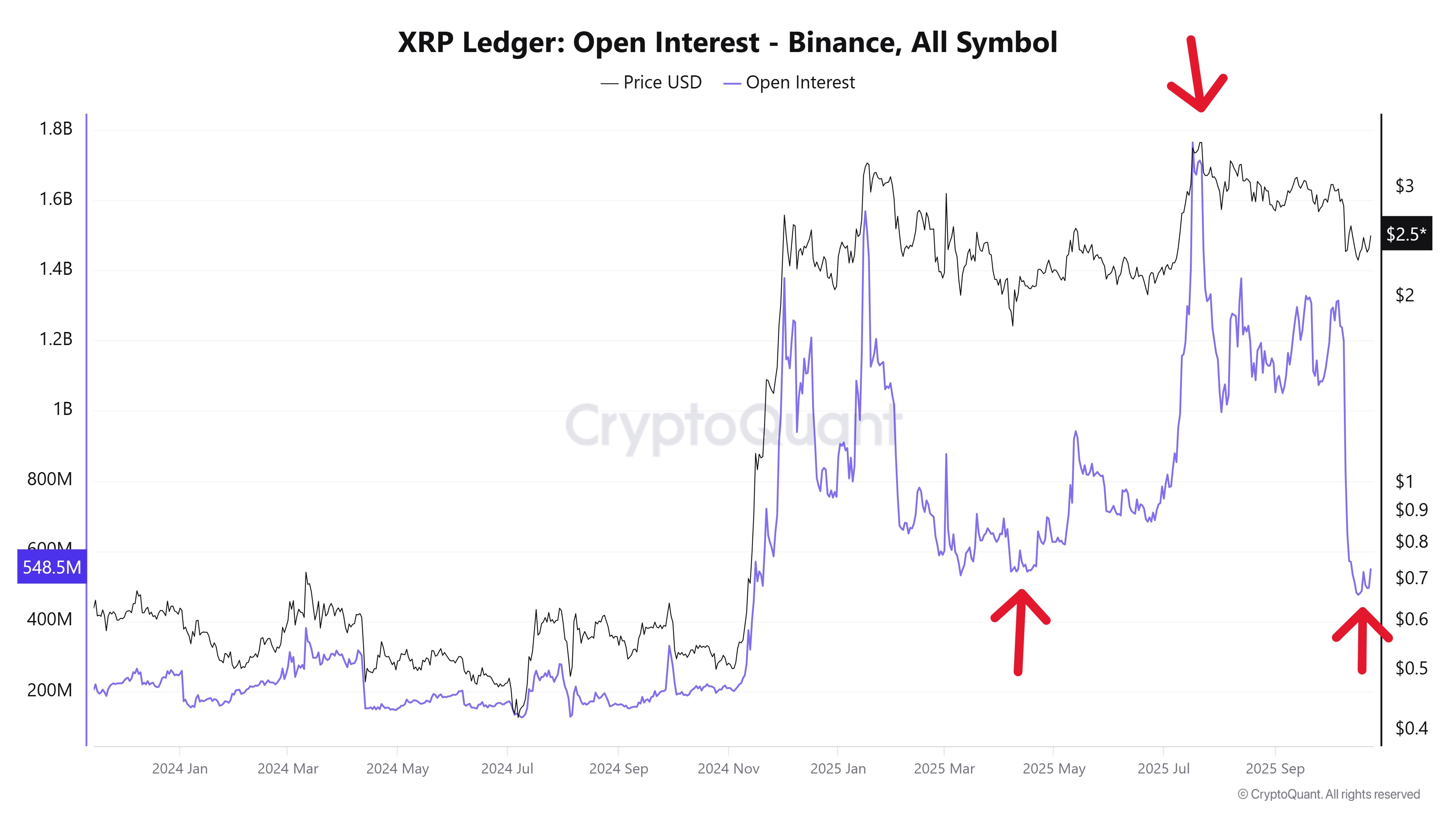

XRP's open interest on Binance has once again reset to yearly lows, providing the XRP market with increased flexibility. This development is largely attributed to the market crash on October 10th, which resulted in extensive liquidations across the market and offered long-term holders a fresh start. According to CryptoQuant analyst Pelin Ay, the market may be positioning itself for a rally comparable to the one that propelled XRP above its previous peak of $3.55 in July.

XRP Open Interest Drops to April Lows

In her most recent analysis, Ay explained that XRP Open Interest (OI), which monitors active futures contracts, has declined to levels last seen in April and May of 2025. During that earlier period, XRP was trading at significantly lower prices, yet the current OI levels are comparable while the token remains stable around $2.5. Ay suggests this indicates that strong holders are currently dominating the market, with speculative trading activity diminishing. In simpler terms, a greater number of buyers are opting to hold actual XRP rather than engage in the futures market.

She noted that following the previous bottom in OI in April, XRP experienced a rapid ascent to $3.5 as trading volume increased. For context, XRP open interest on Binance reached a low of $541.5 million on April 16th. At that time, XRP was trading in the range of $1.8 to $2. However, as OI recovered, prices surged to a peak of $3.55 by July. More recently, XRP open interest has fallen to $494 million, a significant decrease from the $1.3 billion peak recorded on October 6th, just four days before the market crash. It is important to note that on that particular day, total figures had reached $3 billion. With OI now returning to similar low points, Ay believes the current setup closely resembles the conditions observed in April and May.

Support and Resistance Areas to Watch

Ay stated that such substantial drops in OI typically signify one of two scenarios: either leverage has been effectively removed from the system, creating room for the market to rise, or traders have redirected their focus from futures to spot trading. Given that XRP is currently trading near $2.5, she leans towards the former explanation, viewing this as an early stage of a new uptrend. In the meantime, Ay highlighted the $2.20 to $2.40 range as a short-term buying zone. According to her analysis, as long as XRP maintains its position above this range, the broader bullish trend is expected to remain intact. Furthermore, the analyst identified $1.85 as a major structural support level established during the previous consolidation phase. Concurrently, the $0.60 to $0.70 area represents a deeper psychological floor linked to earlier OI lows.

On the upside, Ay views the $2.80 to $3.00 band as the initial resistance level to monitor. Should XRP successfully break through this range, she anticipates momentum to build rapidly. The subsequent test will occur between $3.30 and $3.50, which corresponds to the peak of the last rally and serves as a critical zone.

A Possible XRP Run to $4.5

Clearing this critical level, coupled with an increase in XRP open interest, could potentially trigger a full breakout phase. Based on historical patterns, Ay projects a realistic price ceiling between $4.20 and $4.50 if this scenario unfolds. Ay also observed that XRP's resilience in price, despite weak OI, suggests that a considerable number of short sellers might be trapped. If OI begins to climb again, these short positions could contribute to fueling the next upward movement. She estimates that even a sustained 25% increase in OI over several days could initiate a swift surge towards $3.5, with the potential to extend the rally to $4.5 once that barrier is breached. However, some analysts, such as Blockchain Backer, hold a differing view, suggesting that XRP's short-term price action may currently be leaning bearish.