The cryptocurrency market presents a landscape that can be both fascinating and confusing, particularly for individuals unfamiliar with its intricacies. Many observers tend to concentrate on announcements, speculative rumors, or imaginative predictions. However, a consistently reliable indicator, often underestimated, is the evolution of the Bitcoin price against the US Dollar (BTC USD).

This price indicator is far more than a simple numerical value. It serves as a reflection of the prevailing market psychology, encompassing buyer pressure, prevailing fear or euphoria, and crucially, the state of liquidity. When the Bitcoin price stabilizes within a critical area, it suggests that significant market participants are actively reconfiguring their investment portfolios and positions.

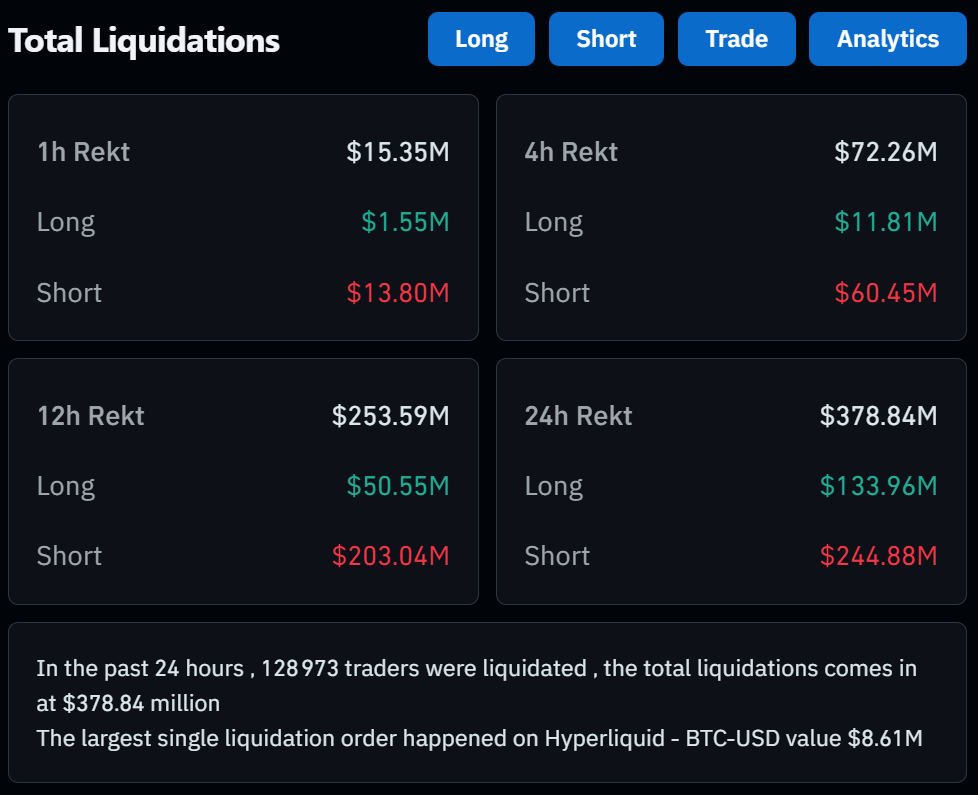

Conversely, when the price breaks through a notable level, it signals the market's endorsement of a new potential trajectory or scenario. Furthermore, abrupt surges or sharp declines in price often indicate significant liquidations, the unwinding of leveraged positions, and substantial capital repositioning by major entities.

A significant portion of market participants overlooks these subtle yet vital nuances. They often react belatedly to market movements, typically after the event has already unfolded, despite ample prior visibility for those who diligently monitor liquidity shifts. By observing the behaviors and patterns that emerge around liquidity zones, one can discern where the truly impactful decisions are being made: those by large-scale holders, institutional funds, and market makers. It is within these zones that the ultimate direction of the market is determined, rather than being dictated by the fleeting emotions of the general audience.

It is important to note that this analysis does not constitute investment advice. Instead, it presents a fundamental reality: an individual who possesses the skill to interpret liquidity dynamics gains an advanced understanding of the market ahead of others. Conversely, those who disregard these principles are left to passively experience market shifts that have long been foreseen and acted upon by more informed participants.