Key Regulatory Concerns for Global Financial Stability

The G20 and the Financial Stability Board (FSB) have issued joint warnings regarding significant risks to global financial stability stemming from the cryptocurrency and Web3 markets. These risks are primarily attributed to identified gaps in the regulation of stablecoins, the oversight of decentralized finance (DeFi) platforms, and the management of cross-border crypto activities. As these markets rapidly expand and attract millions of users seeking innovation and potential profits, global financial leaders now recognize the imperative of robust regulatory frameworks to ensure stability and confidence.

The Financial Stability Board, an international body tasked with monitoring the global financial system, plays a crucial advisory role to the G20. Recent reports from the FSB have pinpointed specific deficiencies in current crypto regulations. These include insufficient transparency and governance for stablecoins, a lack of comprehensive oversight for the evolving DeFi sector, and the challenges posed by the borderless nature of crypto transactions. The potential consequences of these gaps are far-reaching, impacting the security of financial systems, investor confidence, and the flow of global liquidity.

Specific Regulatory Gaps Identified by the FSB

The FSB has highlighted several critical areas where existing crypto regulations fall short. Stablecoins, digital currencies designed to maintain a stable value typically pegged to traditional currencies like the US dollar, are a significant concern. While popular for payments, trading, and as a bridge between various Web3 markets, many stablecoins lack transparent reserve backing and clear governance structures. The FSB warns that the failure of a major stablecoin could have cascading effects across Web3 markets and potentially impact traditional financial systems.

Another major gap is the limited oversight of DeFi platforms and policies. Decentralized finance applications, which aim to remove intermediaries for lending, borrowing, and trading, are still in their nascent stages of regulation. Without clear guidelines, DeFi platforms are susceptible to increased risks of fraud, market manipulation, and systemic failures. The interconnected nature of these platforms means that issues in one can quickly spread, creating a chain reaction that current regulatory frameworks are ill-equipped to handle.

Cross-border crypto activity presents a further challenge. The global operation of Web3 markets and the ease with which transactions move between countries often outpace national regulations. This creates avenues for financial crimes and regulatory arbitrage. The FSB has emphasized the need for enhanced international cooperation and standardized guidance to effectively address these cross-border issues.

Diverse Regional Approaches to Crypto Regulation

The regulatory landscape for cryptocurrencies varies significantly across different regions. In the United States, the regulatory approach remains fragmented, with multiple agencies like the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) asserting jurisdiction over different aspects of the crypto market. This has led to confusion and unpredictability for businesses and investors, with court rulings often shaping regulations in the absence of clear legislative frameworks.

