Key Insights:

- •A top trader highlighted a possible 25% recovery rally for Solana price which could see the cryptocurrency retest the $177 to $180 level.

- •Solana topped in daily DApp revenue and DEX volumes among L1 and L2 networks.

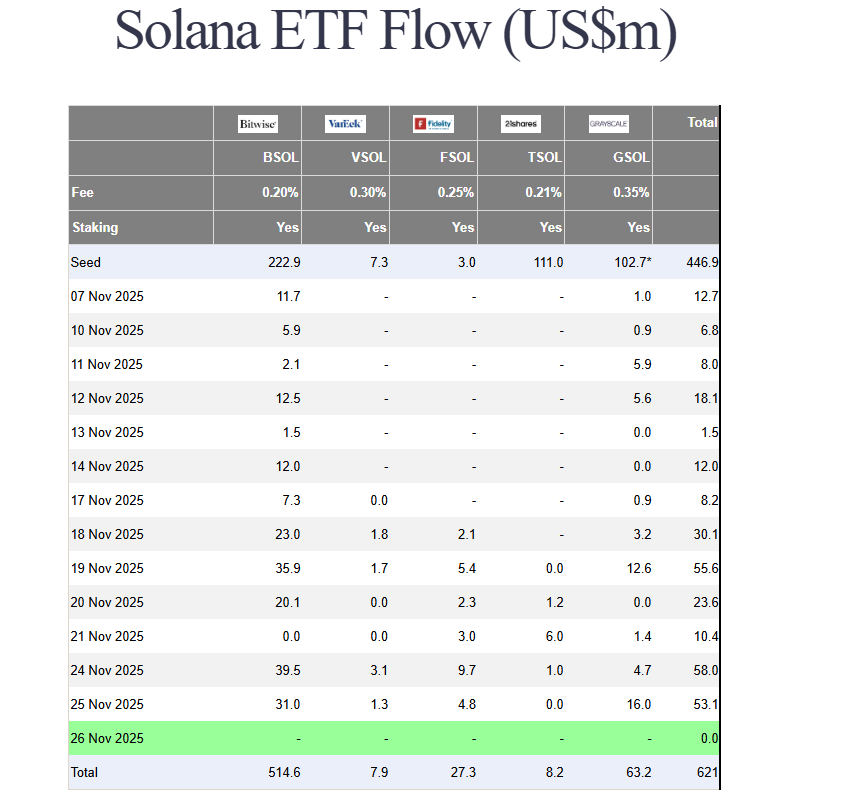

- •Investors added $53.1 million in Spot Solana ETFs on November 25.

Expert Optimism for Solana Price

A top trader has highlighted a potential 25% recovery rally for Solana's price, suggesting the cryptocurrency could retest the $177 to $180 level. This optimistic outlook was shared by trader Captain Faibik on X, where a major trendline was marked on the 2-hour chart.

In parallel, the fundamental metrics of the Solana network continue to exhibit bullish trends. The network has recently led among Layer 1 and Layer 2 networks in both daily DApp revenue and Decentralized Exchange (DEX) volumes.

Furthermore, spot Solana Exchange Traded Funds (ETFs) attracted significant inflows, totaling $53 million on Tuesday. Attention is also focused on Franklin Templeton, a $1.66 trillion asset manager, which may launch its spot Solana ETF product soon, following its filing of the S-8 form with the U.S. Securities and Exchange Commission.

Solana Price Poised for Recovery Rally

For the first time in several weeks, Solana has shown signs of strength, according to top trader CryptoFaibik. He pointed out that Solana's price is approaching a breakout level that has previously capped recovery attempts throughout the month.

The SOL price has been moving back toward a significant trendline with increased stability. The recent bounce from the low-$130s indicates that buyers are gradually regaining confidence.

As SOL tests this trendline, the chart structure appears cleaner than before. The formation of higher lows beneath the price suggests a potential shift in momentum. If SOL successfully breaks above this barrier, the next logical target is estimated to be around $170–$175, aligning with CryptoFaibik's projection of a possible 25% recovery move.

The current setup is straightforward. Buyers need to see a convincing breakout to confirm a trend shift. Until then, SOL remains at a critical juncture where a single strong upward push could pave the way for a broader rally.

Solana Dominates DApp Revenue and DEX Volume

Solana has demonstrated robust momentum within the decentralized finance (DeFi) ecosystem. Recent 24-hour data reveals that the network has led all major Layer 1 and Layer 2 chains in both DApp revenue and DEX activity, continuing a trend observed over several weeks.

The Solana blockchain generated $3.43 million in DApp revenue within a single day, surpassing Hyperliquid L1, Ethereum, and Base. It also facilitated $2.556 billion in DEX volume, underscoring the reliance of traders on its speed and low transaction fees.

The network's fundamentals remain strong. Total value locked (TVL) is holding near $9 billion, and user activity remains high, with over two million active addresses recorded in a 24-hour period. Chain revenue and fees further indicate that the network is processing a substantial volume of transactions despite its cost-effective structure.

Solana ETFs See Significant Inflows; Franklin Templeton Files for ETF Launch

Investors injected $53.1 million into Spot Solana ETFs on November 25, extending a consistent wave of inflows that began at their launch. Market participants view this steady inflow as a sign of growing confidence in Solana's long-term market position.

Bitwise led the inflows with $31 million into Solana ETFs on that day. Grayscale followed with $16 million, and Fidelity contributed $4.8 million. Even VanEck, known for its selective investment strategy, participated with $1.3 million.

Recent news regarding Solana indicates that the total capital invested in Solana ETFs has now reached $621 million. As demand for these ETFs continues to build, market observers have noted that Solana's price is gaining momentum for a potential 25% recovery, which could see it reach the $180 mark.