Is IPO Genie $IPO truly one of the most credible crypto presales of 2026, and does it possess genuine utility beyond mere hype?

For those with experience in the cryptocurrency space, a discerning sense for distinguishing substance from superficiality is often developed. The presale market has become increasingly saturated, with many projects making bold claims without introducing anything novel. Therefore, when a project like IPO Genie begins to garner attention as a top crypto presale of 2026, it warrants a closer examination: what truly sets this project apart?

Let's delve into the specifics to understand what establishes IPO Genie's standards.

The Private Market Problem Often Overlooked

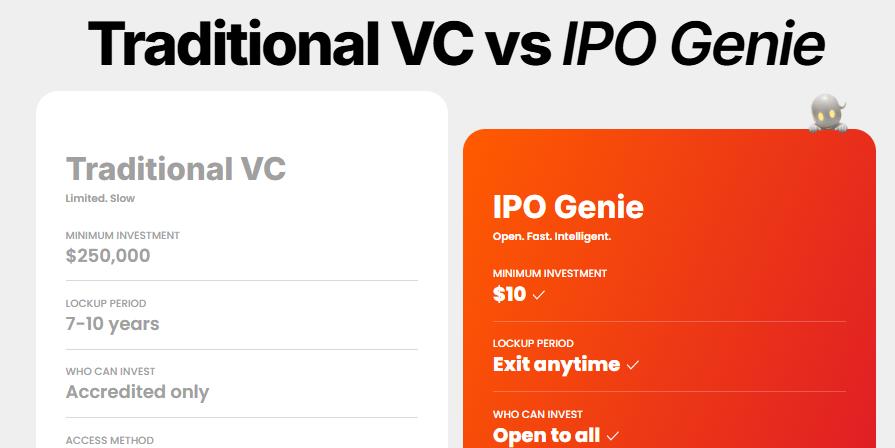

A crucial point that many retail investors may not fully grasp is that approximately 90% of a company's value is created before it becomes publicly traded. By the time an investor can purchase shares of a groundbreaking tech company through traditional brokerage accounts, early investors and insiders have already reaped the majority of the returns. This wealth disparity is not coincidental but rather a systemic issue.

Traditional venture capital is largely inaccessible, with minimum investments often starting at $250,000, lock-up periods lasting seven to ten years, and requiring insider connections. Companies like Uber saw their value surge from $5 billion to $70 billion before their initial public offering, and Stripe remains a private entity valued at approximately $95 billion. IPO Genie aims to democratize access to these early-stage investment opportunities through tokenization, enhanced transparency, and broader participation, effectively bringing liquidity-style access to private markets.

This information provides a foundation for understanding the shifts occurring in private markets and venture capital.

What Makes a Presale Worthy of Attention in 2026?

Throughout several crypto cycles, it has become apparent that many presales generate significant hype but rarely deliver sustained utility. The IPO Genie presale, however, addresses key aspects that are often missing in leading crypto presales focused on utility projects. The $IPO token is designed not merely for speculation but for functionality. Holding the token grants tiered access to vetted startup deals, staking rewards derived from platform fees, governance rights over deal selection, and even downside protection at higher participation tiers.

