- •The SEC will decide on multiple XRP spot ETF applications by the key October 17 regulatory deadline.

- •Approval would provide traditional investors regulated exposure to XRP, potentially increasing its liquidity and market reach.

The SEC is set to announce its verdict on several proposals for XRP exchange-traded funds by October 17. This date marks the final regulatory deadline for these investment products, which would track the spot price of the cryptocurrency. Approval would introduce a new way for traditional investors to gain exposure to XRP without the complexities of direct ownership or storage.

Multiple asset management firms have submitted applications to list and trade these ETFs. Grayscale, Bitwise, Canary Capital Group, 21Shares, and WisdomTree are the key entities involved. Each company has a history of engaging with digital asset investment products. Their collective push reflects a growing institutional interest in broadening the accessible cryptocurrency market beyond the established Bitcoin and Ethereum funds.

Analysts from Bloomberg Intelligence, Eric Balchunas and James Seyffart, have provided a specific forecast for this decision. They assign a 95% probability that the SEC will authorize the XRP spot ETFs. This high degree of confidence stems from the recent regulatory green light for XRP futures and mixed ETFs. The prior approval of these related financial instruments creates a supportive framework, suggesting the market has already accepted the underlying asset for derivative products.

The introduction of a spot XRP ETF could significantly alter the cryptocurrency’s trading dynamics. The outcome will immediately determine the short‑term trajectory for XRP‑based investment products in the United States.

XRP (Ripple) is trading at $2.94, up 3.50% in the last 24 hours. On the weekly scale, XRP has risen 4.31%, while its monthly performance shows a 6.23% gain. Over six months, the token is up 42.8%, and over the past year it has surged 382%. XRP’s current market capitalization stands at $176.31 billion, with a daily trading volume of $6.53 billion, keeping it near the upper range of its 2025 rally.

Technological adoption also advanced, as Ripple’s Interledger Protocol connected with SWIFT, strengthening ties between traditional financial systems and blockchain‑based settlement.

This positions XRP as a crucial bridge for cross‑border payments at scale. Meanwhile, whale activity has increased, with reports of over $6 billion inflows into XRP overnight, suggesting heightened liquidity demand.

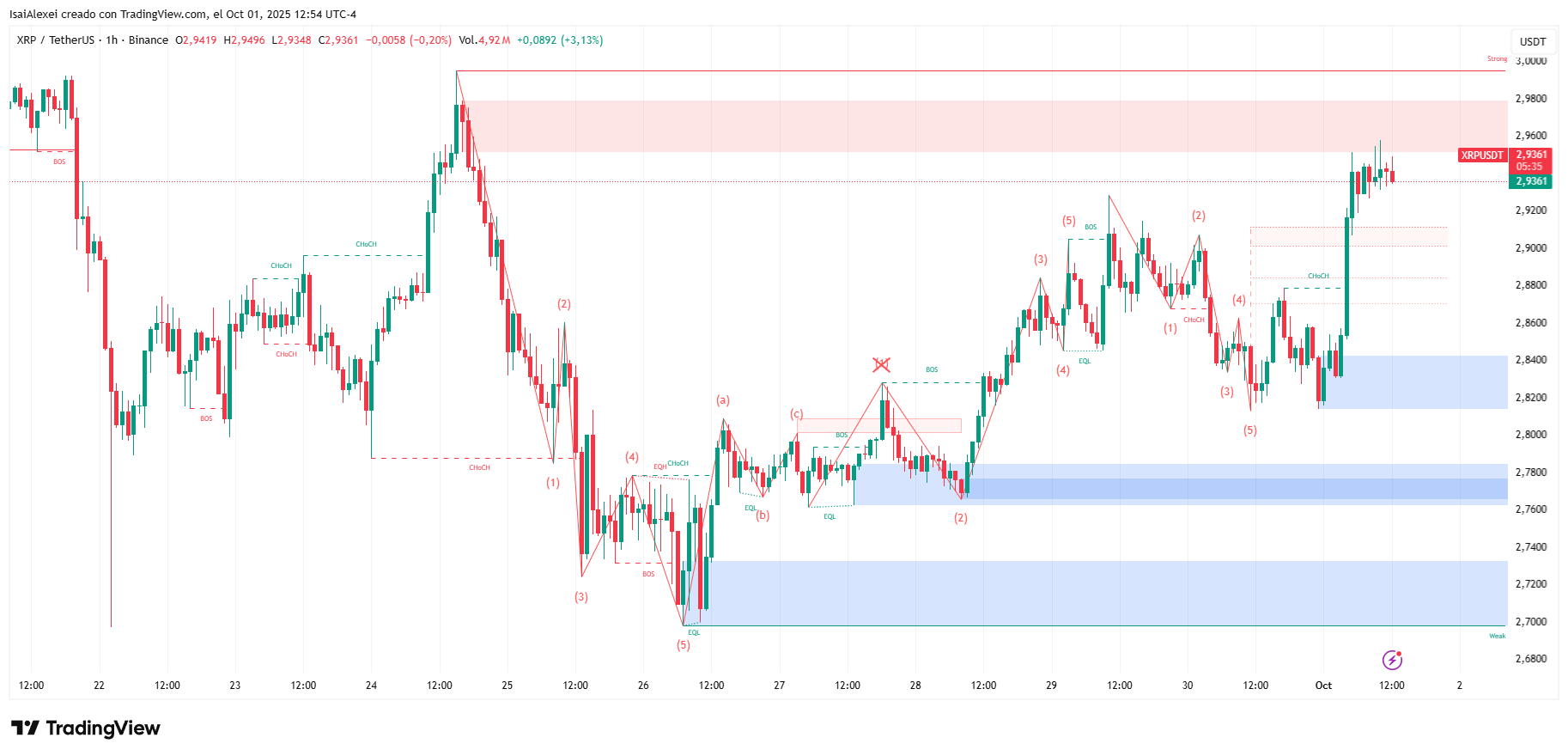

From a technical perspective, XRP is testing resistance near $3.00–$3.10 after bouncing off $2.72 support. Traders see the next upside target around $3.30–$3.50 if momentum continues, while failure to hold $2.80 may bring a correction back toward $2.60–$2.70.

ETHNews prediction: If XRP sustains buying above $2.90, it could attempt a breakout toward $3.30 in the short term. A rejection near $3.00, however, could trigger consolidation between $2.70–$2.90 before another upward attempt.