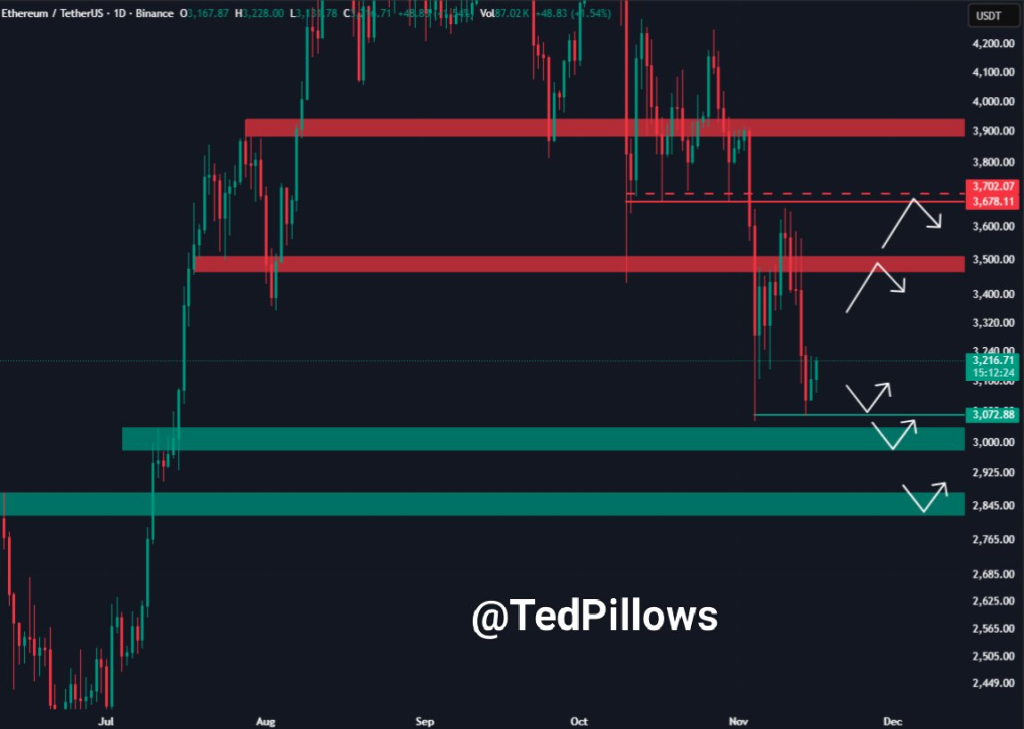

Ethereum is currently trading around $3,214.99, marking a 1.8% increase in the last 24 hours. Despite this recent uptick, the past week has seen a 6% drop, indicating ongoing uncertainty in its price movement.

Analysis of Ethereum's chart reveals that the cryptocurrency is consolidating sideways just below the $3,500 mark. This level has historically served as support and is now acting as a significant resistance.

According to analyst Ted, reclaiming the $3,500 zone is critical for Ethereum. A successful breach of this resistance could pave the way for the cryptocurrency to target the $3,800 level.

“The next crucial level to reclaim is the $3,500 zone, as it'll push Ethereum above $3,800.”

A sustained close above $3,500 could potentially open up further upward momentum, aiming for the $3,700 to $3,800 price range.

Potential Downtrend Below $3,000

Conversely, if Ethereum fails to overcome the $3,500 resistance, the charts suggest a possible decline toward the $3,072 support level. This level is considered vital for bulls to defend. A break below $3,072 could trigger a further drop, potentially testing the support zone between $2,845 and $2,900.

Ted also indicated that a rejection at the current resistance levels could lead to a significant price movement downwards.

“If ETH gets rejected, I think it'll sweep the liquidity below $3,000.”

This outlook is supported by the presence of demand zones identified below Ethereum's current trading price. Traders are closely monitoring the $3,200 level for any signs of weakening momentum.

$3,300 Identified as a Short Squeeze Trigger

Recent market heatmaps have highlighted a significant concentration of liquidity between $3,280 and $3,320. This area is noted to contain a substantial number of short positions, many of which are likely protected by tight stop-loss orders. The density of activity at these levels is confirmed by the presence of red-orange bands on the price charts.

Analyst CW pointed out the potential for a rapid price surge if Ethereum reaches this critical zone.

“If $ETH rises to just 3.3k, most high leverage short positions will be liquidated.”

A swift move into this liquidity zone could force short sellers to cover their positions, potentially triggering a cascade of buying pressure and driving the price higher at an accelerated pace.

Market Awaiting Clear Direction

Currently, Ethereum appears to be trading within a defined range, caught between the resistance at $3,500 and the support at $3,070. The daily trading volume stands at $18.1 billion, indicating substantial market interest despite the current consolidation phase.

The direction of Ethereum's next significant move will likely be determined by whether it can decisively break above the $3,500 resistance or fall below the $3,070 support. Until a clear breakout occurs, the price is expected to remain range-bound, with notable liquidity pools on both the upside and downside. Traders are observing these key levels closely for definitive signals.