Vanguard's decision to lift its internal ban on crypto ETFs marks a significant shift in how a large segment of the population can access Bitcoin. Approximately 50 million clients can now gain exposure to spot Bitcoin and Ethereum funds within the same interface they use for traditional index products and retirement portfolios, without the need to interact directly with cryptocurrency exchanges.

This strategic change has been anticipated for some time, with earlier reports indicating the substantial impact of this move.

The significance of this development lies in its influence on retirement capital. This type of capital tends to compound over extended periods, contrasting with the shorter-term speculative behavior often seen in retail trading. Even a minor allocation, such as shifting from 0% to 1-2% in Bitcoin within large retirement accounts, can introduce structurally significant demand for Bitcoin's available float and influence its long-term price trajectory.

Once conservative capital begins to enter the Bitcoin market, the perceived risk curve for investment strategies typically reorders itself. While some investors may be satisfied with the beta exposure offered by ETFs, more active traders often explore higher-risk segments of the market. This includes Bitcoin-native infrastructure projects and ecosystem plays with higher volatility, which have the potential to outperform the underlying asset during bull market phases.

With Vanguard's policy change now enacted, these opportunities are becoming more accessible, especially considering Vanguard's historical aversion to cryptocurrency and its position as a major asset manager.

This evolving landscape brings Bitcoin Hyper ($HYPER) into focus. As capital and attention return to Bitcoin, infrastructure projects aimed at addressing the network's limitations in throughput, fee volatility, and programmability become increasingly attractive investment prospects.

