Key Developments in Chainlink Ecosystem

- •Whales have accumulated approximately 13 million LINK tokens this week, indicating a growing level of investor confidence.

- •Treehouse has integrated Chainlink's Cross-Chain Interoperability Protocol (CCIP), enabling seamless cross-chain transfers of tETH and TREE.

- •Data from Santiment highlights Chainlink and Hedera as leaders in 30-day real-world asset tokenization growth.

Chainlink (LINK) has attracted increasing attention from both individual investors and institutions this week. Analysts have reported significant whale accumulation, new integrations within the decentralized finance (DeFi) space, and growing recognition across the blockchain and finance industries, underscoring Chainlink's expanding influence.

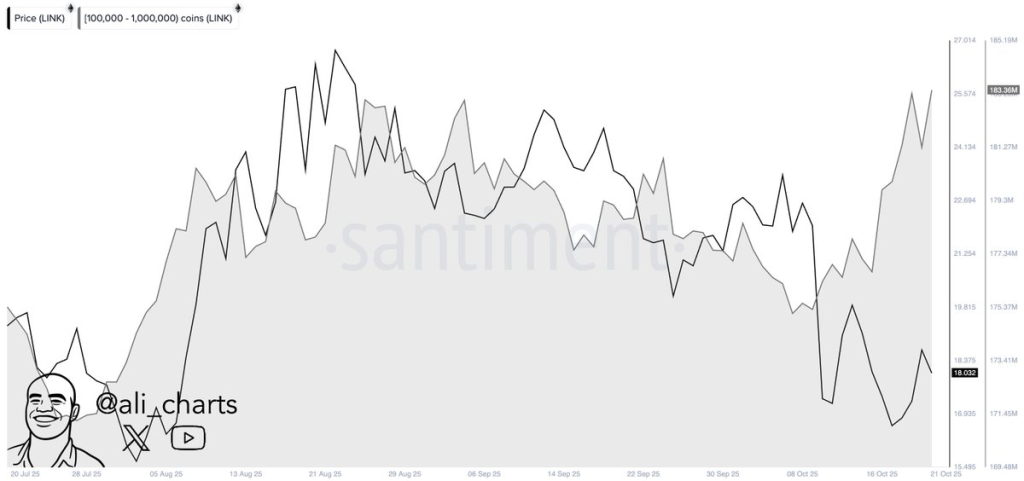

Whale Activity Signals Renewed Market Interest

Whales have accumulated around 13 million Chainlink (LINK) tokens over the past week. On-chain data indicates that large holders are actively increasing their positions in LINK. This trend suggests a growing confidence among institutional and major investors regarding the token's future performance.

The movement of these large wallets has led to a reduction in the available supply of LINK on exchanges. This could potentially impact future market dynamics if the accumulation trend persists. The current accumulation behavior demonstrates strong confidence from large holders who are building long-term positions.

Analysts have observed that consistent buying by these large wallets is often correlated with positive outlooks on network growth and strategic partnerships. Chainlink's overall activity has also seen an increase due to continuous new integrations across the DeFi ecosystem. As of the latest reporting, Chainlink is trading at $17.45, with a 24-hour trading volume of $1.2 billion, and has experienced a 2.54% decrease in the last 24 hours.

Treehouse Expands DeFi Reach as Chainlink and Hedera Lead RWA

Recent developments confirm that Treehouse is adopting Chainlink's Cross-Chain Interoperability Protocol (CCIP). According to data from Chainlink, Treehouse, a decentralized fixed-income platform with a total value locked (TVL) exceeding $375 million, has launched tETH and TREE as Cross-Chain Tokens. These tokens can now be transferred across multiple blockchains, including Arbitrum, Base, Ethereum, TAC, and BNB Chain, facilitating smoother transfers and enhancing liquidity for users.

This integration is expected by analysts to support more efficient cross-chain yield strategies. It also broadens CCIP's utility in connecting DeFi platforms and enabling asset transfers across various networks. Treehouse's adoption of CCIP represents another significant step in the application of Chainlink's cross-chain solutions within the decentralized finance sector.

Data compiled by Santiment indicates that Chainlink (LINK) and Hedera (HBAR) are currently leading the growth in real-world asset (RWA) development. The report places Chainlink at the forefront, followed by Hedera, with IOTA and Stellar (XLM) also showing notable activity in this sector over the past 30 days. These findings point to an increasing trend in the tokenization of assets on blockchain networks. Chainlink's expanding role in providing reliable data feeds and robust smart contract connectivity solidifies its position in this emerging field.