Key Developments in Digital Asset Discussions

U.S. Treasury Secretary Scott Bessent and Singapore Prime Minister Lawrence Wong engaged in a significant discussion on stablecoin adoption on October 31, 2025. This meeting underscored the growing engagement between the U.S. and Asian nations regarding digital assets and their regulatory future.

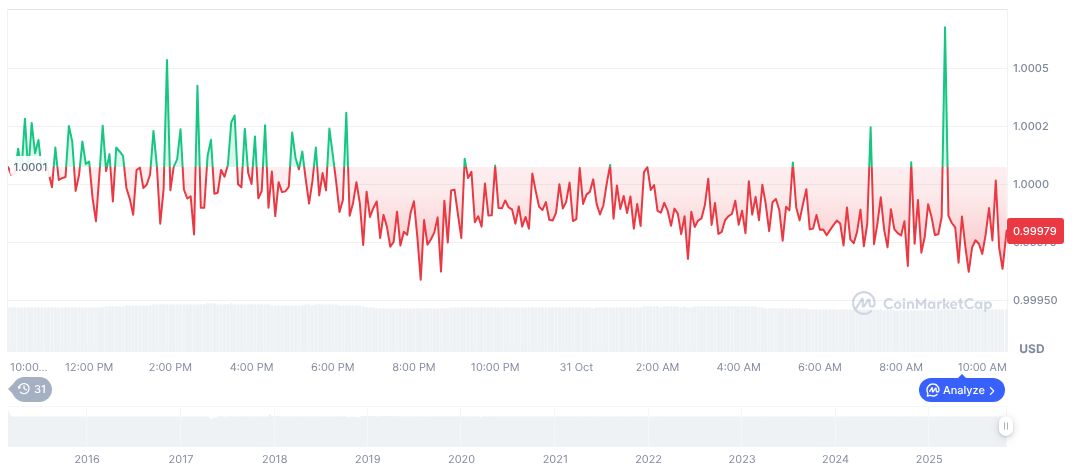

The dialogue highlighted a crucial development in the oversight of stablecoins, with potential implications for digital asset markets. However, at the time of reporting, no immediate impact on prices or trading volumes of major stablecoins was evident.

Exploration of Stablecoin Regulatory Futures

The meeting between Scott Bessent and Lawrence Wong signifies a strategic approach to shaping the future of stablecoins. Both leaders emphasized the importance of robust regulatory oversight in managing these digital assets, a key factor in mitigating systemic risks within the financial system. This exchange further illustrates a focused shift in U.S.-Asia digital policy engagement, with stablecoins now at the forefront.

Market reactions remained subdued following the meeting, primarily due to its focus on regulatory discussions rather than immediate policy announcements. Key figures involved have not released detailed public statements. The market's attention is directed towards significant regulatory developments, with no immediate observable effects on stablecoins such as USDT or USDC.

Janet L. Yellen, Treasury Secretary, U.S. Treasury, stated, "Stablecoins that are well-designed and subject to appropriate oversight have the potential to support beneficial payments options. But the absence of appropriate oversight presents risks to users and the broader system..."

Stablecoin Market Stability Amidst Regulatory Dialogue

The United States and Singapore have previously engaged in discussions concerning digital asset regulations, which have historically piqued market interest without causing immediate shifts in major stablecoins like USDC and USDT. This historical context suggests that current regulatory talks may not lead to rapid market fluctuations.

As of October 31, 2025, Tether USDt (USDT) maintained a stable price of $1.00, with a market capitalization of $183,307,152,909 and a market dominance of 4.96%. Despite a 24-hour trading volume of $140,900,283,826, the 24-hour price change was minimal, recorded at -0.08%.

Research indicates that increased regulatory focus on financial stability and the long-term integration of digital technologies could lead to more secure and widely adopted digital transactions globally. The emphasis on stablecoin security is seen as a crucial step in fostering trust and broader acceptance of digital payment solutions.