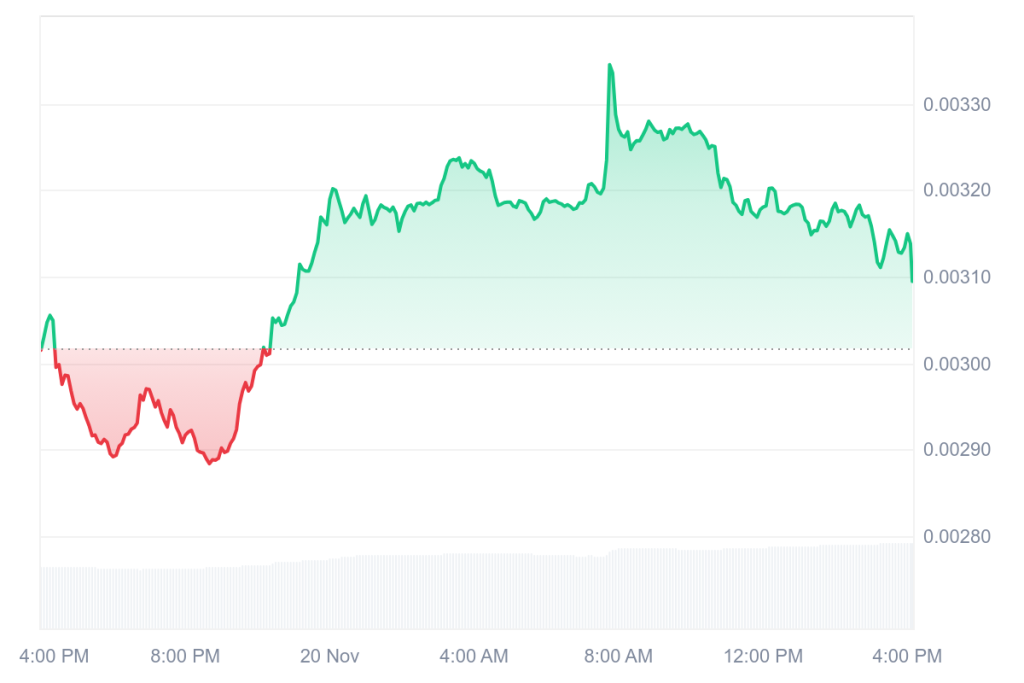

The PUMP price is experiencing renewed momentum today, climbing back into the $0.00310–$0.00320 range after a dip earlier in the week. The 24-hour chart indicates a clean U-shaped recovery, and traders are currently assessing whether this bounce possesses substantial weight or is merely another transient movement within the meme-token cycle. Examining the buybacks, the technical setup, and the introduction of new features provides a clearer perspective on the situation.

Pump.fun Buybacks Are Still Doing the Heavy Lifting

The primary driver behind PUMP's current resilience stems from its ongoing buyback program. As of November 20, Pump.fun had repurchased 7.66 billion PUMP, equivalent to 0.766% of the total supply. These buybacks, totaling $30.65 million, are directly funded by the platform's revenue. A reduction in supply naturally contributes to PUMP price stability, which is precisely what is being observed. A point of concern is the decline in daily platform revenue, which has fallen from $2.28 million in August to approximately $250,000 currently. Since buybacks are contingent on revenue, traders are closely monitoring whether this level of support can be sustained. Nevertheless, for the time being, the buybacks are effectively mitigating sell-pressure and assisting PUMP in recovering from its recent lows.

The PUMP Chart Shows a Classic Short-Term Bounce

From a technical standpoint, the recent price movement is logical. The PUMP price closely approached the pivot level at $0.0030942 before reversing to an upward trend. It is currently holding above the 23.6% Fibonacci level at $0.003345, a threshold that short-term traders often interpret as an early indicator of bullish structure. The Relative Strength Index (RSI) is hovering around 40, suggesting that the token is leaning towards oversold territory without being in a full reversal state. This combination typically attracts dip-buyers, especially when trading volume increases. Indeed, 24-hour trading volume saw a 38.5% rise today, reaching $245.8 million.

The next significant resistance level to watch is the 7-day Simple Moving Average (SMA) at $0.003334. A decisive break above this level would likely fuel further upward momentum; conversely, failure to surpass it could lead to a price retracement toward $0.002774.

“Mayhem Mode” Added Some Spark – But Not Much

Pump.fun's recently introduced "Mayhem Mode," an AI trading bot designed for launching new tokens, also plays a role in today's price action. Launched on November 18, it did contribute to a minor increase in activity, with daily token launches rising from 17,300 to 17,800. However, the rollout did not generate the substantial catalyst that some had anticipated. Despite this, the feature did reintroduce a degree of temporary excitement to PUMP, particularly within the Solana meme-coin community, where attention spans are known to be fleeting.

What’s Next for PUMP?

Today's price movement is not arbitrary. PUMP is experiencing a bounce due to a combination of engineered scarcity through buybacks, a technical setup that has re-engaged short-term traders, and a modest resurgence of interest following the Mayhem Mode launch. The critical question now is whether the PUMP price can successfully break above $0.003334 to transform this bounce into a more sustained rally, or if it will revert to its recent lows.