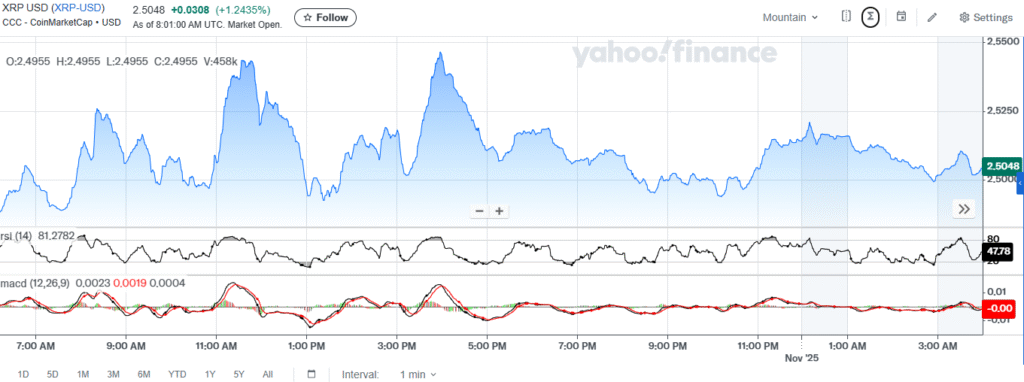

XRP traded between the range of $2.49 and $2.53 on Friday, maintaining its position above the $2.50 support level throughout the day. The price fluctuated within this narrow band, indicating average short-term volatility. Despite these minor movements, XRP remained stable above the $2.50 support zone, unaffected by the day's slight fluctuations.

The XRP saw an increase of almost 1.24 percent during the session, reflecting a controlled purchase rather than an aggressive one. The price briefly peaked at $2.53 before dropping, suggesting minimal upward momentum. However, the steadiness in defending the $2.49 level pointed to underlying market strength.

Market activity was characterized by balanced participation, with buyers and sellers in equilibrium. The sideways movement of XRP indicated a consolidation period preceding a potential breakout. Traders were therefore observing the major resistance at $2.53 as a key point for continuation.

Technical Indicators

The Relative Strength Index (RSI) for XRP settled near 50 after reaching overbought levels earlier in the day. This shift highlighted a cooling momentum following earlier gains, suggesting neutral market conditions that neither favored buyers nor sellers.

Concurrently, the Moving Average Convergence Divergence (MACD) line was close to zero, indicating weak momentum signals. The minor crossovers observed represented brief periods of volatility without a clear trend direction. The XRP histogram remained flat, signifying unenthusiastic price movement.

Market Outlook

XRP may continue to consolidate around the $2.50 level if the general market sentiment remains unchanged. Resistance around $2.53 could lead to minor profit-taking in the short term. Conversely, a breakdown below $2.49 could expose XRP to further losses, potentially reaching $2.47.