Key Insights

- •Bitmine experiences significant price fluctuations as traders monitor crypto stocks, including mining operations.

- •Circle announced robust Q3 financial results, yet its stock, CRCL, is trading lower.

- •Coinbase is facing market pressure due to a decline in cryptocurrency prices.

Crypto stocks are garnering renewed attention in the fourth quarter, with Bitmine, Circle, and Coinbase trading lower despite previous gains. These three companies remain active participants in the market as traders closely observe price volatility, earnings reports, and shifts in cryptocurrency demand. Their performance for the remainder of the quarter may be influenced by stablecoin utilization, trading volumes, and the movement of Bitcoin.

Bitmine Shows Sharp Swings Amidst Volatile Crypto Stock Trading

Crypto stocks continue to be a focal point, with BitMine Immersion Technologies (BMNR) undergoing another volatile trading session. The BMNR stock closed at $29.18 on November 19, representing a 9.6% decrease from its previous closing price. It is currently trading within a broad annual range of $3.20 to $161.00 and holds a market capitalization of $8.30 billion.

The stock also recorded substantial daily trading activity, attracting the attention of many traders monitoring its short-term price movements. Similarly, BitMine traded between $28.75 and $32.78 during the latest session. These sharp swings are occurring at a time when the broader cryptocurrency market is under pressure. Bitcoin has fallen below $90,000 this week, marking its lowest point in over six months. Ethereum is also trading lower, with other major cryptocurrencies following a similar trend.

These market movements have a ripple effect on most crypto stocks, and Bitmine is among the companies that react swiftly to price shifts. Notably, the recent market downturn has led to liquidations across various exchanges. Large liquidation events can often dampen trading interest and increase caution. Bitmine remains actively traded because crypto mining stocks tend to reflect changes in Bitcoin's price more directly than other crypto-related companies. The wide annual trading range of the stock indicates that traders perceive it as a highly volatile asset. For the remainder of Q4, its future performance could be contingent on daily Bitcoin trends and the overall market appetite for risk.

Circle Trades Lower Despite Strong Quarterly Results

Circle Internet Group is experiencing a decline in its stock price, even after reporting strong third-quarter financial results. The crypto stock concluded Wednesday's session at $69.72, marking an approximate 9% drop from its previous close.

This market reaction occurred despite the company announcing solid revenue and profit growth. Circle reported $739.8 million in revenue for Q3, a 66% increase year-over-year. Net income rose by 202% to $214 million. Market observers suggest that a primary driver for this performance was the increase in the circulation of its stablecoin, USDC.

USDC supply reached $73.7 billion, demonstrating a 108% gain compared to the same period last year, with the company reporting a market share of 29%. The majority of Circle's revenue continues to be generated from interest earned on short-term Treasury bills that back USDC. The reserve return rate stood at 4.15% in Q3 as short-term rates eased. Circle noted that its margin decreased by 270 basis points due to higher distribution costs. However, it also stated that the margin improved compared to Q2 as the company collaborates with higher-margin partners.

Circle continues to attract attention because stablecoins play a crucial role in the cryptocurrency market. The stock remains on watchlists, even as it trades lower, with investors closely examining USDC demand and Treasury returns as key factors for Q4 performance.

Coinbase Faces Market Pressure Amidst Growing Crypto Stock Attractiveness

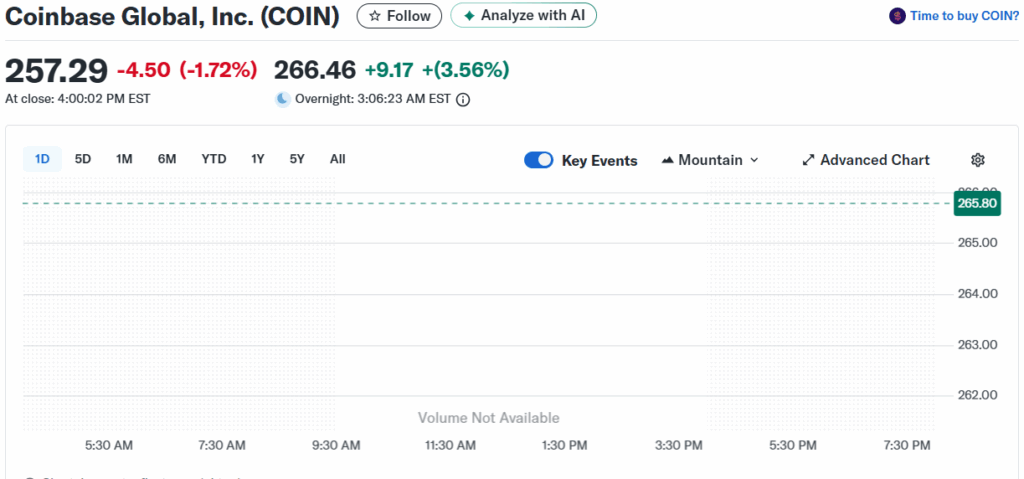

Coinbase Global is also trading lower, reflecting the recent decline in cryptocurrency prices. The crypto stock concluded the November 19 session at $257.29, after a drop of approximately 1.7%. During the day, it traded between $247.02 and $262.82 and holds a market capitalization of $69.37 billion. The company remains one of the most closely watched names in the crypto stock sector.

The market downturn has led to reduced activity across exchanges. Coinbase's revenue is dependent on trading fees, meaning lower prices could negatively impact its earnings. Daily trading volume reached $2.65 billion, and the stock is among the most searched names on several tracking platforms.

Meanwhile, Coinbase had previously reported strong Q3 earnings, highlighting progress with its "Everything Exchange" initiative, which aims to expand its service offerings. The company has also initiated collaboration with JPM Coin through its blockchain system and launched a pre-listing access feature to broaden its product portfolio. These developments indicate growth, yet the crypto stock's performance continues to be influenced by the broader market trends. For Q4, its trajectory may depend on a recovery in Bitcoin prices and overall trading demand.