Trump tariffs have sent ripples through global markets this week, sparking concerns among analysts, cryptocurrency traders, and policymakers about the potential extent of trade pressure. The decision has intertwined economic force with a territorial debate that many believed belonged to the past, but which has now resurfaced with significant global ramifications.

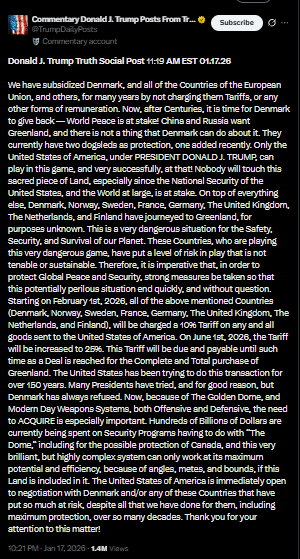

Tensions were reportedly reignited following the stalled negotiations over the U.S. proposal to acquire Greenland. President Trump indicated that the United States has provided decades of subsidies for European defense and now expects strategic concessions in return. This development has brought the Arctic region back into prominent global focus, prompting experts to re-evaluate its importance in future defense strategies.

A Sudden Trade Shock That Caught Markets Off Balance

The impact of the Trump tariffs was swift. Beginning in February, Denmark, Sweden, Norway, Finland, France, Germany, the Netherlands, and the United Kingdom will be subject to a 10 percent import tax, which could escalate to 25 percent by June if no progress is achieved. This tariff pressure is directly linked to Denmark's refusal to sell Greenland to the United States.

A policy brief highlighted that Arctic influence has historically shaped global diplomacy, adding significant weight to the current conflict.

Equity markets in Europe exhibited cautious movements, while the cryptocurrency sector experienced fluctuating reactions. Bitcoin maintained its stability, suggesting that traders perceived it as a safe haven amidst the prevailing uncertainty. In contrast, altcoins showed more pronounced reactions, reflecting the rapidly shifting confidence levels within the market.

Data indicates that political shocks often exert a greater influence on markets than internal sector trends, particularly during periods of trade disruption.

Why Analysts Believe the Greenland Dispute Runs Deeper Than Geography

Analysts contend that the renewed interest in Greenland extends beyond mere symbolism. A defense strategist quoted on a policy forum stated, "Arctic routes decide the future of global security," suggesting deeper strategic considerations behind the dispute.

Trump further emphasized this point by connecting the conflict to the development of the "Golden Dome" missile defense system, which he claims requires Greenland's geographical position to operate effectively. The island's high-latitude location offers strategic advantages for missile tracking, energy corridors, and climate research. This context places Denmark in a challenging position as political and economic pressures intensify.

Crypto Traders Watch the Market Ripple From a Distance

As the news unfolded, cryptocurrency traders closely observed how Trump tariffs influenced risk appetite. Many shared charts on X illustrating Bitcoin's resilience. Market analysts noted that Bitcoin typically remains stable during periods of heightened geopolitical tension, while altcoins tend to experience greater fluctuations.

The market's reaction reinforced a long-held view that crypto investors often use major political events as indicators of near-term volatility. The increased focus on Greenland amplified this trend, as traders sought signals that could impact global risk levels.

Global Politics, Economic Pressure, and Digital Markets Intertwine

The combination of Arctic strategy and Trump tariffs has effectively linked political influence with global commerce. Public comments from policy researchers emphasized that debates concerning the Arctic rarely remain isolated. The renewed push to acquire Greenland, coupled with escalating tariffs, has reignited long-standing strategic tensions, pressuring both sides to defend their national interests.

Conclusion

The uncertainty generated by Trump tariffs served as a reminder to markets of how rapidly global politics can influence financial behavior. The resurgence of Greenland as a strategic bargaining piece underscored the fact that territorial disputes can reshape far-reaching economic decisions, particularly when connected to defense systems like the Golden Dome.

Readers following these developments may find that understanding geopolitical triggers provides practical insight, especially in sectors where sentiment often dictates market movements more quickly than data.

Glossary

Tariffs: Taxes added to imported goods during cross-border trade.

Arctic Strategy: Planning based on northern routes that influence global security.

Market Sentiment: Investor emotions that guide financial decisions.

Volatility: Fast changes in asset prices driven by uncertainty.

FAQs About Trump Tariffs

Why were these countries targeted?

They were tied to political disagreements linked to Arctic strategic planning.

Why is Greenland important in this dispute?

Its location supports defense, navigation, and long-term resource routes.

How might this affect crypto traders?

Political tensions often shape short-term risk-taking in digital assets.

Could the tariffs rise to 25 percent?

Yes, if negotiations remain frozen in the coming months.