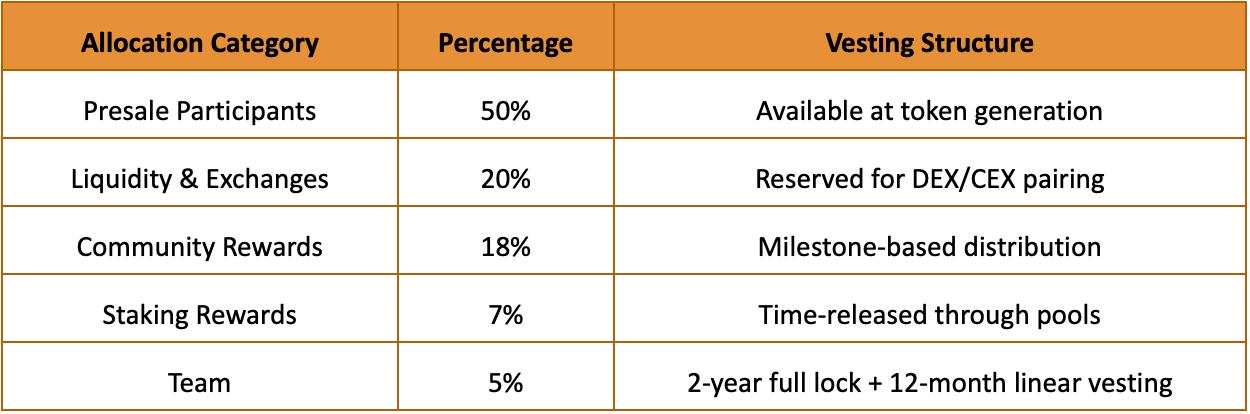

Currently in stage 36 and priced at $0.00011390, the project has meticulously structured its token distribution to circumvent the common dump-and-pump cycles. Team tokens are locked for a full two years, followed by a linear vesting schedule over 12 months. This is a significant detail, as it indicates a strong alignment between the project team and long-term token holders.

Token Distribution Designed to Avoid Common Pitfalls

It is crucial to examine the quantitative aspects, as these are frequently the points of failure for many early-stage crypto ventures. The allocation model reveals whether the founders are committed to long-term growth or are planning a premature exit.

Out of a total supply of 436.9 billion tokens, only 5% is allocated to the team, and this allocation is entirely locked for 24 months before any vesting commences. Investors familiar with the crypto market understand that while robust tokenomics do not guarantee success, flawed tokenomics almost invariably lead to failure.

A notable aspect is the revenue model that underpins the token's value. IPO Genie operates on a traditional venture capital-style carry structure, which includes a 2% management fee and 5% of profits. Additionally, the platform generates revenue through transaction fees and subscription tiers for advanced analytics. This diversified approach indicates that the project is not solely reliant on token price appreciation but is actively building a business designed to generate real cash flow.

The AI Integration: A Genuine Tool or a Mere Gimmick?

Many projects incorporate the term "AI" without any substantial underlying technology. In contrast, IPO Genie utilizes artificial intelligence discreetly for research purposes. This includes scanning startup data, evaluating founders, analyzing funding rounds, and examining code activity to identify potential risks and opportunities. The AI serves to augment human judgment rather than replace it, appealing to investors who prioritize data-driven decision-making.

The distinction between effective artificial intelligence and ineffective AI often lies in its purpose: is it addressing a genuine problem, or is it simply adding buzzwords to the project's whitepaper?

What is Not Offered (And Why It Matters for Credibility)

Credibility is often built by clearly defining what a project is not, as well as what it is.

IPO Genie does not guarantee profits or claim to eliminate risk entirely. Startups can face failure, and regulatory landscapes can change. What the platform does offer is a more secure structure, incorporating compliance checks, transparent processes, smart contracts, and secure custody solutions. These less glamorous, yet critical, features are paramount for long-term sustainability.

If the objective is to find a project promising a 100x return within 30 days, IPO Genie may not be the right fit. However, if the goal is to gain access to vetted pre-IPO opportunities with institutional-grade infrastructure, then it presents a compelling proposition.

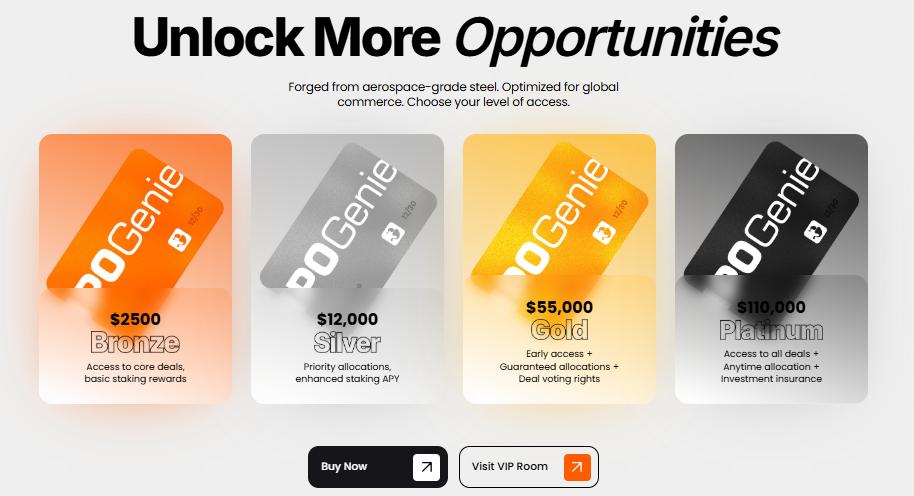

Understanding the Access Tier System

One of the more innovative design elements of the platform is its tiered system. Access is not solely determined by token holdings but by the level of investment unlocked:

