US Federal Reserve Governor Stephen Miran stated that policy must adapt to the expanding stablecoin market, which he anticipates could reach up to $3 trillion by the end of the decade.

Miran, the newest member of the Fed’s board of governors, remarked in a speech, “Stablecoins may become a multitrillion dollar elephant in the room for central bankers.”

Regarding the stablecoin market, he commented, “Based on the surveys that I’ve seen, the forecasts that I’ve seen, it’s a force to be reckoned with absolutely.”

He further elaborated, “The inter-quartile range of private-sector estimates compiled by Federal Reserve staff roughly projects stablecoin uptake reaching between $1 trillion and $3 trillion by the end of the decade.”

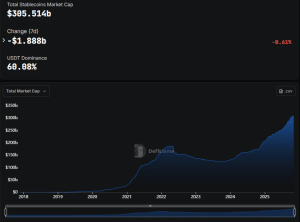

This projected market capitalization is significantly larger than the sector's current valuation, which is approximately $305.514 billion, according to data from DefiLlama.

Miran did acknowledge that “stablecoin growth may not live up to the forecasts,” pointing to potential yield and reward structures that could “limit adoption.”

GENIUS Act Provides Industry With Regulatory Clarity

Miran’s forecast follows the signing of the GENIUS Act into law by US President Donald Trump in July. The Fed Governor indicated that this legislation establishes a “clear regulatory pathway in the US for stablecoins issuers to broaden their reach and solidify stablecoins as a core part of the payment system.”

He expressed encouragement, stating, “I am encouraged that the Federal Reserve is taking steps to recognize the importance of stablecoins for the payment system.”

However, Miran also noted that “economic research has some catching up to do” and that several questions remain unanswered.

These unresolved questions include the volume of assets stablecoin issuers will manage, the origin of these funds (domestic or foreign), and the systemic risks stablecoins pose to the traditional finance system.

Stablecoins Will Strengthen Dollar’s Global Dominance

Miran also suggested that stablecoins are contributing to the US dollar’s global dominance. He pointed out that the largest stablecoins by market capitalization, such as Tether's USDT which represents over 60% of the sector, are tokens pegged to the US dollar.

Fastest growing stablecoins, based on 30d growth (%) in market cap.

One key takeaway:

The stablecoin market attracts both TradFi & crypto-native teams; many of them building on @ethereum.

— Token Terminal 📊 (@tokenterminal) November 6, 2025

The Fed Governor stated his thesis: “My thesis is that stablecoins are already increasing demand for US Treasury bills and other dollar-denominated liquid assets by purchasers outside the United States and that this demand will continue growing.”

He added that even stablecoins operating outside the GENIUS Act’s regulatory framework are “likely to boost demand for Treasurys and other dollar-denominated assets.”

Miran explained, “Stablecoins that do not comply with the GENIUS Act can invest reserves in a much broader range of assets but, to be viewed as reliable stores of value, will likely end up still investing substantially in US dollar securities with minimal credit risk.”

This increased demand, he noted, would subsequently reduce borrowing costs for the US government.

For such stablecoin adoption to occur, Miran argued that a mechanism for converting local fiat currencies into stablecoins is essential.