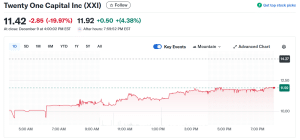

Bitcoin treasury firm Twenty One Capital ($XXI) experienced a significant 20% drop in its share price during its initial trading day. This occurred as competitor Strive announced a $500 million preferred stock offering aimed at increasing its Bitcoin holdings. Twenty One Capital's debut was highly anticipated, bolstered by backing from prominent entities such as stablecoin issuer Tether, Bitfinex, and Japan’s Softbank Group.

The company was listed through a Special Purpose Acquisition Company (SPAC) merger with Cantor Equity Partners, with Strike founder Jack Mallers taking on the role of CEO. In after-hours trading, the company managed to recover some of its losses, showing a 4.4% increase.

Twenty One Capital Positions Itself Beyond a Simple Treasury

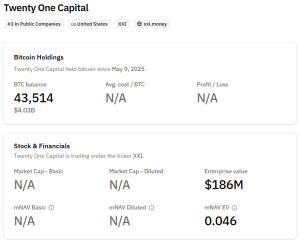

Despite operating in the digital asset treasury (DAT) market for less than a year, Twenty One Capital has rapidly ascended to become the third-largest corporate Bitcoin holder globally. Data from Bitcoin Treasuries indicates that the company holds 43,514 BTC on its balance sheet. This positions it just behind crypto miner MARA Holdings and the corporate crypto treasury leader, Strategy.

However, in a December 9 interview with CNBC, CEO Jack Mallers emphasized that the company should not be viewed solely as a treasury asset. "We don’t want the market to think of us and price us as just a treasury asset," Mallers stated. "We do have a lot of Bitcoin, but we’re also building a business." He further elaborated that the company is developing an operating business and intends to bring numerous Bitcoin-related products to market with the goal of generating cash flow.

While Mallers did not disclose specific plans, he indicated that Twenty One Capital sees significant opportunities in brokerage, exchanges, credit, and lending. He suggested that further details would be announced "sooner rather than later."

Strive Launches $500 Million Offering to Expand Bitcoin Holdings

As Twenty One Capital navigates its challenging market debut, Strive has announced a $500 million stock sales program designed to accelerate its Bitcoin acquisition strategy. Strive, a publicly traded asset manager and Bitcoin treasury company, was co-founded in 2022 by entrepreneur and politician Vivek Ramaswamy.

In a statement released on December 9, Strive indicated that the net proceeds from the stock sale would be allocated for "general corporate purposes." This includes the acquisition of Bitcoin and Bitcoin-related products, as well as working capital needs.

Strive announces $500,000,000 SATA At-The-Market (ATM) program.

— Strive (@strive) December 9, 2025

The program builds on the success of the upsized SATA IPO offering and will provide the company with additional capital for general corporate purposes, including acquiring more Bitcoin.

As of 11/7/25, we HODL…

Strive currently holds the 14th position among corporate Bitcoin holders, with 7,525 coins in its reserves. Similar to Twenty One Capital, Strive entered the DAT sector this year following a public reverse merger announcement in May, which pivoted the company towards a Bitcoin treasury strategy. The acquisition of Semler Scientific in September further solidified Strive's position as a major corporate BTC holder.

Michael Saylor Proposes $50 Trillion Digital Banking Plan to UAE

Both Twenty One Capital and Strive are adopting a strategy reminiscent of Michael Saylor's MicroStrategy, which began accumulating Bitcoin in 2020 through various debt financing methods. Earlier this week, Saylor presented a proposal for digital banking products that he believes could attract up to $50 trillion in capital inflows.

Speaking at the Bitcoin MENA event in Abu Dhabi, Saylor suggested that countries could leverage over-collateralized Bitcoin reserves and tokenized credit instruments to establish regulated digital bank accounts. He posited that these accounts could offer higher yields compared to traditional deposit accounts.

Saylor outlined a framework where digital credit instruments would constitute approximately 80% of a fund associated with these products. This would be complemented by a 20% allocation to fiat currency and a 10% reserve buffer to mitigate volatility.