The question of whether Shiba Inu coin can reach $1 is a persistent one across cryptocurrency forums. While the idea of holding millions of SHIB and witnessing its value climb to a dollar is appealing, the underlying mathematics presents a significant challenge.

Given its substantial total supply, Shiba Inu would require a market capitalization exceeding that of Bitcoin, Ethereum, and the entire stock market combined to reach the $1 mark. Despite these economic realities, a sense of hope persists within its community.

The Mathematical Hurdles for Shiba Inu to Reach $1

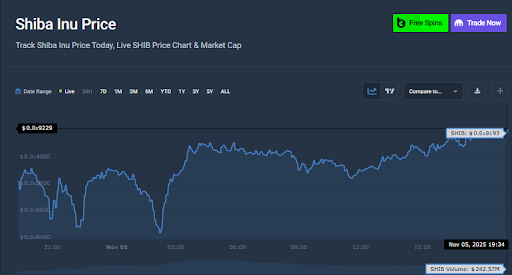

When investors inquire about Shiba Inu's potential to reach $1, the answer is fundamentally rooted in basic arithmetic. SHIB is currently trading at approximately $0.000009009. Even the most optimistic forecasts suggest a modest increase to around $0.00001505 by 2030, representing a roughly 60% gain over nearly five years.

With a total supply of 589.5 trillion tokens, achieving a $1 price point would necessitate a market capitalization of $589 trillion. This figure is over 500 times larger than the entire cryptocurrency market. Even aggressive token burn initiatives have a minimal impact on such a vast supply.

Consequently, while Shiba Inu's community remains actively engaged, the token's economic structure is not conducive to reaching $1 without substantial fundamental changes. Analysts generally classify it as a speculative meme coin, offering potential for short-term gains but unlikely to achieve the $1 milestone under its current economic model.

Long-Term Price Forecast for Shiba Inu (2025-2030)

Based on current projections, it is highly improbable that Shiba Inu coin will reach $1, even over a ten-year period.

Analysts estimate that Shiba Inu's price could range between $0.00001043 and $0.00001505 by 2030, indicating steady but limited growth. Technical indicators suggest a bearish sentiment at 75%, with the Relative Strength Index (RSI) hovering around 31.6 (neutral) and most moving averages indicating a sell signal.

Even under the most favorable conditions, these figures point to modest returns rather than life-changing wealth. Shiba Inu may maintain its brand recognition, but its price momentum is largely driven by hype and temporary surges in trading volume.

Without significant economic adjustments, SHIB's long-term outlook appears relatively flat, prompting traders to explore projects with more tangible growth potential.

Tokenomics: A Reality Check on Supply, Burns, and Hype

A common question is whether Shiba Inu can reach $1 if its community continues to burn tokens. Unfortunately, this strategy has a negligible impact on such a large supply.

While SHIB's burn portal and sporadic burns initiated by large holders remove billions of tokens, this volume is insignificant in the context of its total supply.

The coin's tokenomics were not inherently designed for significant price appreciation. They lack structured scarcity mechanisms, vesting controls, and defined emission curves.

The majority of its price increases are attributed to short-term bursts of hype rather than sustainable fundamental growth. This is a common characteristic of many meme tokens, where perception dictates price until the hype subsides.

Lasting value in the cryptocurrency space is typically derived from mathematical scarcity and controlled token flow, principles that are central to projects designed for organic price momentum and sustainable growth.

Exploring Projects with a Realistic Path to Growth

While meme tokens like SHIB often rely on speculative hype, other projects are engineered with structural mechanisms to foster growth.

These projects often incorporate features such as deflationary tokenomics, robust staking rewards, and carefully designed supply models that make ambitious price targets more achievable.

Key elements to consider in such projects include a fixed or decreasing supply, transparent presale stages that increase price systematically, and mechanisms that reward long-term holding while reducing circulating tokens over time.

Furthermore, projects that undergo independent audits and have locked liquidity demonstrate a commitment to security and stability, which are crucial for building investor confidence and enabling sustained price momentum.

The focus shifts from speculative betting on hype to investing in projects with sound economic foundations and clear, achievable growth strategies.

Understanding Sustainable Price Momentum

Projects aiming for significant price appreciation often implement a multi-faceted approach. This can include a fixed total supply, which inherently creates scarcity as demand increases.

Presale structures that incrementally increase the token price at each stage, coupled with the burning of unsold tokens, contribute to automatic scarcity and price discovery.

Transparency is paramount, with live trackers for progress and burns providing real-time insights into the token's economic activity. Verifications like KYC and audits build trust, while locked liquidity ensures stability.

Staking mechanisms, offering attractive Annual Percentage Yields (APY), incentivize long-term holding. When emission rates decrease as the supply shrinks, this creates a deflationary ecosystem where price movement is mathematically driven rather than subject to market whims.

This structured approach is what leads investors to identify projects with a realistic path to sustained growth and ambitious long-term price targets.

The Foundation for Achieving $1.00

Unlike cryptocurrencies with trillions of tokens, projects designed for significant price appreciation often have a more manageable total supply. This fixed supply, combined with mechanisms that reduce circulating tokens, lays the groundwork for potential value accrual.

Presale phases that systematically increase the price, coupled with a built-in price curve, can create substantial growth even before a token officially launches on exchanges.

Post-launch, staking protocols and vesting models can further reduce the circulating supply while rewarding long-term holders. When liquidity is permanently locked and emission rates decline over time, the scarcity of circulating tokens naturally increases.

This creates a system where every mechanism is designed to compound value rather than dilute it. In such a framework, a $1 price target becomes a measurable long-term objective, contingent on sustained growth and the effective implementation of these economic principles.

This video explores the mechanics behind achieving significant price targets in the cryptocurrency market.

Pro Tip: For those new to crypto investing, it is essential to thoroughly study a coin's tokenomics. This involves understanding the underlying mathematics that influences its price potential. Prioritize projects with defined supply limits, clear vesting schedules, and transparent audits before making any investment decisions.