US President Donald Trump is set to nominate pro-crypto Michael Selig as the next chair of the Commodity Futures Trading Commission (CFTC).

This information comes from a Bloomberg report that cited an unnamed Trump administration official.

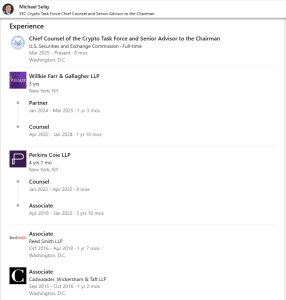

Selig currently serves as chief counsel at the Securities and Exchange Commission’s (SEC) crypto task force and is also a senior adviser to SEC Chair Paul Atkins. Analysts and influencers within the crypto community have often characterized him as crypto-friendly.

We confidently support the nomination of Michael Selig as CFTC Chair. This is a critical era for crypto policy and @MikeSeligEsq is prepared to lead @CFTC from day one with a strong understanding of crypto's potential to position the U.S. as a financial leader for generations. pic.twitter.com/1AWbBRi6oc

Previous Pro-Crypto Appointments and Nominations

Selig is not the first individual with a pro-crypto stance that Trump has nominated for key roles during his administration. At the commencement of his second term, he appointed David Sacks, a former PayPal executive and a prominent investor in the crypto industry, as the White House’s AI and Crypto Czar.

Several months later, Trump nominated Atkins, who is recognized for his more industry-friendly positions on cryptocurrency, to serve as the Chair of the SEC. His nomination received full Senate confirmation on April 9, and he was sworn in as the agency’s Chair on April 21.

The report indicating Trump's consideration of Selig to lead the CFTC follows the stalled nomination of Brian Quintenz. In September, pressure from Gemini co-founders Cameron and Tyler Winklevoss led to Trump withdrawing Quintenz's nomination.

CFTC and SEC Collaborate to Realize Trump’s Crypto Capital Goal

During his presidential campaign, Trump pledged to establish the US as the global crypto capital and declared he would be a “crypto President.”

He moved swiftly to act on this promise. Shortly after his inauguration in January, he established a working group on digital asset markets and signed an executive order to create a US Strategic Bitcoin Reserve and a US Digital Asset Stockpile.

In September, the SEC and CFTC began collaborating on crypto policy with the objective of developing a regulatory framework that safeguards investors while simultaneously fostering innovation.

The agencies issued a joint statement announcing a formal initiative to harmonize their regulatory frameworks for digital assets. Within this statement, the agencies also identified potential areas for coordination, such as aligning product definitions, reporting and data standards, and potentially establishing coordinated innovation exemptions under each agency’s respective authority.

It’s a new day. Onwards 🇺🇸🫡 #ProjectCrypto @SECPaulSAtkins @SECGov @CFTC @A1Policy pic.twitter.com/kChRm036Mg

Both the CFTC and SEC have also taken action based on recommendations from the White House’s digital assets working group concerning the regulation of crypto.

The working group classified the majority of cryptocurrencies as commodities and recommended that the CFTC should assume oversight of the spot crypto markets. President Trump himself has considered granting the CFTC oversight of the crypto market.

In line with the working group’s recommendations, SEC Chair Atkins announced “Project Crypto,” an initiative that aims to ease licensing requirements for crypto firms, among other objectives.