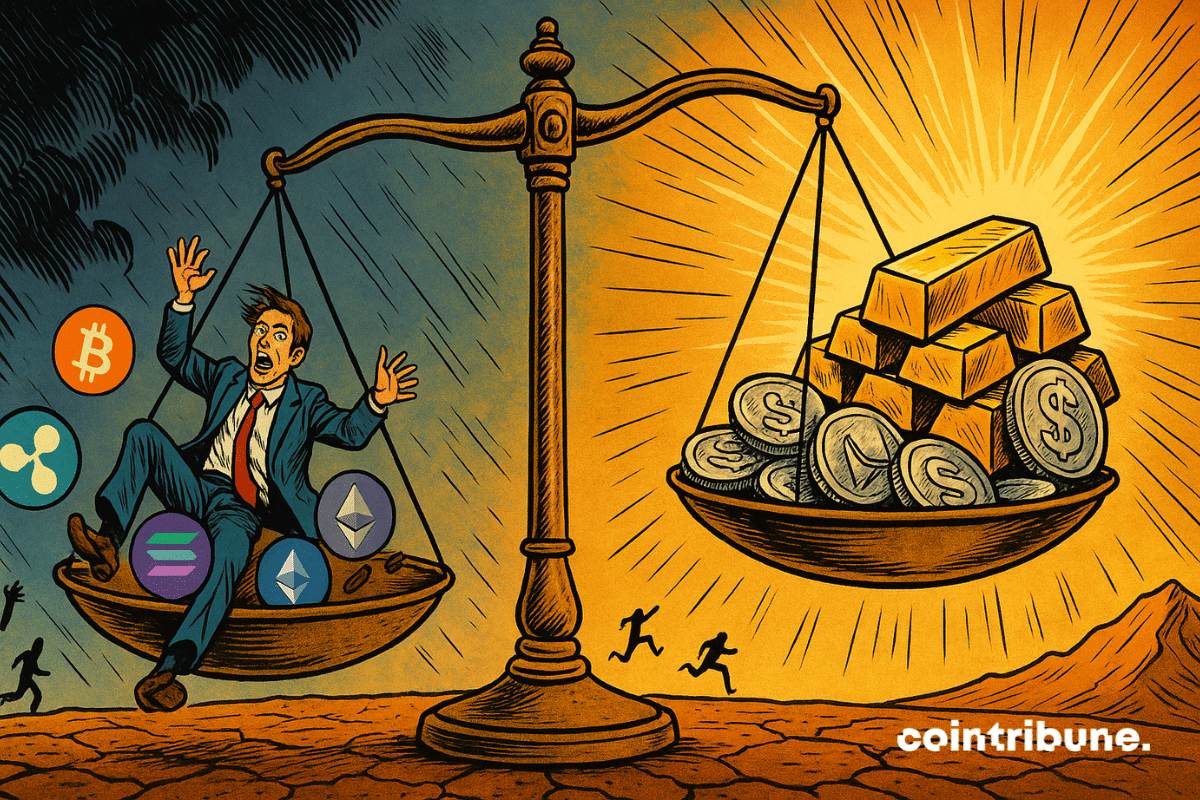

The cryptocurrency market is currently experiencing a period of intense turbulence. While Bitcoin has dangerously slipped below the symbolic threshold of $100,000, gold and silver are shining brightly. Investors are turning away from digital assets to seek refuge in commodities. This shift prompts an examination of the underlying reasons for such a turnaround.

In brief

- •Bitcoin fell more than 9% this month, dropping below the psychological barrier of $100,000.

- •The main cryptocurrencies, including Ethereum, Solana, and Dogecoin, recorded declines ranging from 11% to 20%.

- •Gold and silver increased by 4% and 9% respectively during the same period.

- •Credit risks weighing on digital asset treasuries partly explain this weakness.

Cryptocurrencies Face Significant Declines

Bitcoin is navigating an unprecedented zone of turbulence. The world's leading cryptocurrency has broken below the symbolic $100,000 mark, exerting downward pressure on the entire sector.

Ethereum has fallen by 11%, Solana by 20%, while XRP has limited its damage with a 7% drop. This correction is occurring even as the dollar index slows its growth, an environment that would typically be favorable to digital assets.

Greg Magadini, Head of Derivatives Products at Amberdata, points to an exhaustion of positive catalysts. He explains that all reasons for optimism have been depleted. The Federal Reserve has concluded its monetary easing cycle, the US government shutdown has ended, and traders now find themselves without new support to justify further buying.

The real danger, however, stems from elsewhere. Digital asset treasuries, companies that have massively acquired Bitcoin through convertible bonds, are facing a liquidity threat. They are in direct competition for credit access with governments and artificial intelligence giants. If credit markets seize up, these companies will be compelled to sell their cryptocurrencies to repay their debts.

A downward spiral could be triggered, warns Magadini. Each forced sale would necessitate other holders to liquidate their positions, creating a cascade effect. This systemic risk particularly threatens structures that acquired volatile altcoins at their peak valuations.

Gold and Silver Gain as Public Debt Rises

Precious metals are experiencing a very different trajectory. Gold and silver are attracting investor flows seeking safety amidst the deterioration of global public finances.

The situation is alarming: Japan shows a public debt-to-GDP ratio exceeding 220%, the United States has crossed 120%, while France and Italy are above 110%. This surge in public debt creates an environment where investors are increasingly looking for tangible assets.

Robin Brooks, a researcher at the Brookings Institution, views this surge in precious metals as "the symptom of a deeply failing fiscal policy."

The Eurozone crystallizes these tensions, with heavily indebted countries influencing the European Central Bank's decisions. China is also not immune to this spiral, with its total debt exceeding 300% of GDP.

This flight to quality is even benefiting less-followed metals. Palladium and platinum are recording gains above 1%. Investors are favoring these tangible assets amid the regulatory uncertainty that is currently paralyzing the crypto sector.

Is a Turnaround in Sight?

Historical trends suggest that Bitcoin could experience a rebound. Analysts observe a lag of approximately 80 days between movements in gold and Bitcoin. Once the upward trend of gold stabilizes, the cryptocurrency market could regain strength.

JPMorgan maintains its target of $170,000 over a six to twelve-month period, basing this projection on a miner production cost set at $94,000. The coming weeks will be decisive in determining the market's direction.

The return of liquidity and the clarification of US monetary policy will dictate whether this correction is merely a temporary pause or the commencement of a prolonged bear phase. In the interim, precious metals are firmly retaining their status as undisputed safe havens.