Market Reaction to Shutdown Resolution

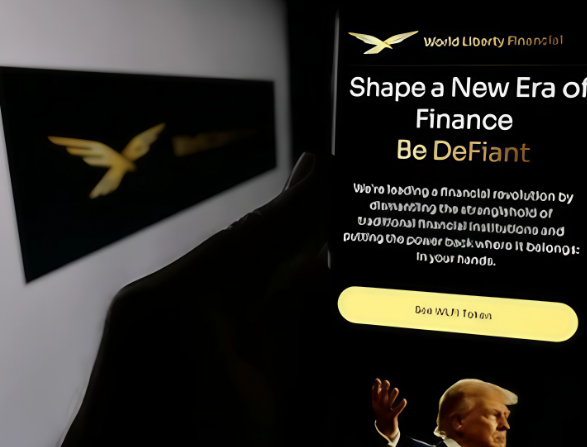

The U.S. Senate advanced a procedural vote on Sunday to end the 40-day government shutdown. This development triggered significant institutional buying as the final post-cloture vote approaches on Monday. In the market, Starknet STRK surged 43% to become the day's biggest gainer, while the Trump-backed World Liberty Financial token climbed 28% over a 24-hour period.

The potential conclusion of the government shutdown is expected to reduce financial uncertainty that had left markets operating in the dark for weeks. According to Nicolai Sondergaard, a research analyst at Nansen, key economic data releases, policy updates, and regulatory processes remained frozen during the shutdown. This situation forced investors to price speculation rather than real fundamentals into their decisions.

Institutional Investor Activity and Ethereum Accumulation

Institutional investors have restarted Ethereum accumulation following the news of the shutdown's impending end. Growing average spot order data suggests that Ethereum may enter a low-volatility accumulation phase if prices can sustain levels above $3,000 to $3,400. This observation was made by the crypto intelligence platform CryptoQuant.

Impact of ETF Inflows on Market Recovery

However, the broader market recovery is contingent on incoming Bitcoin and Ether ETF inflows, according to Nomura Group's Laser Digital derivatives trading desk. These flows will ultimately determine whether the recent bounce represents sustained institutional demand or is merely a result of retail and short-term trading activity.

Catalyst for Spot Crypto ETF Approvals

ETF analyst Nate Geraci described the end of the shutdown as a catalyst for the opening of spot crypto ETF floodgates. He noted on X that this development might lead to the introduction of the first spot XRP ETF under the Securities Act of 1933. This would mark a significant regulatory milestone for altcoin investment products.

The proposed 21Shares fund would become the first XRP exchange-traded product and the fourth altcoin ETP launched under the 1933 Act. It is important to note that spot Bitcoin and Ether ETFs received approval under the same framework but were listed under the Securities Exchange Act of 1934. This act requires exchange oversight, unlike the more streamlined process under the 1933 Act.

Currently, at least 16 crypto ETF applications are awaiting approval, all of which were delayed by the shutdown that has now reached its 40th day. The resumption of regulatory review is expected to accelerate decisions on these pending applications. This could potentially unlock multiple new digital asset investment products for both institutional and retail investors.