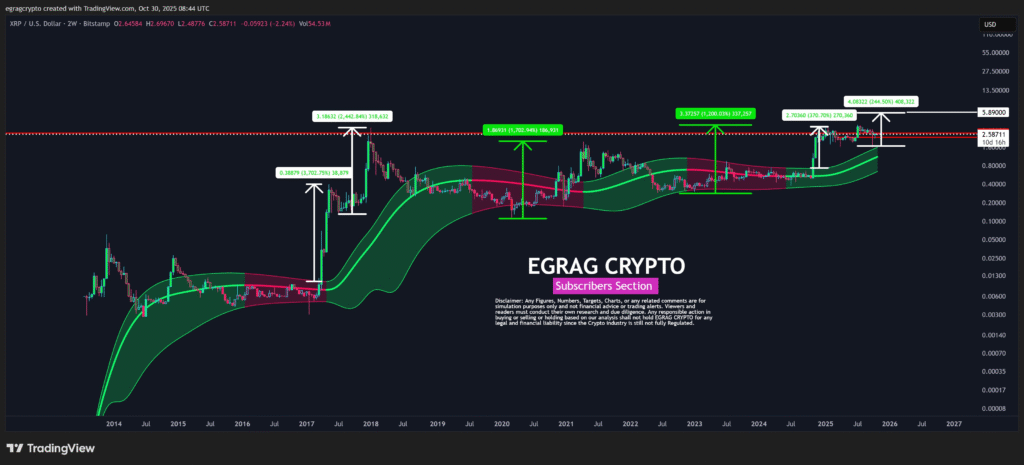

EGRAG Crypto, a market analyst recognized for data-driven technical analysis, has projected that XRP could reach between $5.50 and $6.00 in its next upward phase. This projection is based on the application of the Gaussian Channel indicator on a two-week chart, combined with an analysis of historical cycle patterns, suggesting a continuation of long-term growth for the cryptocurrency.

The analyst's outlook is informed by a comparative study of XRP’s historical performance. In the 2017 rally, XRP experienced a significant increase of nearly 3,700%. In the current market cycle, the asset has seen a gain of approximately 370%.

EGRAG Crypto has proposed that if the final leg of the current cycle achieves roughly 10% of the growth seen in the previous cycle, XRP could still experience a 2.4× increase. This would lead to a price range between $5.50 and $6.00.

According to the analysis, this projection is contingent upon XRP maintaining similar technical behavior and momentum within its established Gaussian Channel pattern. The price model also aligns with the observed trend of higher lows recorded in previous market cycles.

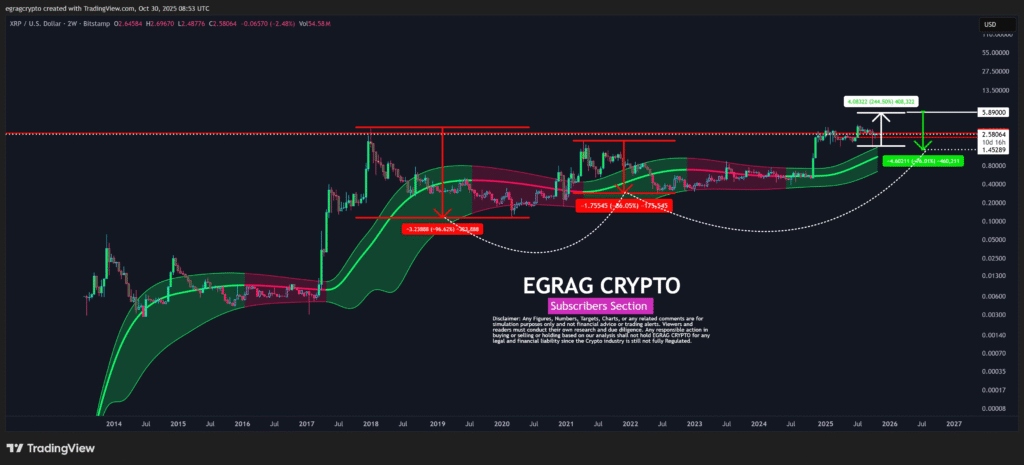

Cycle Data Indicates Reduced Downside Risk

EGRAG Crypto's secondary observation focused on the concept of diminishing returns and drawdowns in XRP's market history. Previous cycles recorded drawdowns of approximately 96% and 86%, indicating a consistent reduction in downside price movement over time. If this pattern continues, the next potential bear market could result in a drawdown of only 76%.

Based on these figures, if XRP were to peak near $6, the subsequent bottom could form in the range of $1.20 to $1.40. This would represent a stronger structural base compared to prior bear markets.

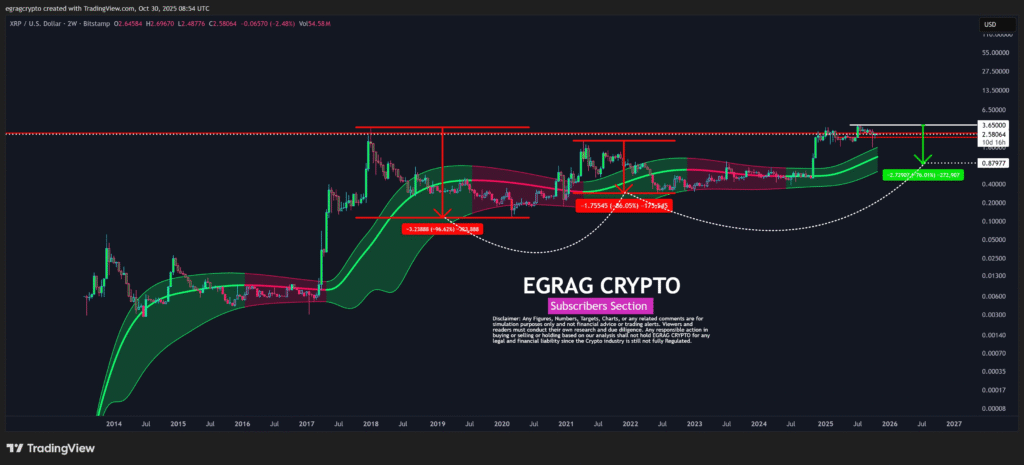

Even if the asset's peak price were to reach $3.65, the projected bottom would still remain around $0.87, suggesting an increase in market resilience over time.

This data-driven forecast reflects a maturing price pattern that is supported by lower volatility and stabilizing cycle dynamics. The analysis concludes that long-term holders who accumulated XRP below the $0.50 mark are positioned favorably within the broader market cycle.

Technical Context and Market Implications

The Gaussian Channel, a technical indicator frequently used to measure trend stability and volatility, remains a central element of the analyst's predictive model. EGRAG Crypto's projections suggest that XRP may continue to follow its historical pattern of contraction and expansion, thereby maintaining a structured uptrend.

While short-term price fluctuations are always possible, the primary focus of this analysis is on broader market cycles and the observed gradual decrease in price drawdowns. XRP is currently trading within a consolidation range, and according to EGRAG Crypto, the next confirmed breakout could be a decisive factor in determining whether the $5 to $6 price zone becomes achievable within the current cycle.