- •Bronze Tier ($2,500 in $IPO): Provides entry to core deals with basic staking rewards.

- •Silver Tier ($12,000): Offers priority allocations and an enhanced staking APY.

- •Gold Tier ($55,000): Grants early access, reserved allocations, and voting rights on deal selection.

- •Platinum Tier ($110,000): Provides full deal access, anytime allocation rights, and additional benefits.

This tiered system is designed to encourage sustained participation by rewarding commitment rather than short-term speculation. Higher tiers offer increased protection, with the Platinum tier including an insurance component to help manage risk more effectively.

Comparative Analysis of Similar Platforms

It is beneficial to position IPO Genie alongside platforms that have established track records. AngelList has facilitated over $10 billion in startup investments, but it typically requires minimum checks ranging from $25,000 to $100,000 and does not offer secondary liquidity. EquityZen has enabled $3 billion in pre-IPO share trading but does not provide primary deal access or tokenization capabilities. Republic has democratized access to over 600 deals but lacks staking utility or governance mechanisms.

IPO Genie integrates key elements from these platforms—compliance rigor, lower entry points, tokenized ownership, and DAO governance—into a unified ecosystem. While its long-term success remains to be seen, the underlying concept is sound.

Addressing the Adoption Challenge

Community engagement is a critical factor, particularly in the cryptocurrency sector. The project has structured its growth strategy through affiliate programs, partnerships with established venture capital networks, and a Deal Builder Marketplace. This marketplace allows scouts and analysts to source opportunities in exchange for rewards and reputation scores.

The platform plans to expand its reach across multiple blockchains, including Solana, Base, and Layer 2 networks, with the aim of reducing transaction costs and broadening accessibility. Furthermore, a Fund-as-a-Service model is being introduced, enabling DAOs and syndicates to operate compliant investment vehicles utilizing IPO Genie's infrastructure.

Clear, measurable milestones, rather than mere launch-day hype, differentiate genuine roadmaps from unrealistic projections.

Actionable Steps Based on This Information

If you are considering IPO Genie as a candidate for a top crypto presale in 2026, it is essential to approach it with the same diligence as any serious investment: conduct independent verification. Visit the official IPO Genie website ($IPO) to access current presale details and review audited smart contracts. Engage with the community activity on their Telegram and X (formerly Twitter) channels. Thoroughly read the whitepaper, paying close attention not only to the highlights but also to the risk disclosures and tokenomics sections.

Leverage experience. Consult with seasoned crypto investors and seek appropriate legal and financial advice. Presale prices do not guarantee future returns. The most robust projects concentrate on addressing real-world problems, maintaining transparency, and demonstrating consistent execution, rather than relying on short-term speculative interest. While IPO Genie's success is not guaranteed, it merits thoughtful evaluation rather than blind enthusiasm or premature dismissal.

Frequently Asked Questions

1: What is IPO Genie?

IPO Genie is a platform designed to offer transparent, tiered access to pre-IPO and early-stage startup investment opportunities through its $IPO token. It integrates staking, governance functionalities, and AI-powered insights to assist investors in discovering and participating in vetted ventures.

2: How does the AI deal scoring system function?

IPO Genie employs AI to analyze startup deals across various critical factors, including market potential, team quality, operational traction, and associated risks. The system generates a comprehensive deal score to facilitate more efficient comparison of investment opportunities for users.

3: Which blockchain networks does IPO Genie support?

IPO Genie currently supports multiple blockchain networks, such as Ethereum and Binance Smart Chain, to streamline token transactions, staking operations, and access to presale opportunities.