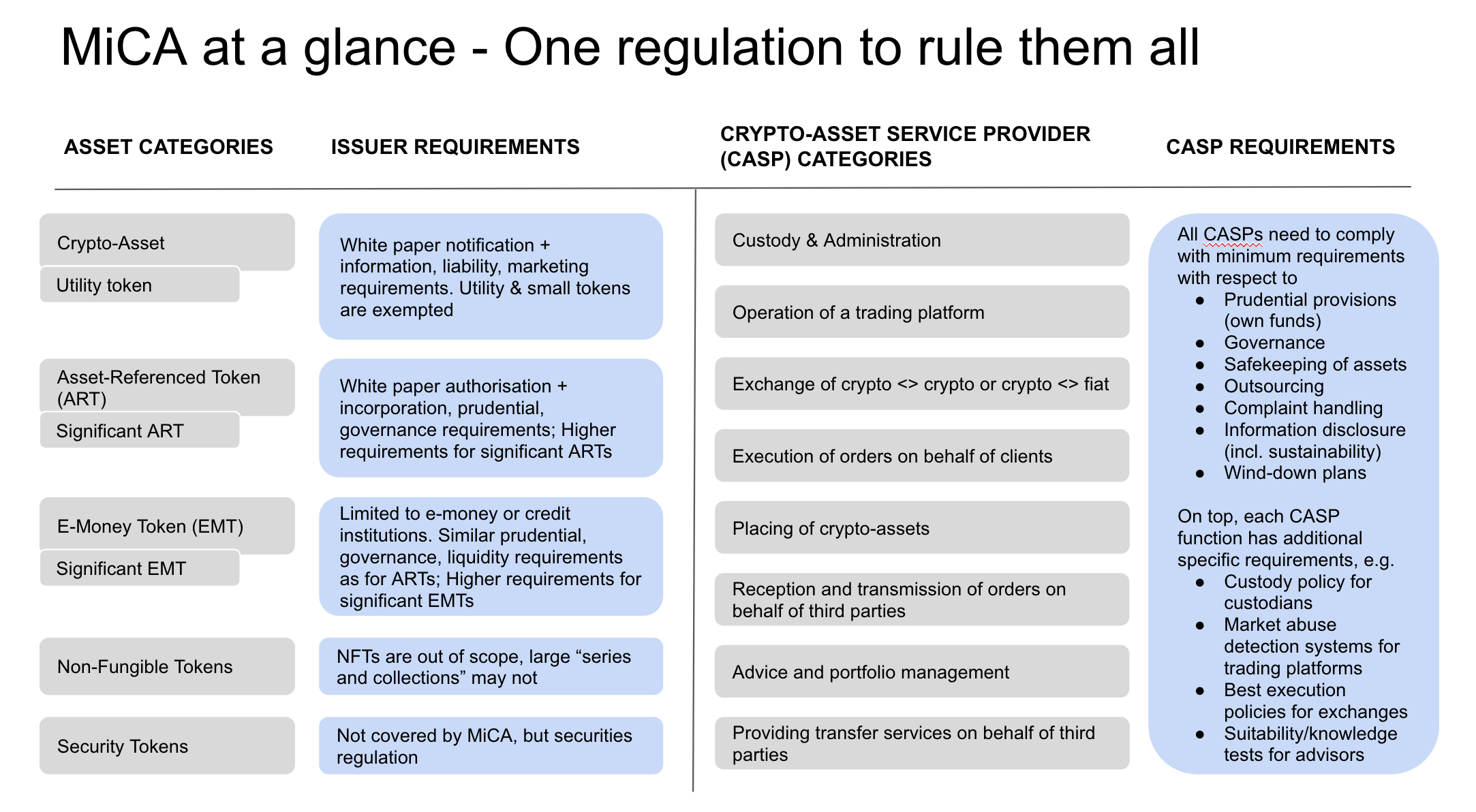

In contrast, the European Union has adopted a more structured and comprehensive approach with its Markets in Crypto Assets (MiCA) regulation. MiCA establishes a detailed framework for stablecoins, crypto exchanges, and other digital assets, aiming to protect investors, enhance transparency, and provide clear rules for companies operating within Web3 markets. While compliance may involve significant costs, the clarity offered by MiCA positions Europe as an attractive jurisdiction for long-term Web3 development.

Asia presents a more varied picture, with some nations actively fostering crypto innovation through supportive environments for Web3 market developers, while others have implemented restrictive measures due to concerns about financial stability, fraud, and capital flight. These regional disparities influence where companies establish operations, where developers focus their efforts, and where investors feel secure deploying capital. They also have a direct impact on cross-border stablecoin flows and the development of liquidity within DeFi platforms.

Impact on Investor Confidence and Market Liquidity

The warnings issued by the G20 and the recommendations from the FSB have a direct bearing on investor confidence in Web3 markets. Inconsistent or unclear regulations can deter investors, leading them to seek opportunities in regions with more predictable legal frameworks or to withdraw from the crypto space altogether.

The trust in stablecoins is a prime example. If users lack confidence in the backing or management of a stablecoin, its adoption and utility decline. This reduction in confidence directly impacts liquidity, which is the ease with which assets can be bought or sold without significantly affecting their price. Lower liquidity can make Web3 markets more volatile and less appealing to new participants. Conversely, clear crypto regulation and well-defined DeFi policies can foster greater trust. Investors who perceive markets as fair and stable are more likely to provide liquidity, thereby supporting the sustainable growth of Web3 markets.

The G20's focus on crypto regulation also signals to institutional investors that these markets are gaining serious attention from global financial authorities. When international regulations improve transparency and accountability, larger institutional investors are more inclined to enter Web3 markets. This influx of capital can lead to increased trading volumes, stimulate further innovation, and facilitate a more robust integration between traditional finance and digital assets.

Navigating the Future of Web3 Regulation

The G20's recent warning marks a significant moment, acknowledging Web3 markets, including stablecoins, DeFi platforms, and crypto exchanges, as integral components of the global financial system with tangible economic and stability implications.

The path forward involves a delicate balance between fostering innovation and implementing necessary regulation. Overly stringent regulations could stifle creativity and the development of Web3 markets, while insufficient oversight could leave users and the financial system vulnerable to undue risks. By heeding the guidance of the G20 and the Financial Stability Board, the crypto community can prepare for a future where stablecoins are more secure, DeFi policies are strengthened, and Web3 markets can achieve responsible growth.

The advent of regulation is inevitable for the industry. The most constructive approach involves active engagement with policymakers, the adoption of transparent practices, and continued innovation within the evolving regulatory landscape. This proactive stance will be crucial in ensuring that Web3 markets remain dynamic, secure, and trustworthy for the long term.