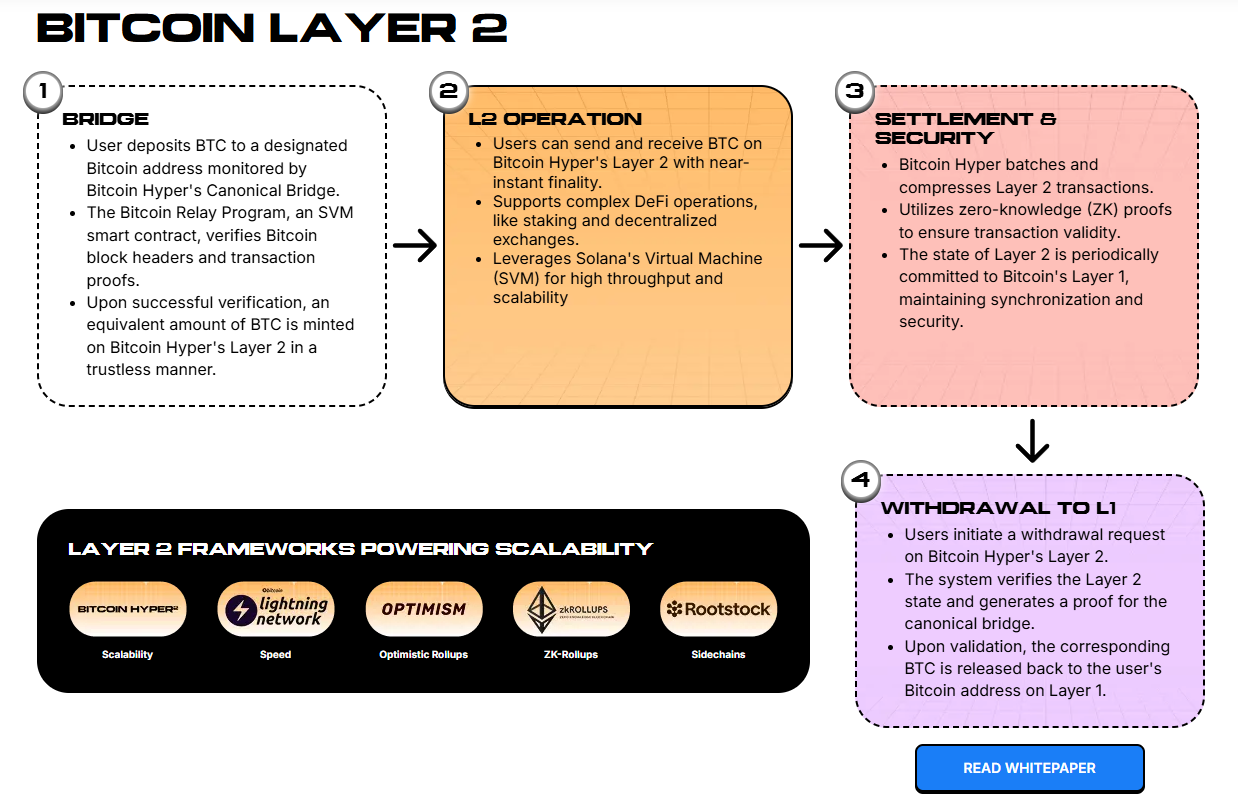

Bitcoin Hyper is positioned as a Bitcoin Layer 2 solution that utilizes the Solana Virtual Machine (SVM) for execution. The project aims to deliver performance comparable to or exceeding Solana's capabilities, while leveraging Bitcoin's robust settlement layer and brand reputation.

Why New Bitcoin Capital Is Looking Beyond ETFs

The immediate consequence of Vanguard's policy reversal is a projected increase in capital flowing into spot Bitcoin and Ethereum ETFs. This influx of liquidity, coupled with a more favorable perception from trustees who previously avoided crypto due to policy constraints, signals a positive development for the market.

However, a more profound, secondary effect is the re-evaluation of Bitcoin as a foundational infrastructure asset rather than a niche or fringe asset. This shift historically attracts greater developer talent and venture capital investment.

If Bitcoin regains its narrative dominance, its inherent limitations will become more apparent. These include the Bitcoin Layer 1's transaction capacity of approximately 7 transactions per second, unpredictable fee spikes during periods of high demand, and a scripting model that has not evolved into full smart contract functionality.

Various solutions are emerging to address these challenges. These include the Lightning Network for payments, rollup-style Layer 2 solutions, and new Bitcoin sidechains designed to capture decentralized finance (DeFi) and gaming activities without entirely departing from the Bitcoin ecosystem.

Within this competitive environment, Bitcoin Hyper distinguishes itself by adopting SVM compatibility and aiming for sub-second execution. This approach targets developers familiar with Rust and the Solana tooling stack who are seeking the security of Bitcoin and the liquidity of $BTC as their base asset.

Bitcoin Hyper’s SVM Layer 2 Pitch to $BTC Holders

While many Bitcoin scaling projects focus on incremental improvements, Bitcoin Hyper is pursuing a high-performance architecture. This involves using Bitcoin Layer 1 for settlement and a real-time SVM Layer 2 for execution.

The objective is to provide parallel processing capabilities similar to Solana's, along with extremely low-latency block production. The state of this Layer 2 will be periodically anchored to Bitcoin to ensure finality and facilitate dispute resolution.

This design directly addresses three key structural limitations of the Bitcoin network:

- •Slow base-layer confirmation times.

- •High and variable transaction fees.

- •Lack of native smart contract capabilities.

On Bitcoin Hyper, developers can deploy SVM-based smart contracts written in Rust, create SPL-compatible tokens specifically for the Layer 2, and build applications for DeFi, NFTs, and gaming. These applications are intended to offer a user experience closer to the sub-second, low-fee environment of Solana, rather than the legacy Bitcoin transaction experience.

From a capital formation perspective, the project has already demonstrated traction. Its presale has raised $28.8 million, with tokens priced at $0.013365. Significant investor interest is evident, with purchases of $379K and $500K contributing to the steady growth of $HYPER.

While $HYPER is the native token funding the project, there are immediate opportunities to benefit through staking rewards. Currently, 40% staking rewards are on offer, though these are dynamic and subject to change as the presale progresses.

If Bitcoin Hyper's execution capabilities meet its SVM performance claims, $HYPER could emerge as a leveraged investment vehicle for those seeking to capitalize on Bitcoin's next infrastructure development cycle.