Is XRP Price Likely to Further Decline or Rebound?

Current onchain analytics reveal that XRP’s bullish-to-bearish sentiment ratio has dipped below 1.0 over the past two days. This indicates that social media chatter is dominated by negative sentiment, with bearish mentions outnumbering positive outlooks, according to analytics platform Santiment.

Nevertheless, Santiment views this widespread “fear, uncertainty, and doubt” (FUD) among retail traders as a bullish signal. Historically, during similar sentiment dips in April, XRP’s price initially declined by over 25%, followed by a rebound of more than 125%, showcasing how small traders’ panic often triggers stronger institutional buy-ins.

This fractal pattern suggests that if the current dip follows the same trajectory, XRP could be poised for a breakout rather than a decline, as larger investors absorb the selling pressure and position themselves for future gains.

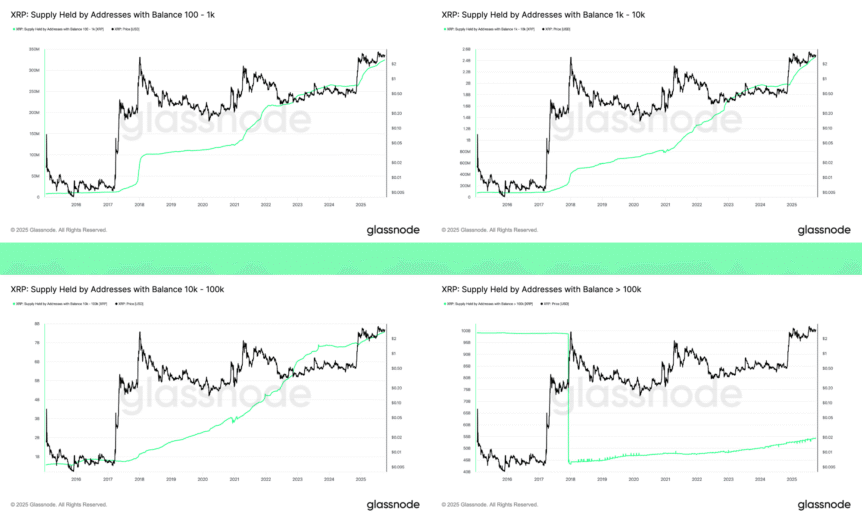

Distribution Trends Among Key XRP Holders

On-chain data further supports a bullish outlook, highlighting increased accumulation among large XRP holders. Metrics show that XRP supply held by entities with holdings exceeding 10 and 100,000 tokens has steadily grown during recent consolidation phases, as reported by Glassnode.

This pattern indicates strong institutional interest, which could significantly influence the price once broader market conditions improve. Despite macroeconomic headwinds such as a weakening US dollar and ongoing US government shutdown, XRP traders appear resilient, supported by positive sentiment around potential SEC approval of XRP-based ETFs.

Such developments could catalyze further bullish momentum once the technical setup confirms a breakout, adding to the growing optimism within the crypto community.

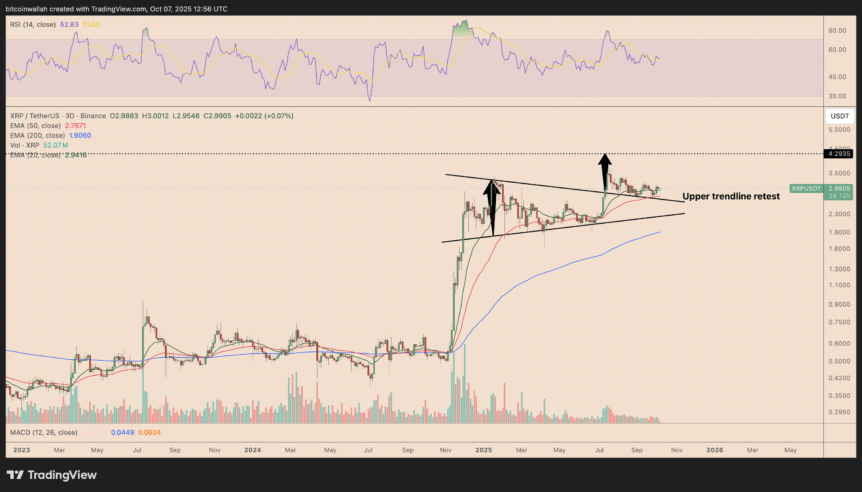

Technical Outlook Shows a Bullish Breakout in Sight

Looking at the chart analysis, XRP is currently in the process of confirming a breakout from a symmetrical triangle formation. The price has recently retested the breakout level, a typical move known as a “retest,” which, if successful, could propel XRP toward a target of roughly $4.29, representing about a 45% rally from current levels.

This upside aligns with previous bullish projections for XRP, indicating a potential substantial recovery. Conversely, a confirmed breakdown below the trendline could see XRP retesting lower support levels near $2.33, increasing the odds of a deeper correction.

Investors should consider that market conditions can change rapidly. This analysis is for informational purposes only and does not constitute financial advice. Conduct thorough research before making any trading decisions.