The past few weeks have presented challenges for Bitcoin enthusiasts, with the asset's price experiencing a significant decline, falling well below the $100,000 mark.

This downturn has led some analysts and members of the cryptocurrency community to signal the potential onset of a bear market. To gain insight into whether a more substantial plunge to $50,000 is imminent, four of the most prominent AI chatbots were consulted.

Expert AI Forecasts

ChatGPT suggests that Bitcoin has entered a bearish phase within a larger bull cycle. However, it indicated that a crash to $50,000 before the end of 2025 is not anticipated and would necessitate "a major negative catalyst." Such catalysts could include a recession, the collapse of a major cryptocurrency exchange—similar to the FTX incident in 2022—or other significant adverse events.

The chatbot highlighted that double-digit corrections are common occurrences within bull markets. It further noted that the current cycle exhibits greater strength compared to previous ones, largely due to the robust demand generated by the introduction of spot Bitcoin ETFs.

In its assessment, ChatGPT estimated the probability of a collapse to $50,000 by New Year's Eve to be in the 5% to 15% range. The AI predicted the most likely price range to be between $70,000 and $110,000, with odds of a new rally above $120,000 estimated at 30% to 40%.

Grok's analysis indicated that a drop to $50,000 is possible, but unlikely, when considering current analyst consensus, historical market patterns, and prevailing macroeconomic tailwinds.

“A drop to $50,000 would require a ~47% further decline from today’s levels, which would be an extreme event even for Bitcoin’s volatile history. While risks exist, most forecasts point to stabilization or upside by December 31, 2025,” Grok stated.

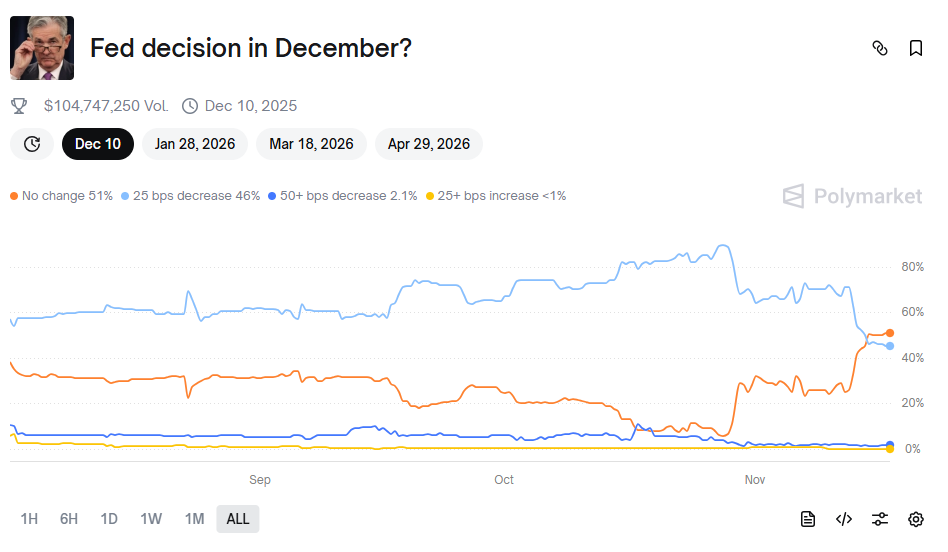

Grok also pointed out that a potential reduction in interest rates by the US Federal Reserve could stimulate the resurgence that Bitcoin bulls are anticipating. The next FOMC meeting is scheduled for December 10. While a few weeks ago, the likelihood of a 0.25% rate cut stood at 90%, the current estimate for "no change" in rates is 51%.

Additional AI Perspectives

Perplexity AI shared a similar outlook, categorizing a significant price collapse as "a lower-probability scenario." The AI suggested that Bitcoin would likely trade above $85,000 through the end of the year, with some bullish projections even forecasting a potential surge to $190,000.

“Bitcoin crashing to $50,000 before the end of 2025 is not the most likely outcome, but it remains a plausible downside risk if adverse macroeconomic or regulatory events worsen. Current technical and fundamental analysis generally indicate a higher base level nearer $85,000-$100,000 with strong long-term bullish momentum overall,” Perplexity summarized.

Google's Gemini offered its perspective, stating that a major banking crisis, an increase in US interest rates, or a large-scale security breach on a prominent exchange could trigger a drop to $50,000.

Conversely, Gemini identified bullish factors such as increased institutional adoption following the introduction of spot BTC ETFs and the growing recognition of Bitcoin as "digital gold" as reasons that make such a significant price drop improbable.