Key Points

- •U.S. President Trump acknowledges tariffs may increase consumer costs.

- •The Supreme Court is reviewing the President's tariff authority.

- •The administration is reportedly considering alternative strategies.

President Trump has indicated that implemented tariffs could lead to higher prices for American consumers. This statement comes as the Supreme Court reviews the extent of his executive authority regarding tariffs.

This potential shift in policy could have significant repercussions for the U.S. economy and its trade relationships. Economic strategists are closely observing the legal interpretations and their subsequent effects on consumer markets.

Tariff Authority Under Review

President Trump's recent acknowledgment suggests that tariffs might impose economic burdens on Americans, a departure from previous claims that foreign entities would bear the costs. This admission coincides with the Supreme Court's examination of his executive powers concerning tariffs.

The implications of this review could include escalating consumer prices and necessitate a reassessment of current tariff strategies. Uncertainty remains regarding the administration's contingency plans, often referred to as "Plan B," should the courts limit these tariff powers.

Economists and policymakers have offered varied perspectives on this development, highlighting the importance of clear and consistent tariff policies. Market participants and the public are keenly interested in understanding the broader economic consequences.

Supply Chain Dynamics and Market Reactions

Historically, in previous trade negotiations, the imposition of U.S. tariffs has often exacerbated supply chain disruptions, leading to increased consumer expenses. This pattern may resurface given President Trump's recent remarks.

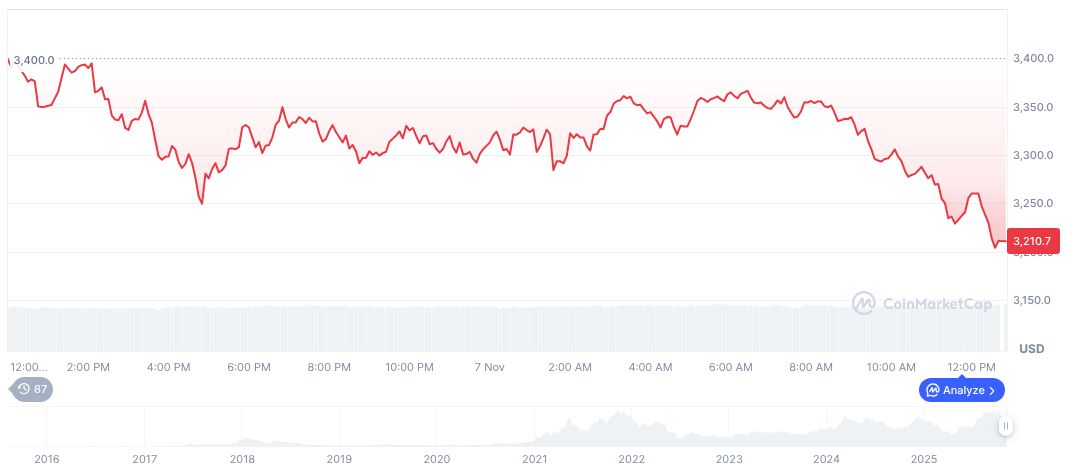

According to market data, Ethereum (ETH) is currently priced at $3,257.15, marking a 24-hour decrease of 2.72%. Its market capitalization is approximately $393,128,151,605, representing 11.83% of the total market share. The reported 24-hour trading volume is $40,374,475,311 million.

Research indicates that ongoing scrutiny of trade policies could lead to intensified regulatory changes, impacting both financial markets and technological advancements. Experts stress the necessity of strategic policy adjustments to mitigate adverse effects on consumer prices. The future actions of the Trump administration are a key area of focus for economic analysts.