Leading analytics platform Santiment suggests that Cardano is sitting in an extreme buy zone following its double-digit collapse.

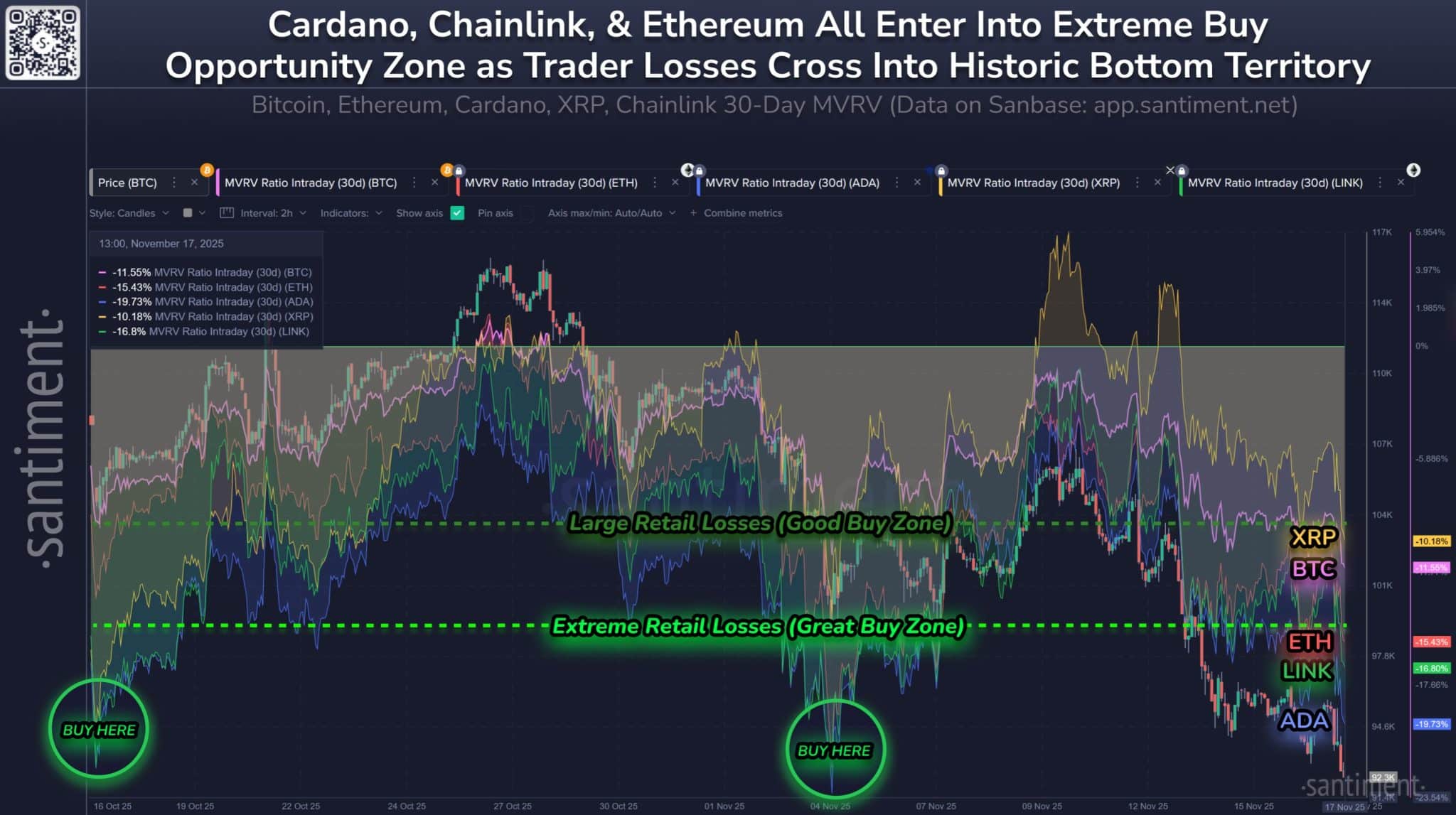

According to Santiment, most established cryptocurrencies are currently showing severe pain in their average trading returns. In its latest 30-day MVRV (Market Value to Realized Value) analysis, the firm highlights Cardano as one of the most undervalued major cryptocurrencies.

ADA Sees Lowest MVRV, Falls to Extreme Buy Zone

Santiment notes that Cardano wallets active over the past month are sitting on a negative average return of 19.7%, causing severe pain for investors. This indicates that a trader who bought ADA last month has already incurred a roughly 20% loss.

Other leading assets are also in the red, though to a lesser degree. Chainlink, Ethereum, Bitcoin, and XRP all show 30-day negative MVRV levels of 16.8%, 15.4%, 11.5%, and 10.2%, respectively, underscoring widespread negative sentiment across the crypto market.

Notably, due to ADA’s low MVRV, Santiment placed the token firmly within what Santiment classifies as an “Extreme Buy Zone.”

The chart from the analytics platform shows Cardano dropping into the “Buy Here” region, suggesting the recent decline may present an attractive accumulation opportunity for investors looking to buy at cheaper rates.

Potential Rebound for Cardano?

Santiment emphasizes that the most strategic accumulation occurs when many traders are in pain due to losses. In such conditions, Santiment noted that negative MVRV values often precede a strong rebound.

At the moment, ADA has continued on its downward trajectory. It briefly dropped to $0.45 today and rebounded to $0.46. At the current price of $0.4690, Cardano has plummeted by 16.81% over the past week, bringing its 30-day loss to 30.28%.

Despite ADA’s continued downturn, several crypto analysts maintain an optimistic outlook for a major rebound. Earlier this month, The DApp Analyst suggested that Cardano could stage a 97% surge after its RSI mirrored a pattern seen earlier in the year. The projection placed ADA at a potential target of around $1.10 at the time of the analysis.

Meanwhile, AltcoinPioneers offered a more conservative projection. He argues that ADA could rise to $0.65 if buyers show strong accumulation while the asset successfully breaks through key resistance levels.

While Santiment’s analysis signals the possibility of a recovery due to ADA’s deep negative MVRV ratio, the token remains weighed down by broader market weakness. As a result, the timing of any meaningful rebound is uncertain.