Key Economic Indicators

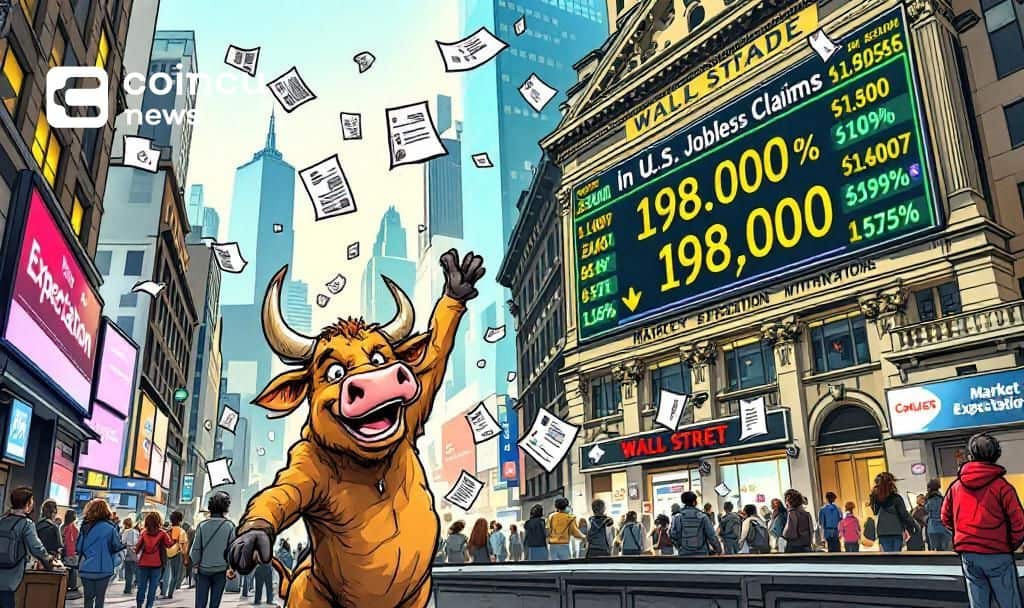

The U.S. Department of Labor reported 198,000 initial jobless claims for the week ending January 10, 2026. This figure fell below market expectations, which had predicted 215,000 claims.

This unexpected decrease signals potential stability in the U.S. labor market, influencing economic forecasts but showing no immediate impact on cryptocurrency markets or macroeconomic concerns.

Labor Market Performance

The latest jobless claims fell to 198,000, departing from the predicted 215,000 mark. This drop of 9,000 from the prior week's adjusted figure of 207,000 highlights a strengthening labor market. Initial jobless claims for the week ending January 10, 2026, were 198,000, down 9,000 from the prior week, according to the U.S. Department of Labor. This decline is illustrated by the 4-week average plummeting to 205,000, a new low since early 2024.

Crypto Market Context

Bitcoin's current market valuation stands at a robust $96,579.97, with a total market cap of approximately $1.93 trillion. Recent trading activity saw a notable decrease in volume by 16.93%, reflecting a price drop of 1.11% over 24 hours, while still witnessing a 6.26% rise over the last week.

Insights from the Coincu research team emphasize the economic resilience shown in these jobless figures, which could spur consumer confidence and financial stability, possibly leading to boosted market growth or innovation in related sectors.

Understanding Economic Resilience

Jobless claims consistently lower than forecasts often indicate economic resilience, potentially influencing employment strategies and long-term market trends.

Bitcoin's current market valuation stands at a robust $96,579.97, with a total market cap of approximately $1.93 trillion.

Insights from the Coincu research team emphasize the economic resilience shown in these jobless figures, which could spur consumer confidence and financial stability, possibly leading to boosted market growth or innovation in related sectors.

Disclaimer

The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.