credibility to these efforts. Their new venture, Evernorth, is focused on accumulating XRP and deploying it within regulated frameworks. SBI Holdings has also announced its intention to purchase XRP directly from the open market, aiming to establish one of the largest public treasuries for the token.

This type of institutional demand, as opposed to speculative trading, could emerge as a substantial catalyst for XRP's price if it continues to grow.

Ripple is continuously expanding its real-world use cases through strategic partnerships. Airwallex, a payment firm linked to Ripple, is extending its services to the Americas with new billing solutions, which could potentially increase demand for XRP liquidity.

Concurrently, RippleX has announced that regulated stablecoins can now be issued directly on the XRP Ledger. This development opens up new avenues for institutional payments and the tokenization of assets within the network.

Collectively, these initiatives are enhancing the utility of the XRP token, aligning with Ripple's long-standing objective of bridging traditional financial institutions with blockchain technology. Adoption driven by utility often takes time to be reflected in price, but once market confidence solidifies, price movements can accelerate rapidly.

Could XRP Really Reach $6?

The analyst's projection of XRP reaching $6 within five weeks is based on observable market structure. A decisive breakout above the $2.52 neckline of the inverted head and shoulders pattern, coupled with sustained upward momentum from Bitcoin, could trigger significant technical buying. When combined with the increasing institutional focus, a short-term surge appears plausible.

Despite these positive indicators, the analyst stressed the importance of patience. Both he and other market observers view the current phase as "brutal consolidation" rather than a sign of weakness. As long as XRP maintains its price above key support levels and continues to attract long-term interest, the technical setup remains favorable.