A new report breaks down what investors actually own when they buy $1,000 worth of Berkshire Hathaway stock, and the results reveal just how conservatively positioned Warren Buffett remains heading into 2026.

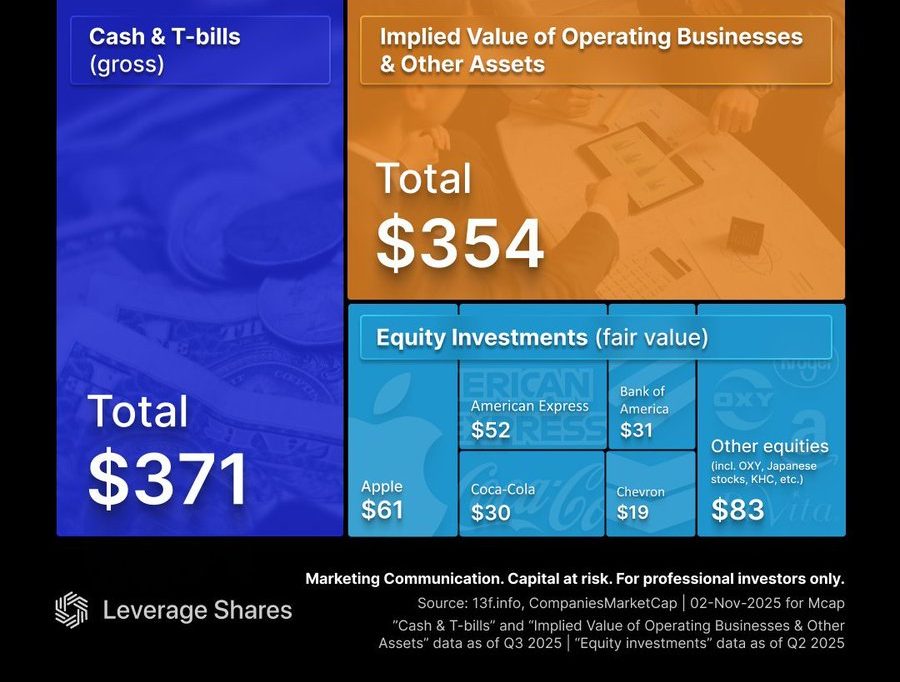

According to the analysis, nearly $371 of that $1,000 sits entirely in cash and U.S. Treasury bills, underscoring Berkshire’s defensive posture amid elevated interest rates, record equity valuations, and geopolitical uncertainty. Buffett’s growing cash pile, now above $180 billion, continues to be both a buffer and a war chest, ready for deployment when markets offer the kind of bargains he’s known to seize.

Equity Investments

The company’s equity investments account for another $245, anchored by iconic holdings such as Apple ($61), American Express ($52), Coca-Cola ($30), Chevron ($19), and roughly $83 in other equities, including energy, Japanese trading houses, and financial firms like Bank of America. These long-term stakes continue to deliver consistent dividends, aligning with Berkshire’s steady compounding philosophy.

Operating Businesses

The remaining $354 reflects the implied value of Berkshire’s vast operating businesses, a diversified empire spanning insurance, railroads, manufacturing, and energy infrastructure. Together, these entities generate billions in annual profit and serve as the backbone of the conglomerate’s stability.

Overall Portfolio Composition

In essence, a $1,000 share of Berkshire isn’t just an investment in the stock market; it’s a portfolio of disciplined liquidity, blue-chip equities, and cash-rich industrial powerhouses. Buffett’s strategy may look cautious on the surface, but as market volatility rises, that mountain of cash positions Berkshire to strike decisively when opportunity returns.