Resort Development and Investment Model

The Trump Organization, in partnership with Dar Global Plc, is developing the Trump International Hotel Maldives, scheduled to open by 2028. This ambitious project will feature 80 ultra-luxury beach and overwater villas, combining the Trump Organization’s renowned luxury branding with Dar Global’s extensive development expertise.

A key aspect of this development is the implementation of digital tokenization. This innovative approach will allow global investors to acquire digital shares in the project, significantly expanding the landscape of real estate investment. This initiative introduces a new bidding avenue for worldwide investors interested in high-end property markets, signifying a notable shift in traditional investment strategies.

"The tokenization of this development marks a pivotal moment in real estate investment, opening new avenues for global investors." - Ziad El Chaar, CEO, Dar Global

Impact on Real Estate and Regulatory Landscape

The integration of blockchain technology into the real estate sector is a transformative force, revolutionizing property transactions by enhancing transparency and accessibility. This tokenization of the Trump International Hotel Maldives development represents a significant step in this evolution.

Financial outcomes stemming from this tokenization model could profoundly influence future regulatory decisions, especially as this approach gains wider traction. Historical trends suggest that this move might encourage other real estate ventures to explore blockchain technology for their projects. Simultaneously, regulatory bodies are likely to be closely evaluating the implications for investor protections and market stability.

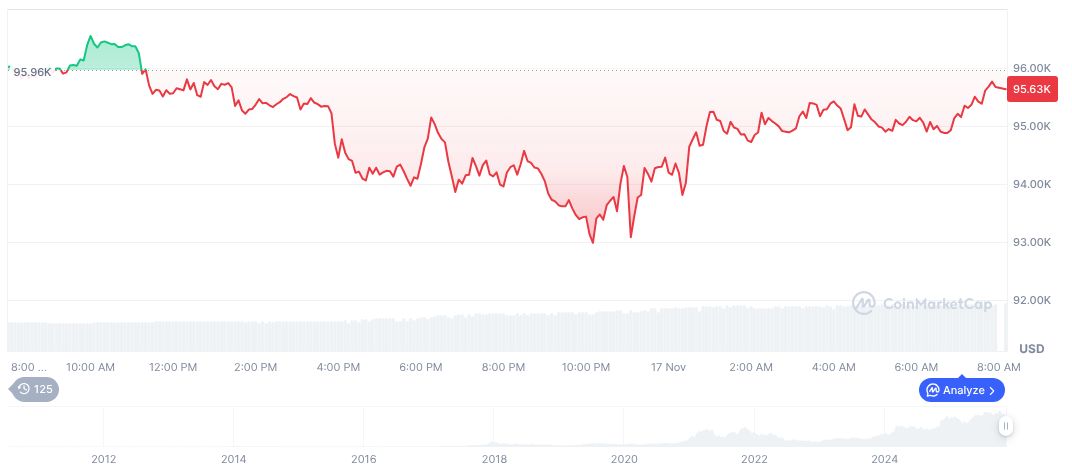

Market Context: Bitcoin Performance

In the broader financial market context, Bitcoin (BTC), as last updated by CoinMarketCap on November 17, 2025, was priced at $95,747.20 with a market capitalization of $1.91 trillion. Despite holding a market dominance of 58.77%, BTC experienced a notable increase in its 24-hour trading volume, which rose by 56.11% to close at $76.86 billion. Over the preceding seven days, BTC's price had seen a decrease of 9.83%.