The financial industry on Wall Street appears to be increasingly convinced that prediction markets are a lasting innovation, solidifying the position of platforms like the crypto-based prediction market Polymarket as significant players in the fintech landscape.

In October, a survey conducted by Bloomberg Markets polled 406 Wall Street professionals regarding their perspectives on prominent prediction markets, including Polymarket and Kalshi.

Polymarket, which was launched in 2020 and is headquartered in New York City, stands as the world's largest prediction market. The platform enables traders to speculate on future events, such as the price of Bitcoin (BTC), election outcomes, and Federal Reserve policy decisions, by utilizing cryptocurrency for transactions.

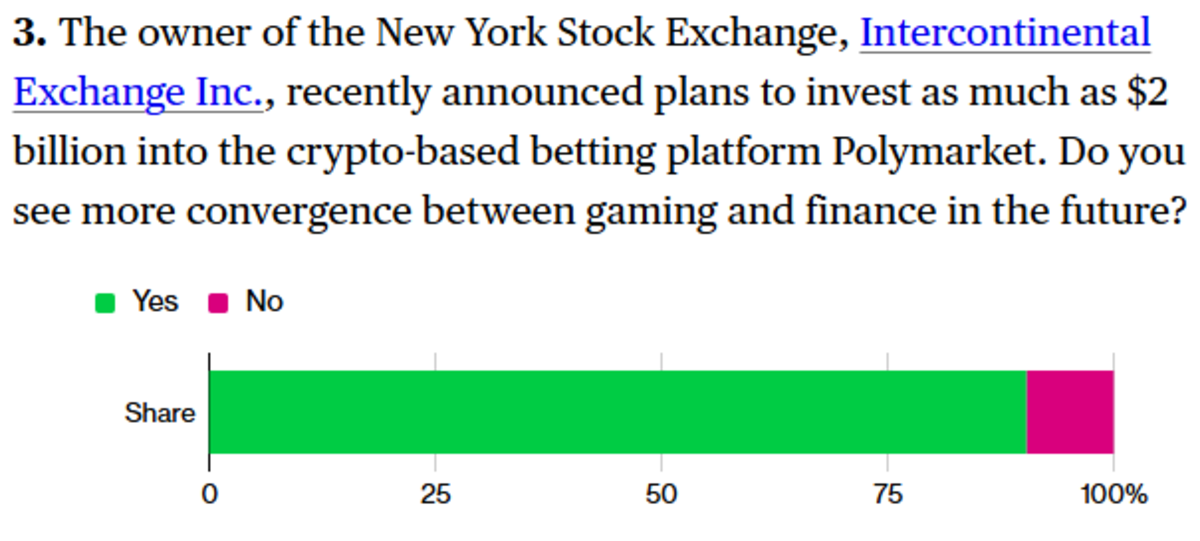

Intercontinental Exchange Inc., the owner of the New York Stock Exchange (NYSE), recently announced an investment of up to $2 billion into Polymarket.

When asked about the likelihood of gaming and finance converging further in the future, approximately 90% of the survey respondents indicated that they anticipate this intersection.

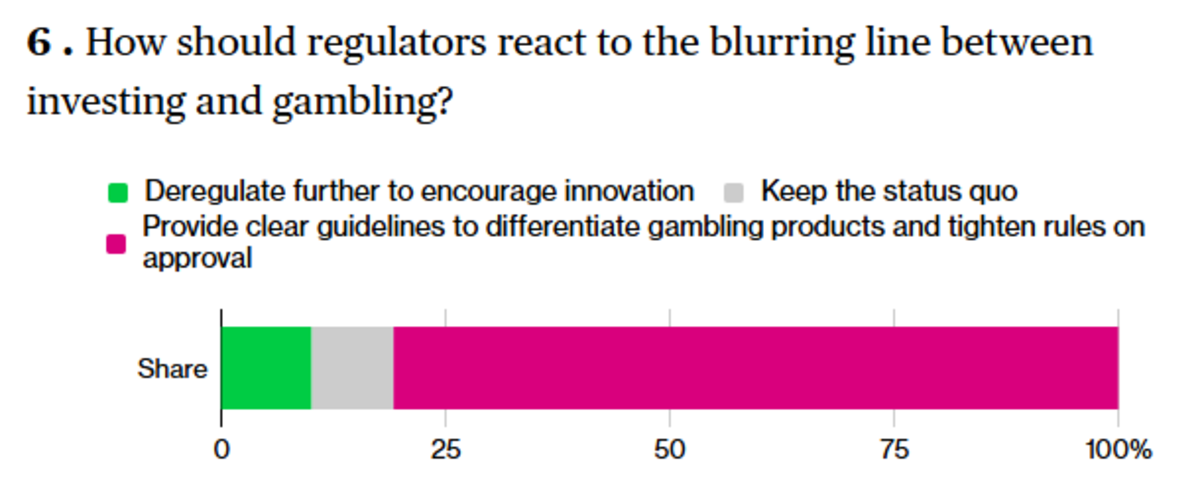

Although a majority of the respondents foresee a future where gaming and finance become more intertwined, they also expect regulatory bodies to actively address the blurring lines between trading and gambling.

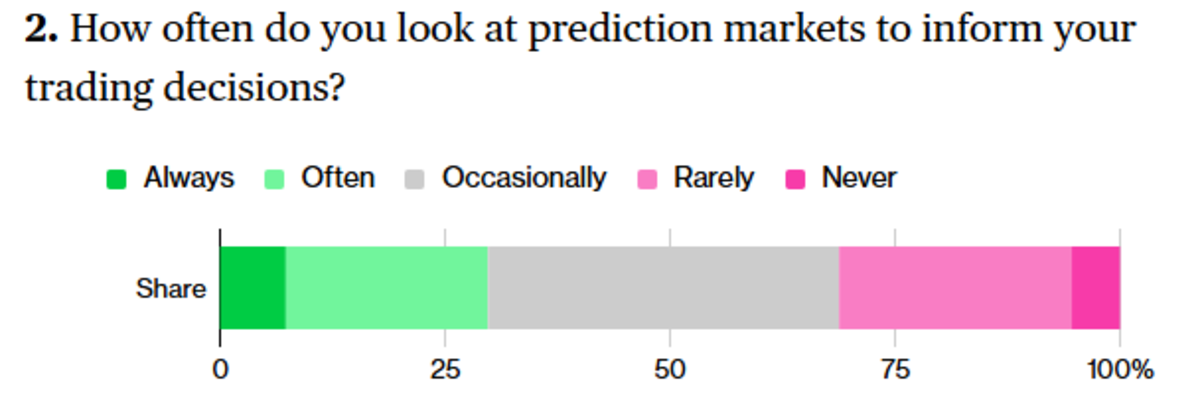

Despite this optimism about the future of prediction markets, the survey respondents expressed a cautious approach when engaging with these platforms themselves, indicating that they do not rely on them for informing their investment decisions.

Tokenization's Limited Disruption Potential According to Wall Street

While professionals on Wall Street express optimism about the trajectory of prediction markets like Polymarket, they do not anticipate that tokenization will significantly disrupt the entire financial system, contrary to the views of some industry leaders.

Tokenization involves the application of blockchain technology to transform real-world assets, such as stocks, funds, and real estate, into digital tokens. This process allows for the 24/7 trading of assets like stocks, a departure from traditional Wall Street hours, and provides investors with access to fractional ownership opportunities.

Although the market for tokenized assets is experiencing growth and industry projections suggest it could eventually rival established players, the traditional financial system continues to be the preferred choice for retail traders due to its long history of operation and established regulatory framework.