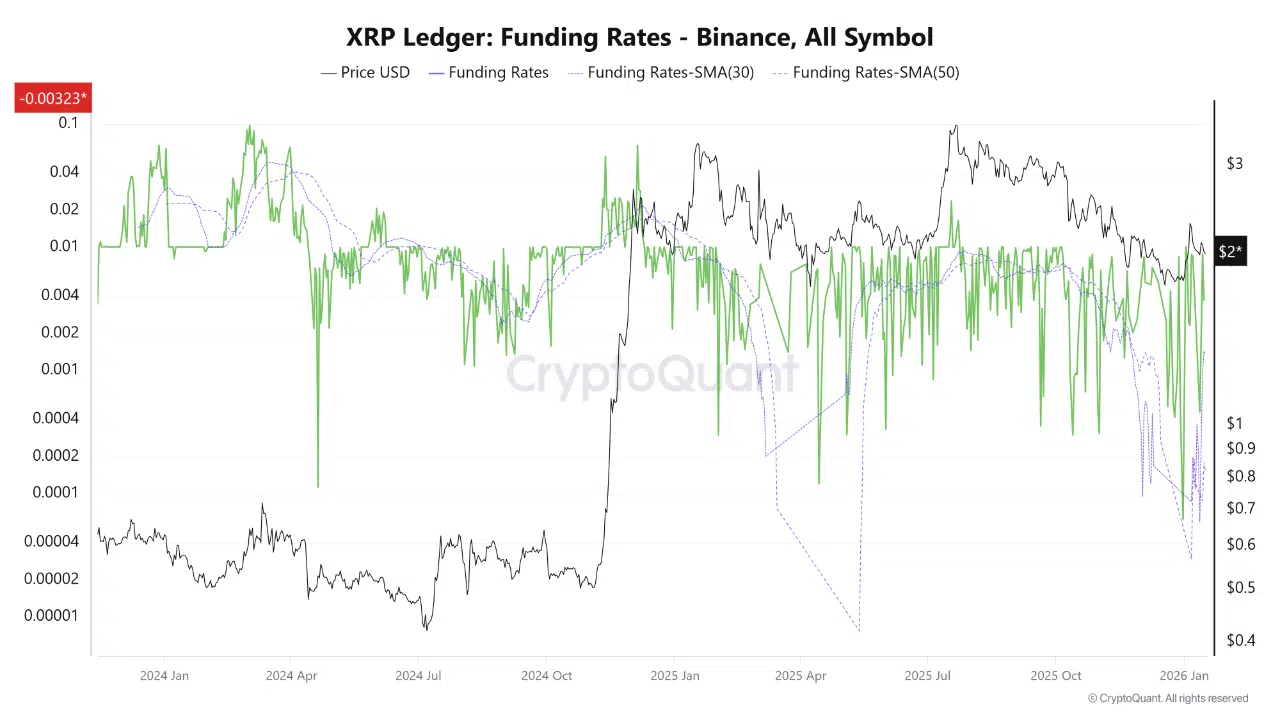

According to a report shared by CryptoQuant, XRP’s derivatives positioning is showing a structure that historically leans constructive rather than bearish, based on current funding-rate dynamics across Binance perpetual markets.

What Funding Spikes Have Signaled in the Past

CryptoQuant’s chart highlights a recurring pattern. When XRP funding rates turn sharply positive, price has often stalled or pulled back shortly afterward. These periods reflect rising costs for long positions and an increased risk of long squeezes. In past cycles, such funding spikes have acted more as overheating warnings than confirmation of trend continuation.

Conversely, periods marked by sudden negative funding spikes tell a different story. When funding-rate moving averages break decisively to the downside, short positioning increases and sentiment turns excessively pessimistic. Historically, XRP has tended to form local bottoms during these phases, followed by short-term relief rallies as shorts unwind.

Current Market Positioning: Shorts in Control

At present, the funding rate sits around -0.00323, with both the 30-day and 50-day funding-rate SMAs trending downward. This confirms that leverage is currently short-heavy, with no signs of excessive long-side optimism.

From an on-chain and derivatives perspective, this is generally a healthier market condition. CryptoQuant notes that when shorts dominate and optimism is muted, the probability of a sharp downside continuation tends to weaken. Any near-term pullbacks are more likely to be shallow and driven by liquidity collection rather than aggressive selling pressure.

Why This Favors an Upside Bias

In this environment, negative funding is not acting as a headwind. Instead, it lays the groundwork for potential upside if conditions shift. Should funding rates begin to rotate back toward positive territory, price has historically responded with upward movement, as short pressure eases and positioning normalizes.

Bottom Line

CryptoQuant concludes that XRP’s current funding structure is not an obstacle to higher prices. While there is no clear signal of an imminent major rally, the balance of probabilities favors upside over downside following this compression phase. The data suggests XRP is building a base where a positive reaction becomes more likely once leverage dynamics begin to unwind.