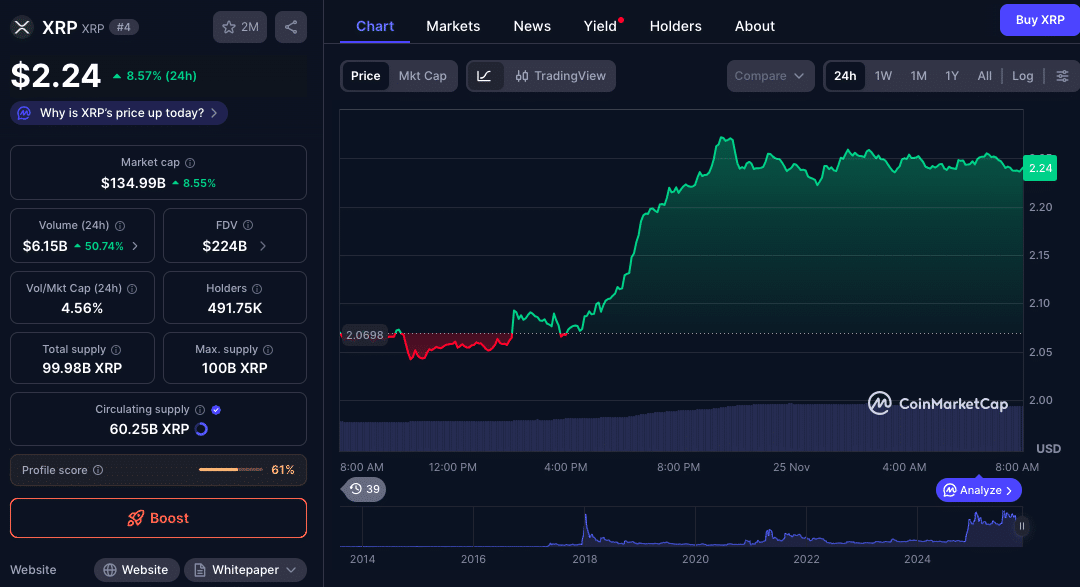

XRP has experienced a significant surge, climbing nearly 9%, following the launch of two major spot XRP Exchange-Traded Funds (ETFs) by Franklin Templeton and Grayscale on the NYSE Arca. This development has not only boosted trading volume but also strengthened institutional confidence in XRP, especially in the months following Ripple's $125 million settlement with the SEC. With established financial institutions introducing regulated products, XRP's low-cost and high-speed transaction technology is gaining recognition as a next-generation solution for cross-border payments.

ETF Surge: Franklin Templeton and Grayscale Lead the Way

Franklin Templeton's XRPZ ETF has debuted on the NYSE Arca, offering investors regulated exposure to XRP. The fund tracks the CME CF XRP-USD Reference Rate, with Coinbase Custody securing the assets and BNY Mellon serving as the administrator. On its inaugural day, the ETF saw approximately 769,000 shares traded, indicating substantial initial investor interest.

Concurrently, Grayscale converted its XRP Trust into the Grayscale XRP Trust ETF (GXRP). This ETF provides exposure to XRP's price through a passively managed trust structure. This move now enables institutions and retail investors alike to hold XRP directly within their brokerage accounts.

Regulatory Clarity Paves the Way for a New Era

The regulatory uncertainty surrounding Ripple and the SEC appears to have significantly diminished. The $125 million settlement between Ripple and the SEC in August 2025 concluded their protracted legal battle, clearing a major obstacle for companies looking to introduce XRP-related financial products.

This newfound regulatory certainty has removed the primary hurdle for asset managers aiming to launch ETFs. The swift approval processes for Grayscale's ETF conversion and Franklin Templeton's Form 8-A filing exemplify how companies are capitalizing on this clearer regulatory landscape.

Institutional Bullishness Driven by XRP's Real-World Use Case

Unlike many speculative digital assets, XRP's primary focus on payments provides a clear basis for understanding its value. Transactions on the XRP Ledger (XRPL) are processed within 3 to 5 seconds with minimal fees, making it a cost-effective solution for cross-border payments.

Franklin Templeton has highlighted XRP's role as a "foundational element in global settlement infrastructure," characterizing it as a bridge asset and currency integral to modern financial systems. This institutional perspective positions XRP as a fundamental payment technology.

Broader Implications for Global Settlement Systems

The introduction of regulated XRP ETFs also signifies an opening to the broader global financial market. Asset managers now investing in XRP are anticipating that the strengths of these next-generation cross-border payment systems—speed, cost-efficiency, and reliability—will drive their adoption.

Analysts suggest that XRP has a strong potential to impact payment corridors in Asia, Africa, and the Middle East, regions where settlement inefficiencies still present challenges.

A New Chapter for XRP

The wave of ETF launches is poised to reshape how both traditional investors and cryptocurrency enthusiasts perceive XRP. Making XRP accessible through mainstream brokerage accounts could lead to increased investment flows, enhanced liquidity, and broader adoption. The approval of trusted products like GXRP significantly contributes to legitimizing XRP within regulated markets.

This momentum has the potential to stimulate further investments in infrastructure, foster new partnerships, and drive the development of novel use cases leveraging XRPL's settlement capabilities.

Conclusion

The introduction of XRP ETFs by Franklin Templeton and Grayscale represents a significant milestone for the XRP community. With regulatory clarity established and institutions increasingly recognizing the value of this settlement-focused technology, XRP is well-positioned for consideration in the development of digital assets for global finance.

This renewed confidence, coupled with growing adoption and infrastructure development, aligns perfectly with XRP's core value proposition: facilitating fast, scalable, and cost-effective cross-border payments.

Glossary

ETF (Exchange-Traded Fund): A regulated investment fund that tracks the price of an asset and is traded on stock exchanges.

XRP Ledger (XRPL): A distributed ledger designed for efficient value exchange, characterized by high transaction speeds and low costs.

Form 8-A: A registration filing required by the SEC for certain securities.

CME CF XRP-USD Reference Rate: The benchmark rate used to price XRP in financial products.

Bridge Currency: A cryptocurrency used to facilitate cross-border transactions between different fiat currencies.

Frequently Asked Questions About New Franklin Templeton and Grayscale XRP ETFs

What do the new XRP ETFs actually own?

Both the XRPZ ETF from Franklin Templeton and Grayscale's GXRP ETF are backed by XRP. For instance, GXRP holds XRP in a trust that passively tracks XRP's market price.

Why did the price of XRP soar based on news of an ETF?

The launch of these ETFs signifies institutional entry into XRP through a regulated avenue, offering exposure to a large-cap digital asset. Additionally, Ripple's legal settlement with the SEC has reduced regulatory risks.

Is XRP now completely "safe" from the watchful eyes of regulators?

While the ETF launches and Ripple's settlement are significant advancements, the cryptocurrency market remains complex. These ETFs provide regulated exposure, but XRP, like all digital assets, still carries risks due to potential regulatory shifts.

Why are technologies opting for XRP, not just Bitcoin or Ethereum?

The technology underpinning XRP is specifically optimized for fast, low-cost payments and clearing. These characteristics make it particularly suitable for cross-border transactions, potentially more so than for acting as a primary store of value.

Who can invest in these XRP ETFs?

Individuals with brokerage accounts that trade on the NYSE Arca can now invest in XRPZ and GXRP, eliminating the need for direct XRP purchase and custody.

References

GlobeNewswire

Business Wire

CoinAlertNews

CoinDesk

Financialcontent