Key Developments and Initial Reactions

Changpeng Zhao, Binance's founder, was pardoned by U.S. President Donald Trump on October 23, 2025. This decision marks a significant moment for the cryptocurrency sector in the United States.

The pardon is expected to improve Binance's regulatory landscape, potentially catalyzing U.S. market growth and elevating Binance Coin (BNB). This development could also attract further investments and prompt global interest in U.S.-based crypto ventures.

Regulatory Impact and Community Divided

Changpeng Zhao, founder of Binance, was officially pardoned by U.S. President Donald Trump, ending legal challenges stemming from a 2023 conviction due to Bank Secrecy Act violations. Zhao expressed on X platform his intent to help the U.S. advance in cryptocurrency and Web3.

The decision potentially improves Binance's regulatory standing in the U.S., easing restrictions and allowing for greater operational growth. Major crypto assets like BNB, BTC, and ETH may experience increased trading volumes in response to this clarity.

I am deeply grateful for the pardon received today. My heartfelt thanks to President Trump for his commitment to fairness, innovation, and justice in the United States. I will do everything possible to help the U.S. become the cryptocurrency capital and to promote the development of Web3 globally.

Following the pardon, Senator Elizabeth Warren criticized Trump, alleging it was a reward for Zhao’s ties to Trump-affiliated endeavors. The crypto community remains divided, with active debates expected online among industry participants and observers.

BNB Price Performance Amid Policy Shifts

Zhao's pardon follows historical precedents such as BitMEX's settlement and pardons earlier in 2025, which have often led to temporary market rallies in the crypto sector.

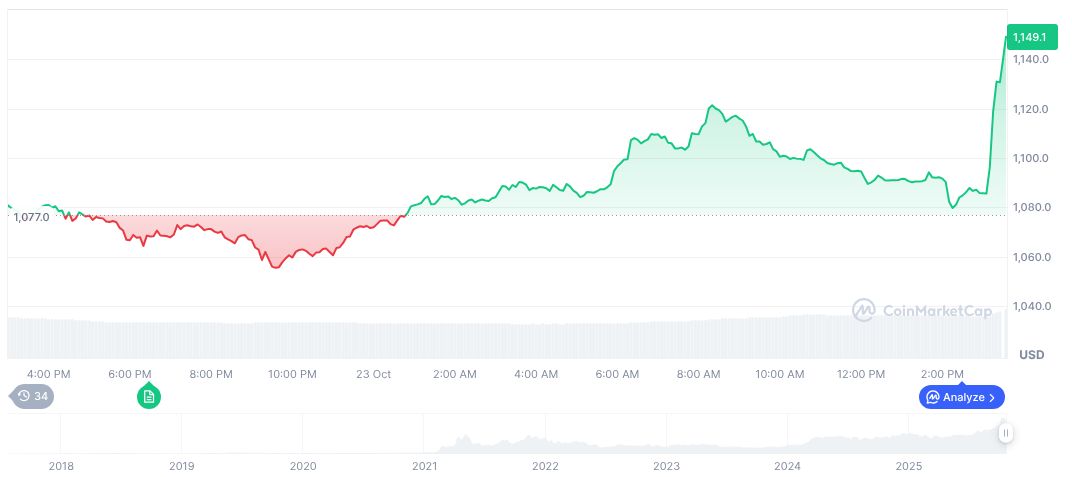

According to market data, BNB is currently priced at $1,127.70, with a market capitalization of $156,953,498,312.39 and a 24-hour trading volume of $5,542,441,823.00. BNB witnessed a 5.00% increase in the last 24 hours, although it declined by 2.23% over the preceding seven days, as of 17:30 UTC on October 23, 2025.

Researchers indicate potential implications for U.S. financial regulations. The pardon could signal a shift towards more crypto-friendly policies under the current administration, fostering innovation and operational expansions for major entities like Binance.