Key Developments and Market Impact

President Trump has pardoned CZ, the former CEO of Binance, marking a significant turning point in U.S. cryptocurrency policy and potentially altering Binance's global regulatory standing. This development is expected to foster optimism regarding more lenient cryptocurrency regulations within the market.

This presidential pardon signifies an end to the previous administration's stringent approach to cryptocurrencies and signals a potential rejuvenation of global confidence in Binance. It may also prompt broader regulatory changes, contributing to increased market optimism.

Presidential Pardon Alters Crypto Regulatory Climate

President Trump utilized his constitutional authority to pardon Changpeng Zhao (CZ), who had faced charges from the Biden administration related to anti-money laundering violations. This pardon represents a pivotal change in U.S. cryptocurrency policies.

The presidential pardon could enable CZ to resume involvement in Binance's U.S. operations and potentially improve the company's compliance standing. Market analysts and investors interpret this as a possible easing of U.S. crypto regulations.

Arthur Hayes, Co-Founder, BitMEX, stated, "A presidential pardon for CZ is a watershed moment—U.S. finally signals openness to global crypto leadership."

Economic Ripple Effects for Binance and Cryptocurrency

Historical pardons, such as the case involving Arthur Hayes in 2022, have historically brought stability to related ventures, contrasting with instances where denials led to increased regulatory scrutiny.

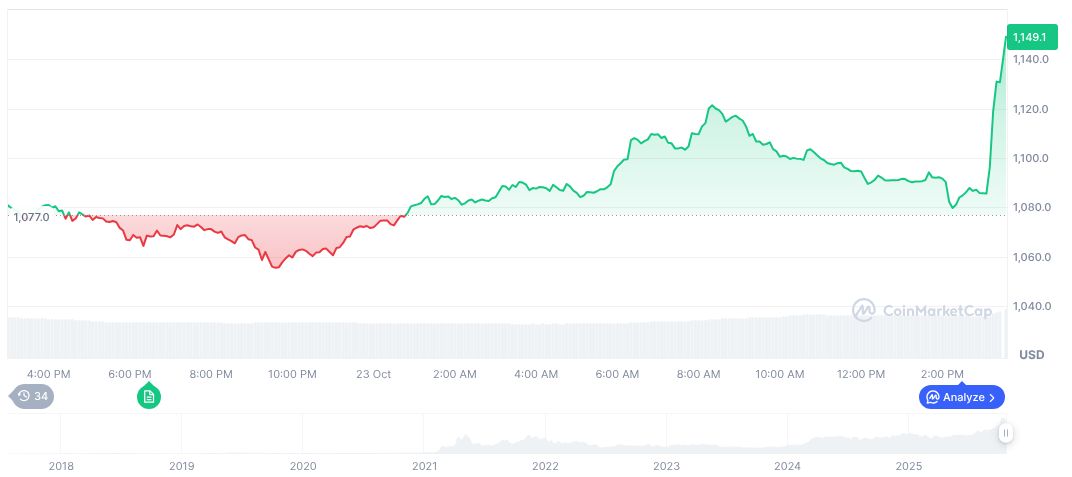

BNB, currently priced at $1,118.42, possesses a market capitalization of $155.66 billion, representing a market dominance of 4.20%. Data indicates that the BNB price has increased by 4.50% over the past 24 hours and has shown a substantial rise of 44.39% over the last ninety days.

Research highlights the potential for an improved regulatory and market position for Binance. The pardon could not only facilitate the expansion of Binance's U.S. operations but also enhance confidence among investors and developers, suggesting a more promising future for the cryptocurrency industry.