XRP has experienced a notable decline, falling to $2.40 after a 5% drop over 24 hours and an 8% decrease over the past week. This recent pullback originated from the $2.70 level, which analysts have identified as the peak of a correction phase. Despite ongoing short-term pressure as the asset approaches key support zones, longer-term patterns remain intact.

Correction Nearing Key Support Zone

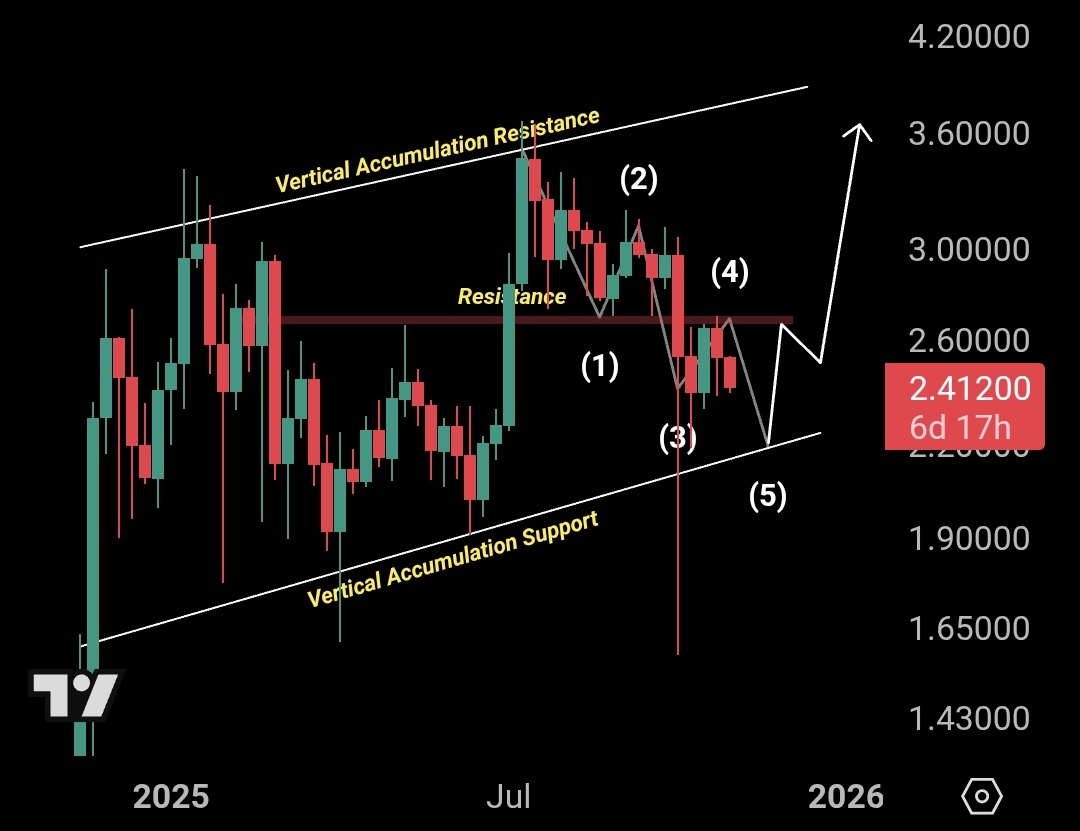

Analyst ChartNerd has indicated that the current price drop aligns with the fifth wave of a larger correction that commenced after XRP reached $2.70. The price action observed since then has followed a distinct five-wave structure, with the potential for the final leg to conclude near the $2.00 mark. The area just above this level, identified as vertical accumulation support, has historically provided stability during previous pullbacks. ChartNerd further commented on the situation, stating,

“Possible wick to $2 possible,” while also noting that “no macro structure has been lost.”

This observation suggests that the broader trend has not been invalidated. XRP continues to trade within a rising channel, and crucial support levels from prior cycles remain in place. A reversal near the $2.00 level could serve as confirmation for the completion of this particular wave.

In a related development, XRP has now spent over a year trading above its 2021 highs and previous all-time high candle closes, indicating sustained interest above these significant historical levels.

Short-Term Chart Points to Weakness

In contrast to the longer-term outlook, separate analysis from Ali Martinez highlights a bearish movement in the short-term view. The 4-hour chart indicates that XRP faced rejection near the $2.57 level and has since fallen below $2.45. This trend is characterized by the formation of a lower high pattern, with downward pressure exerted by moving averages contributing to the ongoing weakness.

$XRP showing signs of weakness. A retest of $2.25 might be next! pic.twitter.com/RMYX15hbRt

— Ali (@ali_charts) November 2, 2025

Martinez's chart projects a potential move through lower support zones, with the possibility of reaching $2.25 before any significant recovery occurs. The current structure suggests a short-term downtrend, although it is important to note that longer-range support levels are still being respected.

ETF Expectations and Market Sentiment

As recently reported, interest in a potential spot XRP Exchange-Traded Fund (ETF) has intensified in recent weeks. Prediction markets, such as Polymarket, widely anticipate its approval, with current odds hovering close to 100%. The conclusion of Ripple's legal case with the Securities and Exchange Commission (SEC) earlier this year was a pivotal moment, removing a significant regulatory hurdle and paving the way for potential advancements in this area.

Following renewed optimism and broader market support from a recent interest rate cut, XRP briefly surpassed the $2.65 mark. However, the price action has since moderated. Market participants are now closely monitoring both the timeline for the potential ETF launch and key support levels to ascertain the next direction of XRP's price movement.