The price of Monero (XMR) jumped to a record high today, January 15, as demand for privacy tokens increased. The token reached $798, marking a significant surge of 713% from its lowest point in 2023. This ascent has propelled Monero's market capitalization to over $12 billion, positioning it as the 12th largest cryptocurrency.

Factors Driving the Surge

The current demand for privacy tokens has been a primary driver for XMR's impressive rise. Other privacy-focused cryptocurrencies have also experienced substantial gains, with Dash (DASH) jumping over 100% this week. Decred and Humanity Protocol have seen increases of 60% and 30% respectively in the last seven days. Collectively, the market capitalization of all privacy tokens has climbed to $73 billion.

This heightened demand has significantly boosted Monero's trading volume, reaching $465 million in the past 24 hours. Furthermore, its futures open interest has hit a new record high, exceeding $275 million.

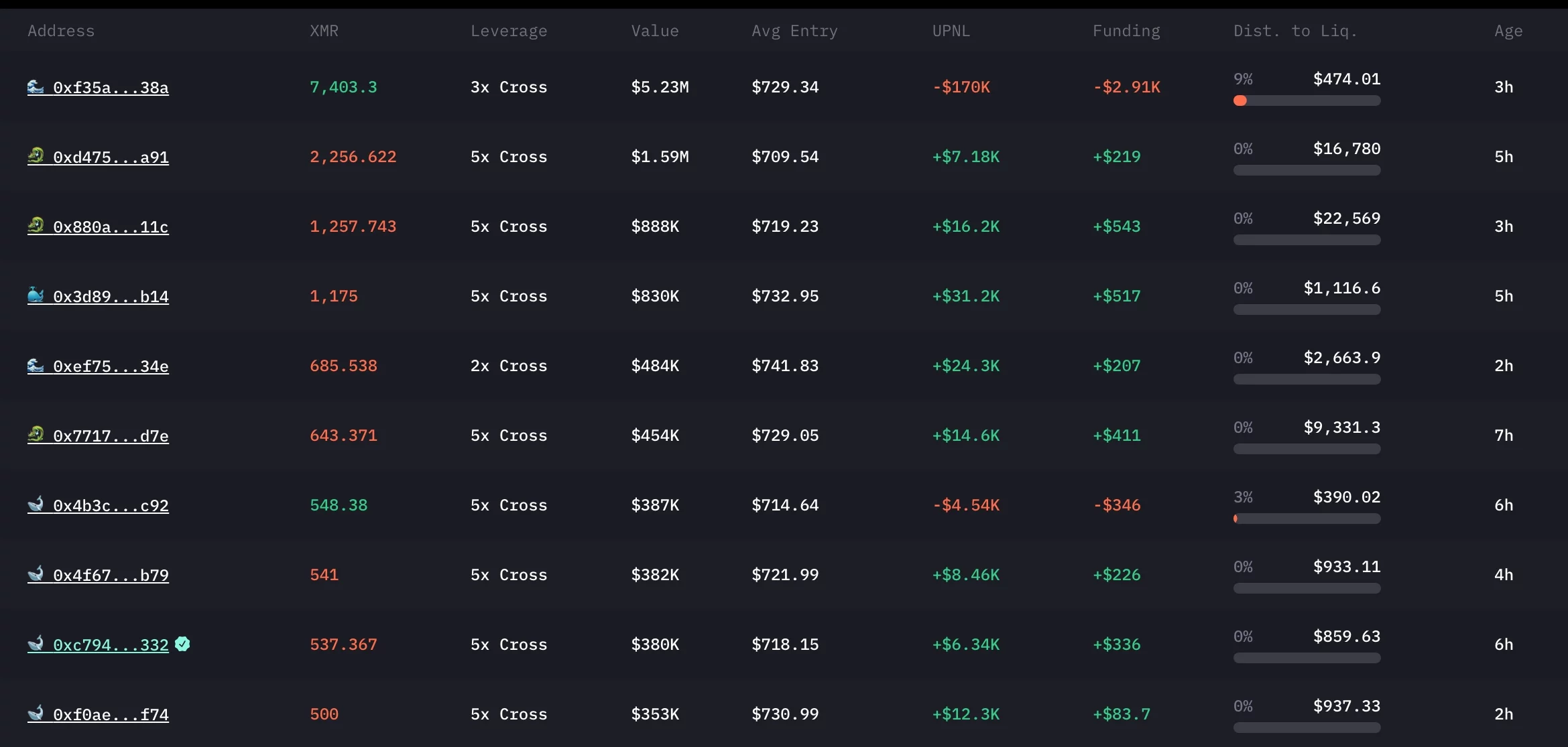

The listing of XMR on the Hyperliquid platform has also contributed to the rally. This listing allows traders to engage in leveraged long or short positions with up to 5x leverage. Following the announcement, a significant trader, referred to as a "whale," reacted by opening a leveraged trade valued at $2.27 million, signaling an expectation of continued price appreciation. Another trader initiated a long position worth over $5.2 million at an average price of $729.

Historical Context and Regulatory Influence

The current rally in Monero's price began in 2024, coinciding with developments in the Tornado Cash case. US authorities had previously sanctioned Tornado Cash, accusing it of money laundering. In response, a group of users filed a lawsuit arguing that immutable contracts do not constitute "property," a stance that the court upheld.

In March of this year, the Trump administration lifted the sanctions against Tornado Cash, a significant victory for the privacy-focused cryptocurrency sector. The rally further accelerated in the fourth quarter, partly spurred by increased demand for Zcash (ZEC).

XMR Price Technical Analysis

Technical analysis of the weekly chart indicates that the XMR token found its bottom at $97 in 2024 before its subsequent surge to the current record high of $798. The price has now moved above the critical resistance level of $517, breaking through the upper boundary of a cup-and-handle pattern. This pattern is widely recognized as a strong bullish continuation signal.

The depth of this identified pattern is approximately 85%. Projecting this same distance from the upper side of the pattern suggests a potential target price of $965. Reaching this level would increase the likelihood of XMR hitting the significant psychological milestone of $1,000. However, a decline below the upper side of the cup formation would invalidate this bullish outlook.