Operational Restart and Initial Offerings

WazirX, a prominent Indian cryptocurrency exchange, is set to resume operations on October 24th. This reopening follows a year-long hiatus after a significant hack, with the exchange having secured court approval for its restructuring plan in Singapore. Initially, trading will be limited to the USDT/INR trading pair and a select number of other markets. As part of its recovery strategy, WazirX will issue Recovery Tokens to its users, marking the commencement of a compensation plan designed to address the impact of past events.

The resumption of services signifies a crucial juncture in re-establishing confidence and stability within India's cryptocurrency landscape. Market observers anticipate potential shifts in trading dynamics and user engagement following this development.

User Trust and Regulatory Considerations

Announcements regarding the exchange's restart were disseminated through WazirX's official communication channels, including Twitter and Telegram, eliciting considerable user interest and questions concerning security measures. Nischal Shetty, the founder of WazirX, has underscored the team's commitment to executing a seamless operational transition. He stated, "The team is working at full speed to make this happen and aims to resume even sooner if possible."

Key operational changes implemented at launch include the elimination of transaction fees and the initial focus on USDT/INR and select cryptocurrency markets. The partnership with BitGo, a U.S.-based custodian, is intended to bolster the security of user assets.

Market Context and Future Outlook

The recovery and relaunch process undertaken by WazirX bears resemblance to the strategies employed by other exchanges that have faced major security breaches, such as Mt. Gox. In those instances, multi-year repayment plans were instrumental in rebuilding community trust and ensuring long-term operational viability.

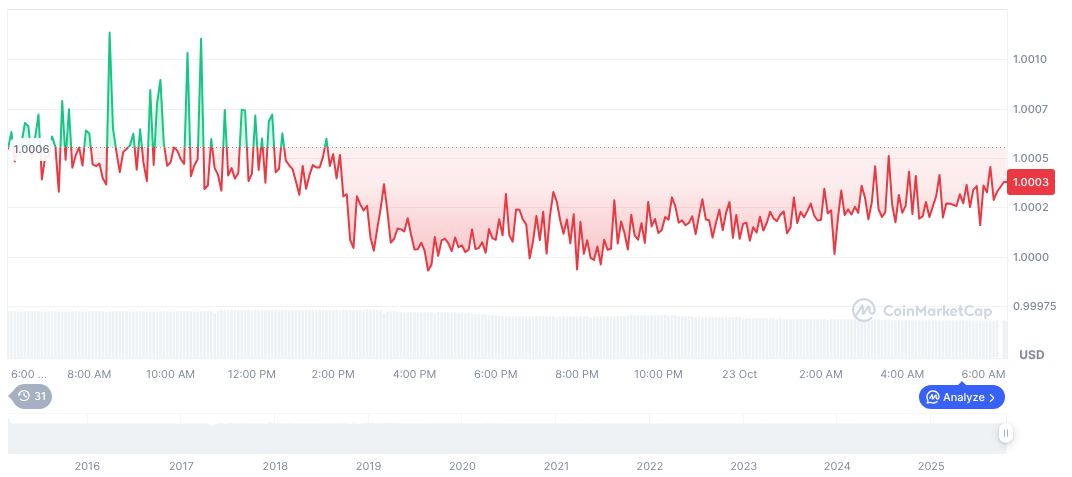

According to available market data, Tether USDt (USDT) is currently trading at approximately $1.00. Its circulating supply stands at 182.50 billion, with a 24-hour trading volume of $152 billion, reflecting a 19.52% decrease. The price has remained relatively stable, experiencing a minor dip of 0.05% in the last 24 hours.

Industry analysts suggest that the relaunch of WazirX could potentially lead to increased regulatory scrutiny in both India and Singapore. The model of using platform revenue to fund Recovery Token buybacks may offer a new avenue for distressed exchanges to adopt. Historical events consistently highlight the paramount importance of restoring user trust for the sustained success of any cryptocurrency platform.