The Biden administration is reportedly moving towards appointing a permanent chairperson for the US Commodity Futures Trading Commission (CFTC). This potential appointment comes as Michael Selig, President Donald Trump’s nominee, undergoes the vetting process. The development is seen as a significant step towards achieving greater clarity in cryptocurrency regulation, a crucial demand from the industry amidst ongoing legislative debates.

Who is Michael Selig, and What Are His Views on Cryptocurrency?

Michael Selig, a graduate of George Washington University Law School, has a substantial background in regulatory and legal fields. His government career began with the CFTC, where he worked with former Commissioner J. Christopher Giancarlo from 2014 to 2015. He subsequently held legal positions at prominent firms such as Cadwalader, Wickersham & Taft and Perkins Coie, before becoming a partner at Willkie Farr & Gallagher in January 2024. More recently, Selig served as chief counsel to the SEC’s Crypto Task Force and as a senior advisor to the SEC chairman, gaining extensive experience across both traditional finance and digital asset regulation.

Selig has been an outspoken advocate for the cryptocurrency industry. In a public statement via X, he expressed his aspiration to establish the U.S. as the "Crypto Capital of the World," indicating a belief in a "Golden Age" for American financial markets and the burgeoning opportunities within digital assets.

David Sacks, who serves as the White House’s AI and crypto policy czar, has commended Selig's commitment to modernizing digital asset regulation, citing his comprehensive experience at both the SEC and CFTC.

“[Selig] has not only been instrumental in driving forward the President’s crypto agenda as Chief Counsel of the SEC Crypto Task Force, he also brings deep experience in traditional commodities markets from his time working at the CFTC under former Chairman Chris Giancarlo,”

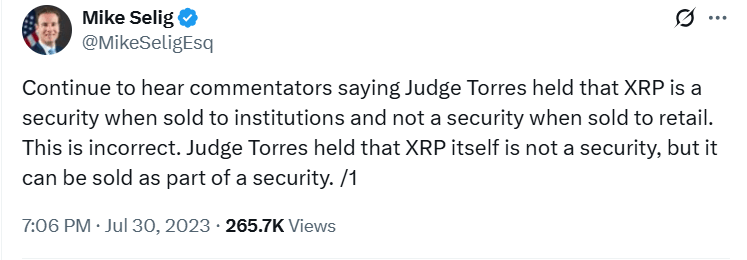

Industry observers have noted Selig's consistent emphasis on classifying digital assets as commodities. His analysis of the SEC v. Ripple case in 2023 underscored this perspective. He argued that XRP, being "simply computer code," could be viewed similarly to other fungible commodities such as gold or whiskey.

Selig further stated, "the SEC can’t argue a $2 billion penalty against Ripple with a straight face, or definitively classify XRP as a security."

This commodity-centric approach to digital assets could significantly shape future legislative initiatives, particularly as Congress contemplates reforms to cryptocurrency regulation amidst a challenging political environment characterized by delays and disagreements.

Coordinated Efforts Between CFTC and SEC Face Hurdles Amidst Political Gridlock

In the Senate, the Responsible Financial Innovation Act is under review. If enacted, this legislation would reclassify numerous cryptocurrencies as commodities, thereby transferring primary regulatory authority to the CFTC. Currently, the CFTC regulates derivatives and possesses anti-fraud jurisdiction within the crypto sector, but a comprehensive regulatory framework remains elusive due to persistent political obstacles.

The progress of this bill has been considerably slowed. Threats of a government shutdown and escalating bipartisan tensions have impeded its advancement beyond the September deadlines.

Concurrently, the SEC and CFTC have been attempting to align their regulatory strategies. In September, SEC Chairman Paul Atkins announced plans for a joint roundtable with the CFTC to harmonize crypto regulations, aiming to foster market stability and innovation. However, SEC Chair Caroline Pham has indicated that inter-agency rivalry, rather than collaboration, has often affected their operational efficiency.

Both agencies have jointly contributed recommendations through initiatives such as the SEC’s Project Crypto and the CFTC’s Crypto Sprint. Nevertheless, the effectiveness of these collaborative efforts is constrained by the ongoing government shutdown, which impedes staffing and regulatory activities, according to former CFTC Chair Giancarlo.

With Selig's potential appointment as chairperson, the CFTC's role in supervising crypto markets may become more defined. However, securing necessary political approvals and ensuring a functional budget are essential prerequisites for any decisive regulatory actions. Prominent figures in the industry, including the Winklevoss twins, continue to advocate for expedited legislative progress and clearer regulatory guidelines.