The XRP price climbed 2% in the last 24 hours to trade at $2.49 as of 8 p.m. EST, with trading volume down 57% to $2.04 billion.

This development occurs as Bitwise moves one step closer to launching a US-listed XRP ETF after filing the “final amendment” to its S-1 registration with the US Securities and Exchange Commission (SEC) on October 31. This filing signals that an approval may arrive within weeks.

The Bitwise XRP ETF is set to trade on the New York Stock Exchange (NYSE) with a management fee of just 0.34%, a competitive rate that puts pressure on other similar financial products to maintain low costs.

Bitwise just filed Amendment No. 4 for its XRP ETF with the SEC — another step toward bringing spot $XRP exposure to U.S. markets.

This isn’t rumor; it’s right on Form S-1 under the Securities Act of 1933.

Momentum’s building. #XRP#ETF#Ripplepic.twitter.com/Krtvd56gxF— 𝗕𝗮𝗻𝗸XRP (@BankXRP) November 1, 2025

The growing excitement around the Bitwise XRP ETF has reignited interest in XRP, boosting market sentiment for the cryptocurrency and keeping it in the public eye.

XRP Price: Strong Fundamentals and On-Chain Developments

The recent increase in XRP's price is underpinned by robust fundamentals and significant on-chain developments. XRP stands as one of the world's largest digital assets, boasting a market capitalization exceeding $30 billion.

This digital asset powers the XRP Ledger (XRPL) blockchain, a network primarily recognized for its efficiency in facilitating fast cross-border remittances. Furthermore, the XRPL is actively expanding its capabilities into decentralized finance (DeFi) and asset tokenization.

The XRP Ledger network currently supports over five million active wallets and consistently processes transactions within seconds, all while maintaining transaction fees below $0.01.

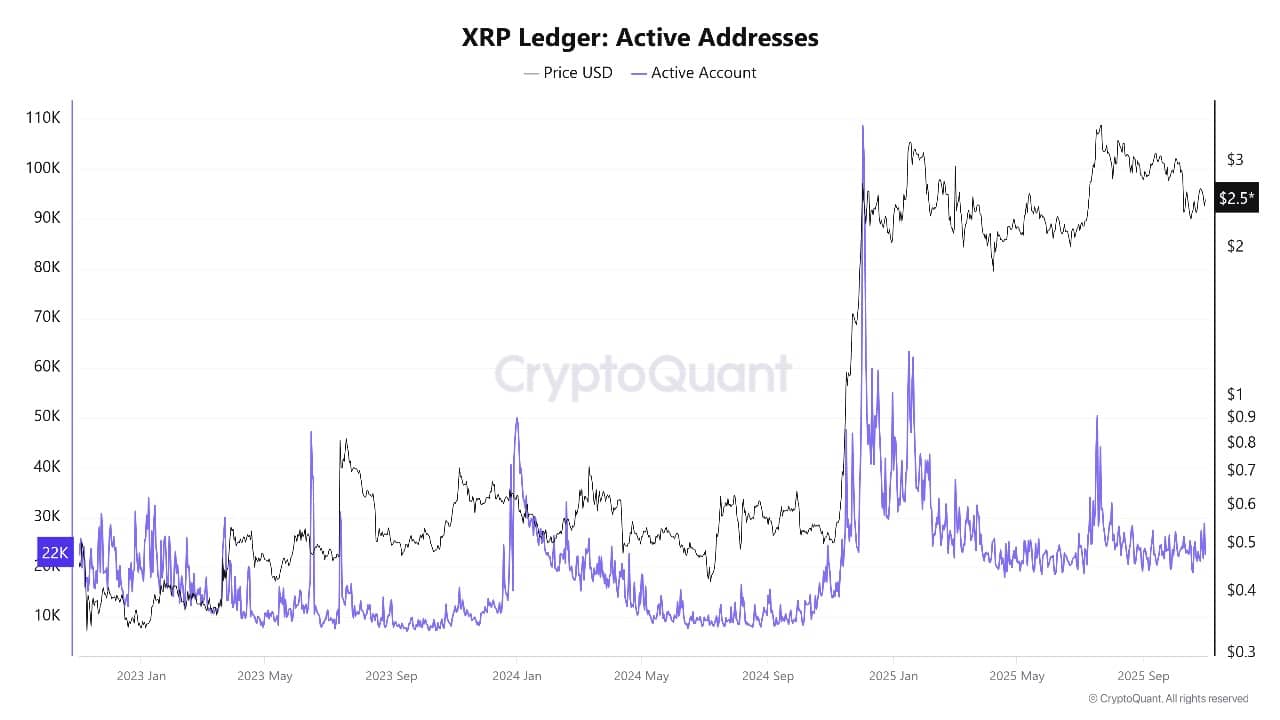

On-chain data indicates a rise in activity on the XRPL, occurring in anticipation of the ETF decision. Transaction volumes are trending upwards, and whale wallets have resumed accumulation following a period of minor selling by short-term holders last week.

Institutional interest is also demonstrably strong, with an observed increase in the movement of funds from exchanges into self-custody wallets. This behavior is often interpreted as a signal that investors anticipate positive price action in the near future.

Industry experts also suggest that the forthcoming ETF product could enhance liquidity within the XRP market and alleviate supply pressure, as a greater number of XRP coins are likely to be locked into long-term investment vehicles.

The combination of increasing network activity, growing wallet numbers, and sustained institutional interest could provide the necessary impetus for further price appreciation for XRP.

XRP Price Technical Analysis: Signs of a Key Reversal

From a technical perspective, XRP's weekly chart indicates a pivotal moment for both traders and investors. Following a rebound from lows near $1.02 earlier in 2025, XRP reached a high of approximately $3.66 in July. Although the price subsequently retreated, it managed to hold above both the 50-week and 200-week simple moving averages (SMA). These key support levels are situated at $2.52 and $1.02, respectively.

The recent upward movement back above the 50-week SMA is considered a significant bullish indicator, particularly as the narrative surrounding the ETF unfolds. Buyers have successfully defended the support zone between $2.45 and $2.60. If this range continues to hold, technical indicators suggest a potential push towards the previous high of $3.66, with intermediate resistance anticipated around the $3.00 mark.

Short-term indicators are currently presenting a mixed-to-bullish outlook. The Relative Strength Index (RSI) is positioned at 47.35, which is considered neutral but offers room for further upside potential should momentum increase. The MACD (Moving Average Convergence Divergence) histogram is showing signs of flattening, suggesting that bearish pressure is diminishing and that buyers may regain control in the near future.

The Average Directional Index (ADX) at 23.66, while not indicative of an extremely strong trend, aligns with the ongoing accumulation observed at current price levels.

Should bulls maintain the price above $2.52 and buyers respond positively to any minor dips, XRP could rapidly ascend towards the $3.00 level once the ETF news is officially confirmed. Conversely, a decline below $2.45 might trigger short-term selling pressure, potentially leading XRP to retest support closer to the 200-week SMA at $1.02 before new buyers emerge.

With the anticipation surrounding the ETF building and current technical support holding firm, the outlook for the XRP price appears predominantly bullish. The upcoming ETF decision, expected within weeks, could be the catalyst for the next significant price movement, as traders focus on both the $3.00 target and the possibility of new all-time highs if current trends persist.