Western Union is set to introduce a dollar stablecoin on the Solana blockchain in 2026, collaborating with Anchorage Digital. This initiative marks a significant step in the company's expansion into digital payment solutions. The new token, named the US Dollar Payment Token (USDPT), is designed to function within a network that aims to bridge digital and traditional forms of money.

The company announced that this network will facilitate easier value transfer between cryptocurrency wallets and physical cash, contributing to the goal of achieving faster and more cost-effective cross-border remittances. CEO Devin McGranahan highlighted the strategic importance of the USDPT, stating it will allow Western Union to "own the economics linked to stablecoins" and represents a key milestone in the company's ongoing digital transformation. The USDPT is anticipated to be available in the first half of 2026.

It's official: @WesternUnion , the world's largest money transfer business, is building exclusively on Solana. 🔥 pic.twitter.com/dJMnKN5EY4

— Solana (@solana) October 28, 2025

In conjunction with the stablecoin launch, Western Union will introduce a "Digital Asset Framework." This framework is intended to consolidate the company's extensive network of global partners, including various wallet and wallet provider services. The objective is to provide users with "seamless access to cash off-ramps for digital assets."

New Stablecoin and Framework to Enhance Financial Accessibility

Western Union, a company with a history dating back to the first telegraph line in 1861, is modernizing its network by integrating blockchain technology for transactions that can be processed around the clock in mere seconds. The company noted that while digital commerce has brought the world closer, access to cash remains a localized issue. Western Union believes its USDPT stablecoin and Digital Asset Network have the potential to fundamentally alter how money is transferred globally. Executives expressed that this strategic move is a return to the company's core mission of connecting people through technology, utilizing contemporary digital infrastructure.

Solana Chosen Amidst Ethereum Dominance in Stablecoin Market

The decision to build on the Solana network and issue the USDPT through Anchorage Digital stems from a shared vision with Anchorage to modernize financial infrastructure and promote global digital asset adoption while adhering to regulatory standards.

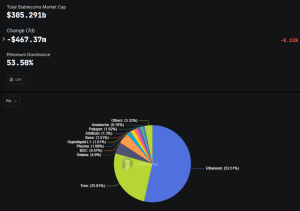

Western Union's selection of Solana diverges from the prevailing trend in the stablecoin market, where the Ethereum network is the primary platform for token issuance. According to data from DefiLlama, Ethereum currently holds a 53.51% share of the stablecoin market, followed by Tron with 25.81%, and Solana with a significantly smaller 4.9% market share.

Despite its smaller market share in stablecoins, Solana possesses technical advantages. Chainspect data indicates Solana ranks as the second-fastest blockchain in terms of transactions per second (TPS), with a theoretical capacity of 65,000 TPS and a real-time TPS of 767.1 TPS. In comparison, Ethereum, ranked as the 20th-quickest blockchain, has a theoretical TPS of 178.6 TPS and a real-time TPS of 16.91 TPS. It is important to note that Ethereum's transaction speeds are significantly enhanced by its layer-2 scaling solutions, such as Optimism and Arbitrum, which also reduce transaction fees.

USDPT Enters a Highly Competitive Stablecoin Landscape

The USDPT will enter a market dominated by established players like Tether's USDT, the largest stablecoin with a market capitalization exceeding $183 billion, and Circle's USD Coin (USDC), which has a market cap of over $75 billion. Circle has also recently launched the testnet for its Arc blockchain, attracting interest from major firms like BlackRock and WisdomTree.

Western Union will also compete with other financial services companies that have ventured into the stablecoin space, such as PayPal and MoneyGram. PayPal launched its dollar-backed stablecoin in partnership with Paxos in 2023 and integrated it into its remittance app. MoneyGram, meanwhile, has introduced a wallet that supports USDC. Furthermore, bank-led networks are actively exploring stablecoin payouts for international transfers.

The increased interest in stablecoins follows a period of gaining regulatory clarity, particularly after U.S. President Donald Trump signed the GENIUS Act into law in July.